2025 Tax Tips: Claiming Dependent Parent Allowance & FAQs

Taxpayers will receive their tax returns in May each year for the tax season, commonly known as the "Green Bomb", to claim the Parent's Allowance for maintaining a parent, grandparent who is ordinarily resident in Hong Kong and aged 55 or above, and who meets the conditions of residing with the family or paying at least TP4T12,000 per annum in respect of the child's maintenance.

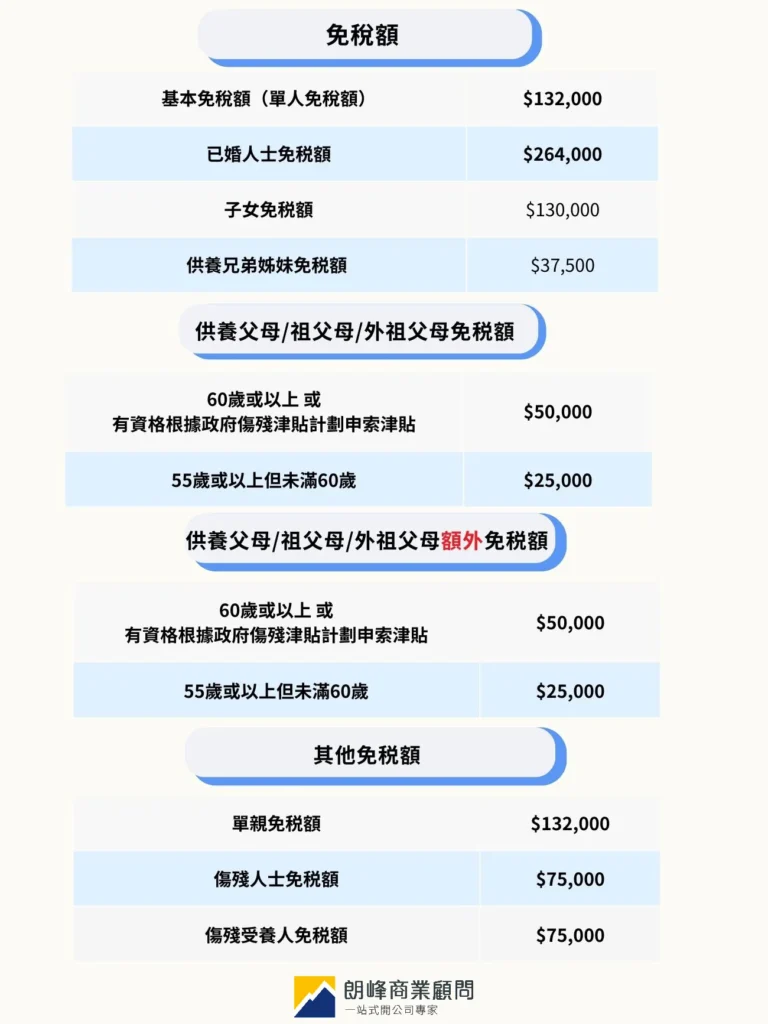

What is the basic allowance?

The basic allowance, also known as the personal allowance, is $132,000 per taxpayer for 2024/25, which means that if you earn more than $132,000 per year you will need to pay tax.

Married person's allowance

Married people can file their tax returns separately as individuals or together as a couple.Married person's allowanceThe married person's allowance is $264,000 for 2024/25. If one of the partners earns less than the $132,000 limit on the basic personal allowance, a joint return may be more favourable depending on whether there are additional tax concessions available each year.

