2025 Tax Return] What are the personal allowances? Salaries Tax Deductions and Allowances - Tax Saving Tips

Taxpayers are receiving their tax returns in May. What are the ways to save tax in this year's 2025? What are the ways to save tax in 2025? How to file tax return to save tax? The following are answers to common questions on salaries tax, allowances and deductible items.

What is salaries tax?

Salaries tax can be interpreted as income tax, and the year of assessment is from 1 April of each year to 31 March of the following year.

Calculation of Salaries Tax

There are two ways of calculating salaries tax, namely, by applying progressive rates to the net chargeable income in real terms and by applying standard rates to the net income.

progressive tax

Real amount of taxable income (total income - total deductions - total allowances) X progressive tax rate

| Realised taxable income | duty rate | tax payments |

|---|---|---|

| First HK$50,000 | 2% | HK$1,000 |

| Subsequently HK$50,000 | 6% | HK$3,000 |

| Subsequently HK$50,000 | 10% | HK$5,000 |

| Subsequently HK$50,000 | 14% | HK$7,000 |

| Balance | 17% | / |

Standard Taxes

Net Income (Total Income - Total Deductions) X Standard Tax Rate (15%)

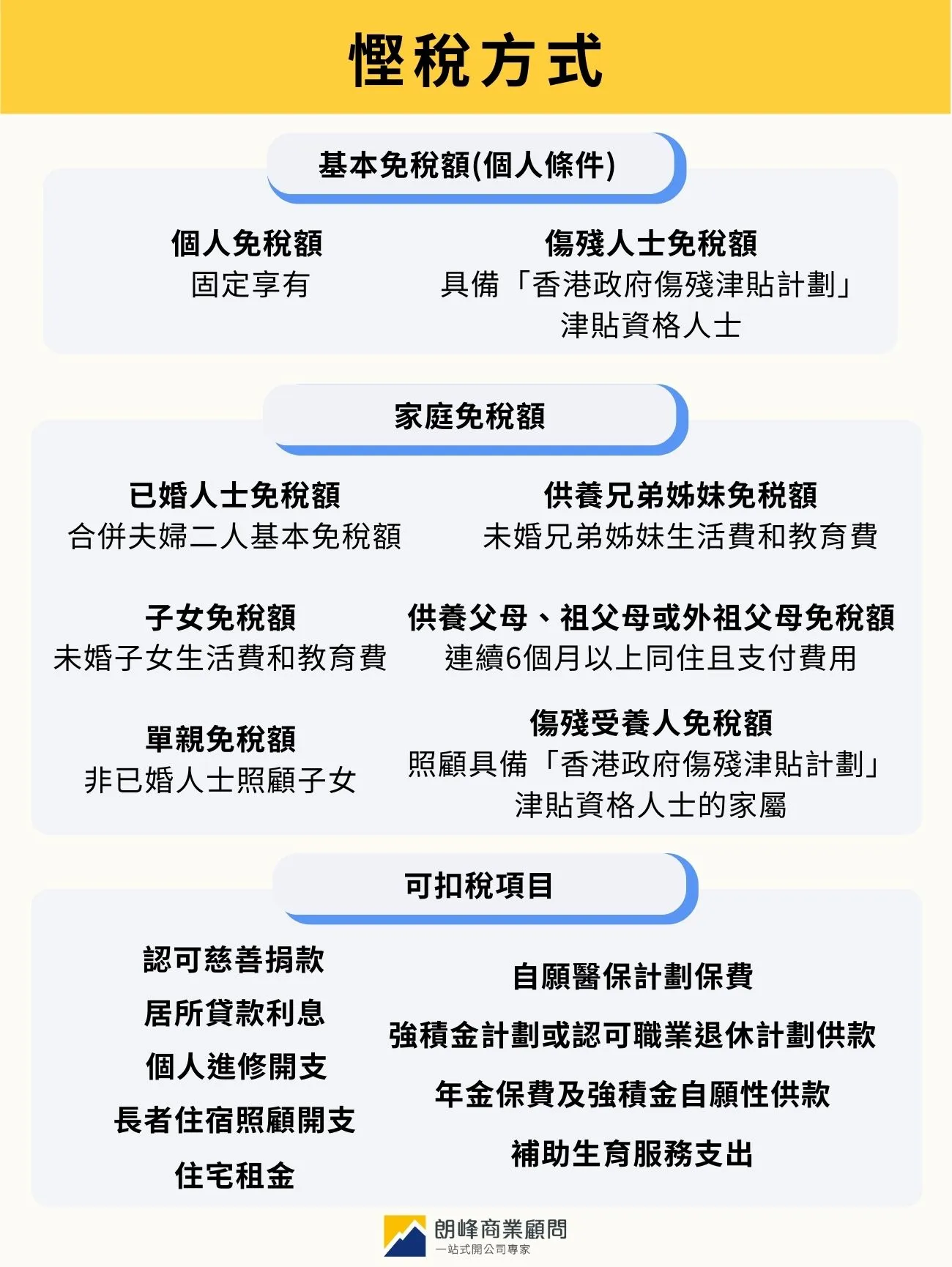

How do you save on taxes?

Based on the above calculation of salaries tax, it can be seen that in order to save tax, you need to make use of the total amount of deductions and allowances.

There are four ways in which tax relief is available for this programme year:

- Tax measures for the year

- Basic Allowance/Personal Allowance: Allowance based on personal conditions

- Family Member Allowance (FMA): the amount of allowance granted to a family member according to his/her conditions.

- Deductible items

Below are the eligibility criteria and tax deduction ceilings for different types of tax concessions.

Tax Savings Approach 1: Highlights of Budget 2025 Tax Initiatives

There are three salaries tax-related measures in Budget 2025

- Further concessions on salaries tax and tax under personal assessment

- 2024/25 Implementation of a two-tier system of standardised tax rates

- 2024/25 Tax Deduction for Fertility Incentives

The reduction in salaries tax and tax under personal assessment from the original ceiling of $3,000 to $1,500 for the current year of assessment 2024/25 will be reflected in the final tax payable for the year of assessment 2024/25.