Additional Allowances

In addition to the Personal Allowance or Married Person's Allowance, there are other allowances:

| Tax Free Items | Tax allowances for 2024/25 and beyond |

|---|---|

| Child allowance (1st-9th child) (per child) | $130,000 |

| Dependent Sibling Allowance (per person) | $37,500 |

| Dependent parent and dependent grandparent allowances

Aged 60 or above OR Eligible to claim allowances under the Government's Disability Allowance Scheme | $50,000 |

| Dependent parent and dependent grandparent allowances

Aged 55 or above but below 60 | $25,000 |

| Dependent Parents and Dependent GrandparentsAdditionalTax Allowance

Aged 60 or above OR Eligible to claim allowances under the Government's Disability Allowance Scheme *Additional Allowance means that you have resided with us continuously throughout the year without paying the full cost. | $50,000 |

| Dependent Parents and Dependent GrandparentsAdditionalTax Allowance

Aged 55 or above but below 60 | $25,000 |

| Single Parent Allowance | $132,000 |

| Tax allowance for the disabled | $75,000 |

| Disabled Dependant Allowance (per person) | $75,000 |

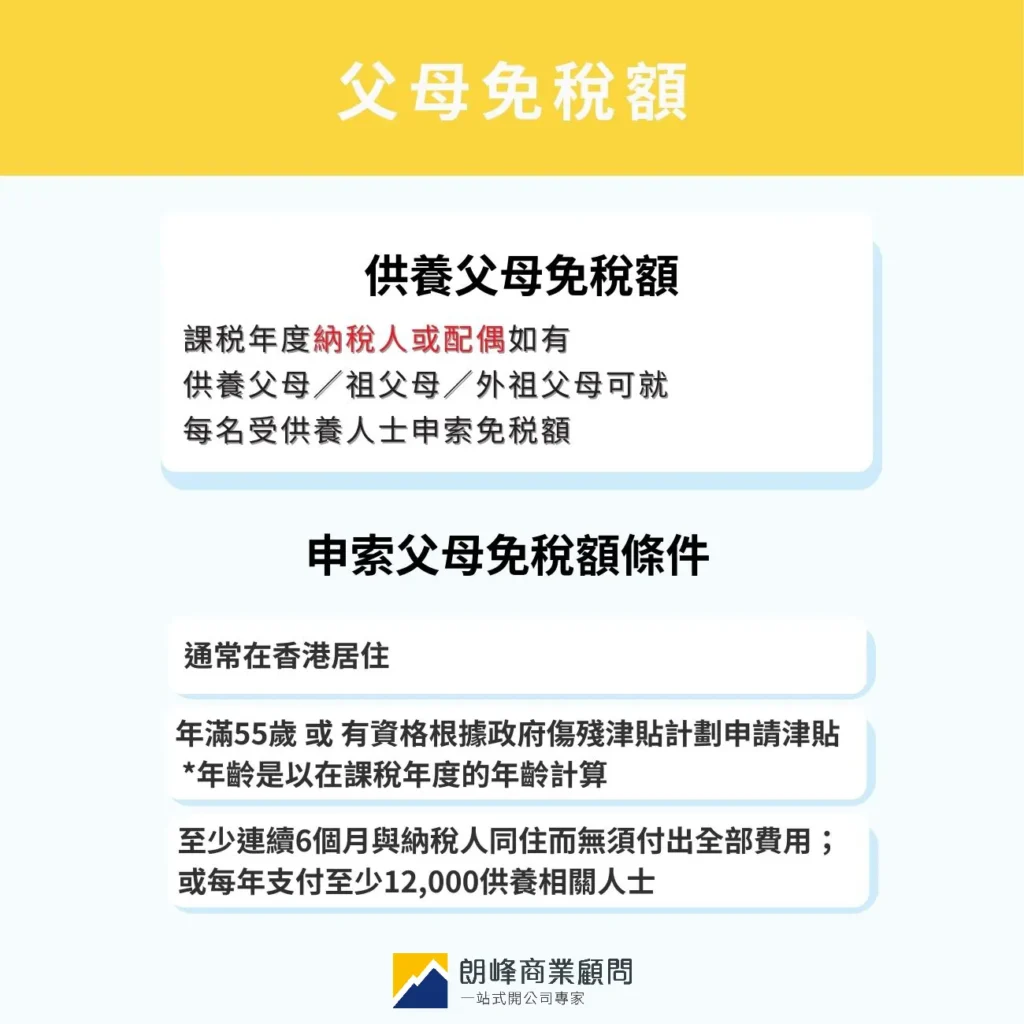

What is the Dependent Parent Allowance?

A taxpayer or his/her spouse who is a dependent parent/grandparent for the current year of assessment may claim an allowance in respect of each dependent person, ranging from a minimum of $25,000 to a maximum of $100,000 for each eligible dependent person who fulfils the following three conditions during the current year of assessment:

Conditions for claiming dependent parent, grandparent allowance

- Usually resides in Hong Kong

Dependent parent allowance cannot be claimed if the dependant has taken up residence overseas for a prolonged period of time

- have reached the age of 55 or are eligible to apply for an allowance under the Government's Disability Allowance Scheme

Age is calculated on the basis of age in the year of assessment, which is from 1 April of each year to 31 March of the following year. Taking 2024/25 as an example, it means that a person must be born before 31 March 1970 in order to be eligible to reach the age of 55 years.

- Living with the taxpayer for at least 6 consecutive months without paying the full cost; or the taxpayer or his/her spouse pays at least $12,000 per year for the maintenance of the relevant person.

The condition of cohabitation is a minimum of 6 consecutive months, and an additional allowance can be claimed if it is for a full year and no full costs are incurred.

Dependent Parent Allowance Frequently Asked Questions

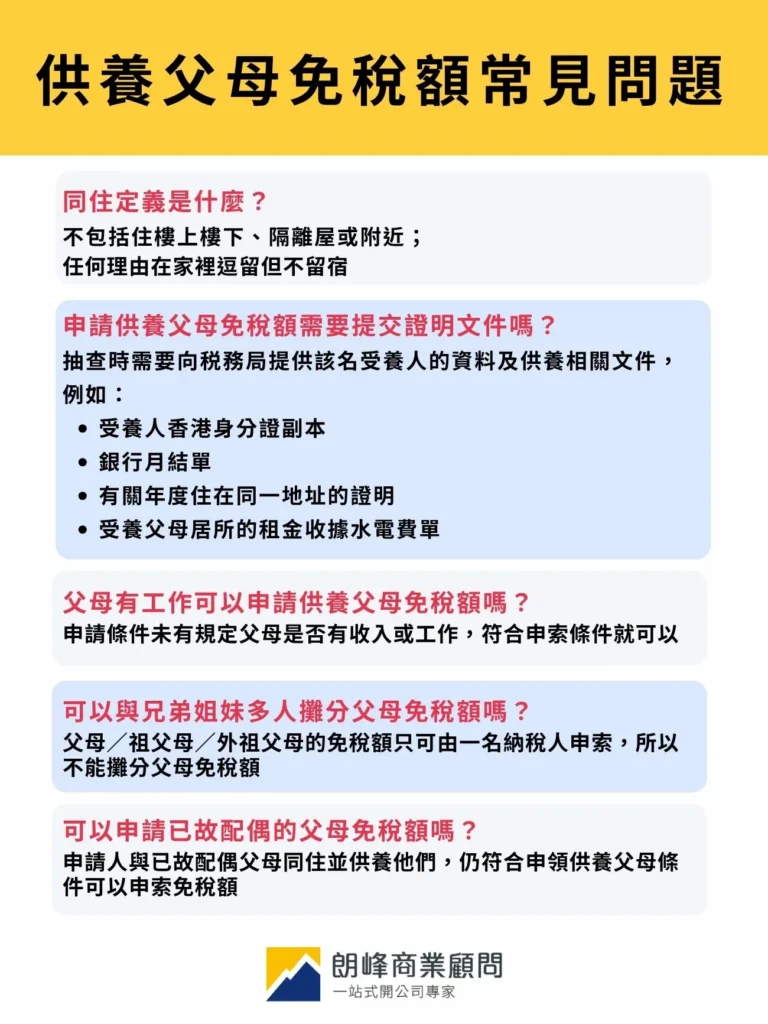

What is the definition of cohabitation for the Dependent Parent Allowance?