Tax Savings II: Personal Allowance

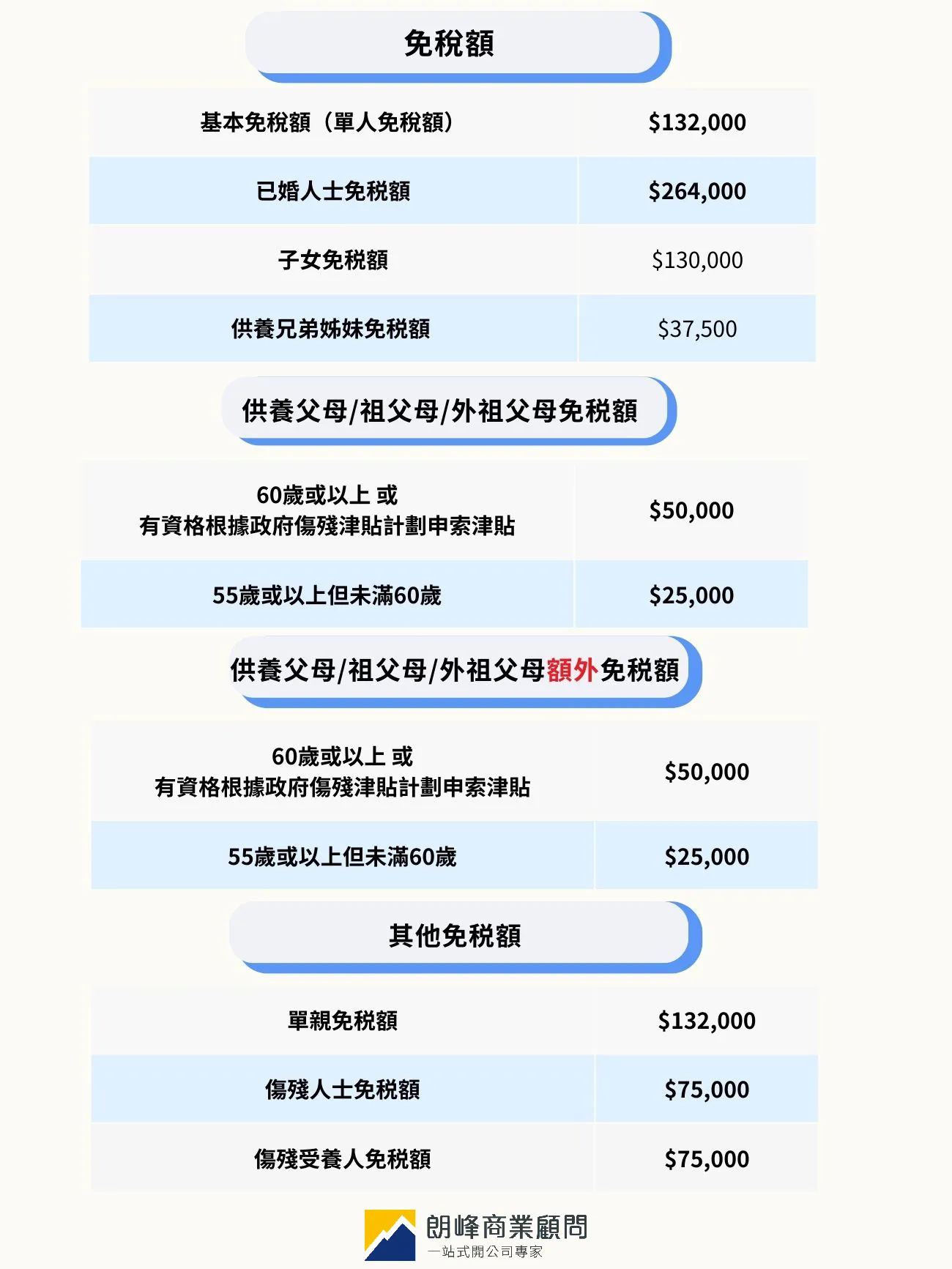

Basic Allowance

The basic allowance, also known as the single person allowance, is available to every taxpayer. The basic personal allowance for 2024/25 is $132,000 per taxpayer, which means that if you earn more than $132,000 per year you will have to pay tax.

| Tax Free Items | Tax Allowance |

|---|---|

| Basic Allowance | $132,000 |

Disabled Person's Allowance

with a "yes" clause.Hong Kong Government Disability Allowance Scheme"Eligible recipients of "allowances" (Normal Disability Allowance (NDA), Higher Disability Allowance (HDA)) may claim these allowances even if they have not yet applied for the Hong Kong Government's Disability Allowance (DA) Scheme.

| Tax Free Items | Tax Allowance |

|---|---|

| Disabled Person's Allowance | $75,000 |

Application for Disability AllowanceConditions:

- certified by the Director of Health or the Chief Executive of the Hospital Authority as severely disabled

- Severely disabled for more than 6 months

- certified by the Director of Health or the Chief Executive of the Hospital Authority to be dependent on others for care in their daily lives

- Not residing in any government-subvented residential institution, HA organisation or special school under the Education Bureau

Tax saving method 3: Family member allowances

Married Person's Allowance

Married persons may file their tax returns separately as individuals or together as a couple, but individuals withMarried person's allowanceIt cannot be used on top of each other, i.e. if one of the parties chooses to file a tax return in his/her personal capacity, the other party can only choose to file in his/her personal capacity.

| Tax Free Items | Tax Allowance |

|---|---|

| Married Person's Allowance | HK$264,000 |

Child Allowance

Child Allowance refers to the payment of living expenses and education expenses for an unmarried child for the year of assessment and can be claimed if the following conditions are met:

- Under 18 years old

- Under 25 but in full-time education (university, school or educational institution)

- Aged 18 or over, but incapable of working due to physical or mental problems.

A child can be a natural child, adopted child, or stepchild of a spouse or ex-spouse, but be aware thatThe child allowance can only be claimed by one of the children.The couple will need to agree between themselves who will make the claim or how the allowance will be apportioned.

| Tax Free Items | Tax Allowance |

|---|---|

| 1st to 9th child (each) | HK$130,000 |

| Additional child allowance for each child born in the year of assessment | HK$130,000 |

Single Parent Allowance

If you're inFor the whole year of assessmentA single parent allowance can be claimed by a person who is not married and who is responsible for the upbringing and maintenance of his or her children. However, if you are married, divorced, widowed or living apart from your spouse during the year of assessment, you do not qualify for the Single Parent Allowance and you will not be able to claim the allowance until the next year of assessment at the earliest.

| Tax Free Items | Tax Allowance |

|---|---|

| Single Parent Allowance | HK$132,000 |

Dependent Brother and Sister Allowance

You or your spouse may be able to claim the Dependent Sibling Allowance if you or your spouse are supporting an unmarried sibling for the year of assessment and the following conditions are met:

- a sibling under the age of 18; or

- Sibling under 25 but in full-time education (university, school or educational institution)

- A sibling has reached the age of 18 but is incapable of working due to physical or mental problems.

The Dependent Brother/Sister Allowance can only be claimed by one of the siblings, and it will need to be mutually agreed who will claim it or how it will be apportioned.

| Tax Free Items | Tax Allowance |

|---|---|

| Dependent Brother/Sister Allowance | HK$37,500 |

Dependent parent, grandparent allowance

A taxpayer or his/her spouse who has a dependent parent/grandparent for the current year of assessment may claim maintenance in respect of each of his/her dependants.Parental AllowanceThe following three conditions must be fulfilled by the dependents during the year:

- Usually resides in Hong Kong

- have reached the age of 55 or are eligible to apply for an allowance under the Government's Disability Allowance Scheme

- Living with the taxpayer for at least 6 consecutive months without paying the full cost; or the taxpayer or his/her spouse pays at least $12,000 per year for the maintenance of the relevant person.

An additional allowance may be claimed if the support is for a full year of continuous residence with the taxpayer and is not fully paid for.

| Dependent Parent and Dependent Grandparent Allowances (per person) | Tax Allowance |

|---|---|

| Aged 55 or above but below 60 | HK$25,000 |

| Aged 60 or above | HK$50,000 |

| Aged below 60 but eligible to claim an allowance under the Government's Disability Allowance Scheme | HK$50,000 |

| Additional Dependent Parent and Dependent Grandparent Allowances (per person) | Tax Allowance |

|---|---|

| Aged 55 or above but below 60 | HK$25,000 |

| Aged 60 or above | HK$50,000 |

| Aged below 60 but eligible to claim an allowance under the Government's Disability Allowance Scheme | HK$50,000 |

Disabled Dependant's Allowance

If the taxpayer in the year of assessment is supporting a family member who is eligible for an allowance under the Hong Kong Government's Disability Allowance Scheme, e.g. spouse, child, parent, grandparent or sibling, etc., the taxpayer will be required to pay a monthly allowance to the family member who is eligible for an allowance under the Hong Kong Government's Disability Allowance Scheme.

And this isAdditional increase in tax allowancesIn addition, the Disabled Dependant's Allowance can be claimed even if you have claimed the Married Person's Allowance, Child Allowance, Dependent Parent and Dependent Grandparent Allowances, Elderly Residential Care Expenses Deduction, or Dependent Brother or Dependent Sister Allowance.

| Tax Free Items | Tax Allowance |

|---|---|

| Disabled Dependant's Allowance | HK$75,000 |

Tax Savings 4: Personal Deductible Items

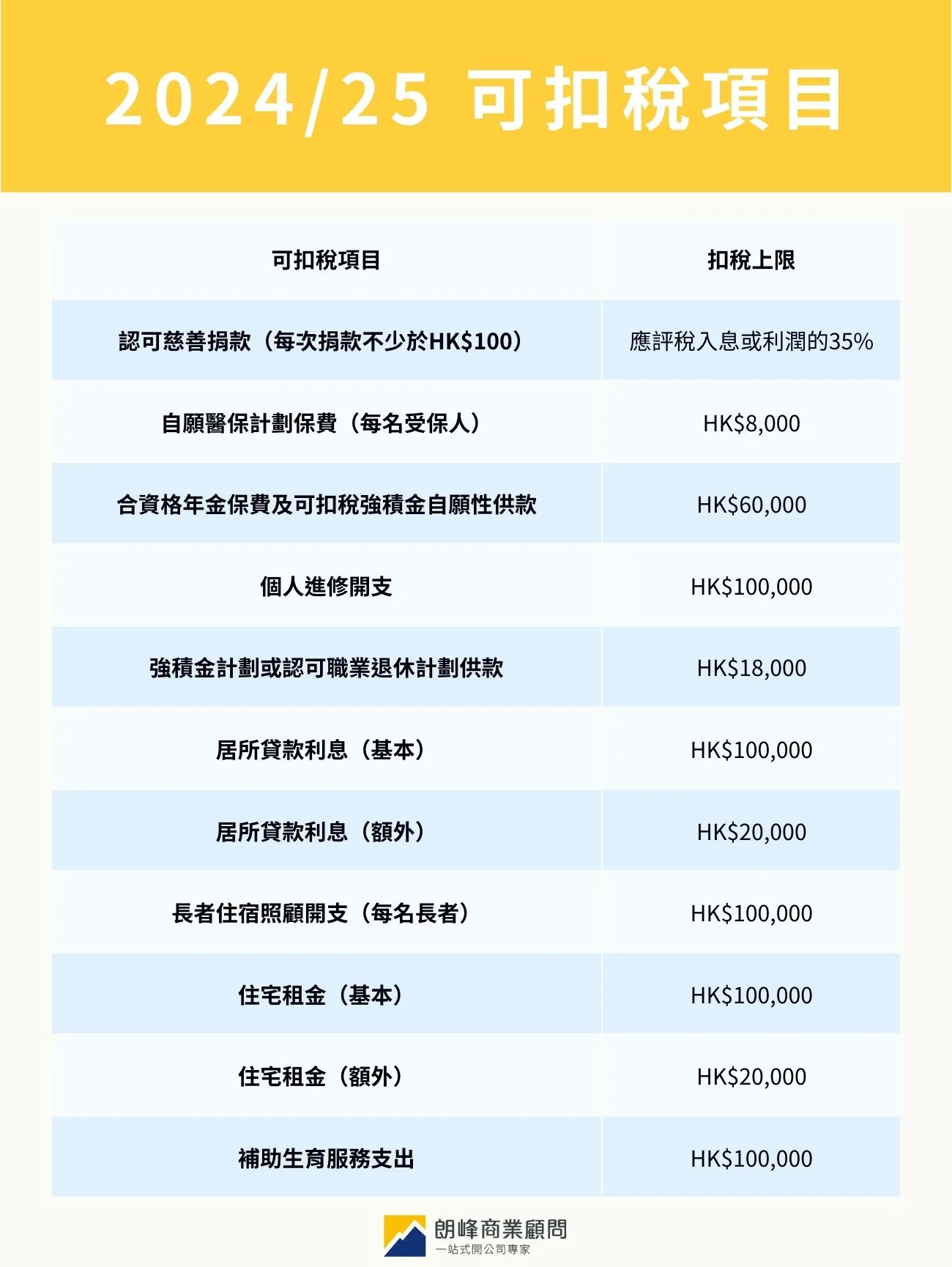

Approved Charitable Donations

Donation to a person who has made a donation under section 88 of the Inland Revenue Ordinance.CharitiesIf you are a spouse, you can claim a tax deduction for cash donations made to the Government or donated to the Government for charitable purposes, up to a maximum of 35% of your assessable income or profits, and your spouse can also claim a deduction for the rest of your recognised charitable donations if you reach your own claim limit.

| Deductible items | Tax deduction ceiling |

|---|---|

| Approved charitable donations (not less than HK$$100 per donation) | 35% of assessable income or profit |

Voluntary Health Insurance Plan Premiums

Purchase by yourself or your relatives under the Eligible Voluntary Health Insurance PlansApproved ProductsThe premiums paid are tax deductible under salaries tax and tax under personal assessment.

Relative means:

- Spouse;

- Your or your spouse's parents, grandparents who have reached the age of 55 or are eligible to claim an allowance under the Government's Disability Allowance Scheme

- Unmarried child or unmarried sibling of you or your spouse under the age of 18, under the age of 25 but in full-time education and incapacitated

| Deductible items | Tax deduction ceiling |

|---|---|

| Voluntary Medical Insurance Plan Premium (per insured person) | HK$8,000 |

'Eligible Annuity Premiums' and 'Tax-deductible MPF Voluntary Contributions'

Policyholders who pay eligible annuity premiums and make tax-deductible MPF voluntary contributions are entitled to a tax deduction of up to $60,000.

The amount deductible shall be the net amount of eligible premiums paid less surrendered premiums and there is no limit on the number of policies for which deduction can be claimed.

| Deductible items | Tax deduction ceiling |

|---|---|

| Eligible Annuity Premiums and Tax Deductible MPF Voluntary Contributions | HK$60,000 |

Expenditure on self-education

Expenditure on self-education, such as prescribed education courses and related examination fees, needs to be for the purpose of obtaining or maintaining a qualification for use in employment and meets one of the following conditions

- Educational programmes offered by education providers

- Training or development programmes provided by trade, professional or business associations

- 由Schedule 13 to the Inland Revenue OrdinanceTraining or development programmes accredited or recognised by specified institutions

If you are attending a course for which you have received a fee remission from your employer, the government or any other fee remission, the remission cannot be claimed as a deduction and self-education expenses can only be claimed at your own expense.

| Deductible items | Tax deduction ceiling |

|---|---|

| Expenditure on self-education | HK$100,000 |

Contributions to MPF Schemes or Recognised Occupational Retirement Schemes (RORS)

You may apply for deduction of your mandatory contributions to a Mandatory Provident Fund scheme or contributions to a recognised occupational retirement scheme, bearing in mind that the deduction ceilings for the two contributions do not overlap and that the amount of your contributions to a 'recognised occupational retirement scheme', but not more than the amount of your mandatory contributions as calculated in accordance with the requirements of the MPFSO, may be deducted.

| Deductible items | Tax deduction ceiling |

|---|---|

| Contributions to MPF Schemes or Recognised Occupational Retirement Schemes (RORS) | HK$18,000 |

Home loan interest

In addition to the home itself, loan interest on the car parking space is deductible, which simply means that the amount of the contribution is tax deductible, but the claim must meet all the following conditions:

- You are the owner of the house.

- The property must be in Hong Kong

- the property was used wholly or partly as your place of residence during the year of assessment concerned

- The loan for which you paid interest on the property loan in the year of assessment concerned was for the purchase of the residential property.

- the loan is secured by a mortgage or charge over the dwelling or any other property in Hong Kong

- The lender is the Government, a financial institution, a registered mutual savings and loan society, a licensed money lender, the Hong Kong Housing Society, your employer, or an organisation or association approved by the Commissioner of Inland Revenue.

| Deductible items | Tax deduction ceiling |

|---|---|

| Home loan interest (basic) | HK$100,000 |

| Home loan interest (additional) | HK$20,000 |

Expenditure on residential care for the elderly (per elderly person)

If your parents, grandparents are not living with you but are living in an institution such as a home for the aged, you may claim deduction of the elderly residential care expenses.All conditionsOnly then can you apply:

- Must have reached the age of 60 in the year of assessment; or be eligible to apply for an allowance under the Government's Disability Allowance Scheme.

- is receiving residential care in a residential institution in the year of assessment.

- Expenses are payable to a residential care home or to any person who collects money on behalf of the residential care home.

- The expense must be paid by you or your spouse in the relevant year of assessment.

- The home must be within Hong Kong and holding a licence or certificate of exemption issued by the Social Welfare Department under the Residential Care Homes (Elderly Persons) Ordinance or the Residential Care Homes (Persons with Disabilities) Ordinance; or a scheduled nursing home exempted from licensing under section 128 of the Private Medical Organisations Ordinance.

| Deductible items | Tax deduction ceiling |

|---|---|

| Expenditure on residential care for the elderly (per elderly person) | HK$100,000 |

Residential rents

Renters can also get tax deductions for rentals, provided that the dwelling is your principal premises and the building is not prohibited from being used for residential purposes by any law or specified instrument, and of course, if the car parking space is included in the lease, the car parking space rentals can also be regarded as a deductible amount.

If there is more than one tenant under the tenancy or not for the whole of the tax year, the deduction ceiling will need to be pro-rated.

| Deductible items | Tax deduction ceiling |

|---|---|

| Residential rent (basic) | HK$100,000 |

| Residential rent (additional) | HK$20,000 |

Expenditure on subsidised maternity services

To alleviate the burden on parents, expenses incurred for eligible assisted reproduction services are tax deductible under salaries tax and tax under personal assessment provided that you have paid for the expenses in that year, and to be eligible for the deduction, the person who has paid for the expenses of the eligible assisted reproduction services must be a:

- taxpayer

- Spouse residing with the taxpayer

- Taxpayer and taxpayer's spouse residing with the taxpayer

A person who receives or will receive eligible assisted reproduction services must be:

- taxpayer

- Spouse of the taxpayer

- Taxpayer and Taxpayer's Spouse

Those who have received assisted reproduction services are also eligible to claim tax deduction for the expenses incurred under the following conditions:

- Fertile Couple

- Persons undergoing sex selection of embryos to avoid concomitant genetic diseases

- A single person who has placed gametes or embryos in a woman before the end of the marriage and continues the procedure after the marriage has ended

- Patients undergoing chemotherapy, radiotherapy, surgery or other medical treatment which may result in loss of fertility

| Deductible items | Tax deduction ceiling |

|---|---|

| Expenditure on assisted reproduction services | HK$100,000 |

Salaries Tax and Personal Allowances Frequently Asked Questions

When will I receive my tax return?

Tax returns are normally issued by the Inland Revenue Department (IRD) on the first working day of May each year, and the returns for the year of assessment 2023/24 were sent out on 2 May 2024.

Can Personal Assessment save tax? Who needs to use Personal Assessment?

Personal Assessment is one of the assessment methods that combines salaries, business profits or losses and rental property income, and assesses the profits or losses from other incomes together, so there is no need to consider using Personal Assessment if you do not have any other business or rental property.

How to deal with mistakes and omissions in tax allowances?

After filing a return and before receiving an assessment: submit amendments in writing to the Assessor.

Upon receipt of the tax assessment: Fill inIR831 Form

After tax payment: Written corrections to the Inland Revenue Department

How do I pay salaries tax?

Tax payments can be made in person at the Inland Revenue Department, through internet banking, Payment by Phone Service (PPS), Faster Payment Service (FPS), Bank Automated Teller Machines (ATMs) and credit cards.

Late filing of tax return

Late filing of tax return will not only result in penalty but also prosecution. According to the Inland Revenue Department, late filing of tax return will result in the loss of your allowances and deductions, such as MPF contributions, recognised charitable donations, etc., which will be cancelled and not available, leaving you with the basic allowances only.

Do self-employed people have to pay tax?

Income below the basic allowance of $132,000 is not actually taxable, but it is required to be reported whenever a tax return is received, not just because you know you won't have to pay tax in the end.

Do I have to pay taxes on my part-time job?

Income below the basic allowance of $132,000 is not actually taxable, but it is required to be reported whenever a tax return is received, not just because you know you won't have to pay tax in the end.

If I do not receive a tax return, does it mean that I do not have to file a return or pay tax?

No, not receiving a tax return does not mean that you do not need to file a return. If you know that you need to pay tax but have not received a tax return, you have to notify the Inland Revenue Department (IRD) or make an enquiry before 31st July each year. You can take the initiative to enquire whether the IRD has issued you a tax return by using the following methods:

- Telephone

- In person at the Inland Revenue Department, Central Enquiry Unit, 5 Co-ordinating Road, Kai Tak, Kowloon, Hong Kong.

- Easy Tax Platform

Can married people save more tax by combining their tax assessments?

The married person's allowance for 2024/25 is $264,000. If one of the partners earns less than the $132,000 limit on the basic personal allowance, a joint return may be more favourable.

For example, if the additional tax relief for the current year is $1,500 and the total amount for a married couple is $3,000, and if they are assessed separately and have to pay tax, they will be able to enjoy more tax relief if they file their tax returns separately.

In fact, the Inland Revenue Department (IRD) will help you to calculate which method can pay less tax, so you do not have to worry about choosing the wrong method of tax assessment.

2024/25 Salaries Tax Standard What is the two-tier system?

Policy Address 2024 proposes a two-tier system for salaries tax and tax under personal assessment, whereby the maximum tax rate for a net income of $$5 million or less will remain unchanged at $15%, while the tax rate for a net income exceeding $$5 million will be adjusted upwards to $16%, and so the standard two-tier system will be changed to a two-tier system for next year's year of assessment.

| Net income* | duty rate |

|---|---|

| $ 5 million or less | 15% (maintenance) |

| Higher than $5 million | First $5M: 15% Excess over $5M: 16% |

What is the 2024/25 Supplementary Childbirth Service?

To alleviate the burden on parents, the loan interest deduction or residential rent tax deduction and the expenditure on assisted reproduction services will be increased respectively in 2024.

- For the first child born on or after 25 October 2023, the maximum amount of deduction for home loan interest deduction or residential rent tax deduction for a child with whom the taxpayer resides is increased from $100,000 to $120,000 until the child reaches the age of 18 years.

- To introduce a deduction of up to $100,000 a year for expenses on assisted reproduction services.

Conclusion

Understanding the key points of your 2024/25 tax return and the ways to save tax can be a safe bet for you. Remember that taxpayers must complete and return their tax returns within 1 month from the date of issue to avoid affecting their tax allowances.

Further tax planning and advice can be obtained from a Longford business advisor, contact us today on Whatsapp by clicking on the bottom right!