The definition of living together does not include parents living upstairs, downstairs, in or near a partitioned house, etc., where one is responsible for the rent of the house, nor does it include any reason for staying in the home but not staying overnight.

Can parents, grandparents living in homes for the aged, homes for the aged, etc. claim tax allowances?

As they do not fall within the definition of living together, they cannot claim dependent parent, grandparent allowance. If they have reached the age of 60; or if they are eligible to claim an allowance under the Government's Disability Allowance Scheme, they can refer toDeduction for elderly residential care expensesOne item.

Do I need to submit documents to claim the Dependent Parent Allowance?

You do not need to provide any documents when submitting your tax return. However, you still need to confirm that you are eligible for the Dependent Parent Allowance before completing Part 11.4 of your tax return.

In future, random checks may be conducted, at which time information on the dependant and the relevant documents on the dependant's support will need to be provided to IRD, for example:

- A copy of the dependant's Hong Kong Identity Card

- Monthly Bank Statement

- Proof of residence at the same address in the relevant year

- Rent receipts and utility bills of the dependent parent's home

The above information will not only be checked to see if the information provided is consistent with the past records of the Inland Revenue Department (IRD), but will also be verified by other government departments such as confirmation of entry and exit certificates by the Immigration Department (ImmD), and so on, and therefore, taxpayers are obliged to provide the information truthfully.

Can I claim dependent parent allowance if my parents are working?

The conditions do not include the need for the dependants to be unemployed or have no other income, so as long as they fulfil the eligibility criteria, they can still claim the dependent parent allowance even if they are still working or have other income.

Can multiple siblings share the Parental Allowance?

Parent/grandparent allowances can only be claimed by one taxpayer. Therefore, if the allowance cannot be apportioned or claimed repeatedly by more than one person, it is recommended that the child with a larger personal income should apply for tax saving.

Can I claim the deceased spouse's parent allowance if my spouse has passed away?

If the taxpayer's spouse has passed away, if the applicant is residing with the deceased spouse's parents and is supporting them, he/she still meets the conditions for claiming the Dependent Parent Allowance.

Is there a limit to the deduction of the Additional Dependent Parent/Grandparent Allowance?

Dependants who meet the additional condition of residing with the taxpayer for a whole consecutive year during the year of assessment without having to pay the full cost can claim an additional allowance, which is not subject to any tax deduction ceiling.

Can I claim the Parental Allowance if my dependant is an adoptive parent or step-parent?

Legally adopted parents/step-parents fall within the definition of "parent" and therefore meet the basic requirements to claim the Parent's Allowance.

Can I claim the Dependent Parent Allowance if I am not related by blood?

It is customary to have elders who are closer to one another as family members or parents, but "godparents", "godmothers", and step-parents who are not formally registered as married do not fit the definition of "parents".

The definition of "parents" includes only the natural parents of the individual or spouse, legally adoptive parents/step-parents, or parents of a deceased spouse.

Can a non-Hong Kong resident spouse claim the Dependent Parent Allowance for his/her spouse?

A spouse who is not a Hong Kong resident may claim dependent parent allowance if his/her parents and dependent grandparents meet the requirements, such as residing with the taxpayer for a continuous period of six months.

However, as the spouse does not have a Hong Kong Identity Card, according to the information provided by the IRD, a copy of the other spouse's identity document and a copy of the marriage certificate are required. If the spouse is issued with a Hong Kong identity card in future, he/she should notify IRD in writing of the relevant identity card number within one month.

Consequences of False Declaration of Parental Allowance

Any misrepresentation of parental allowances or incorrect statement is an offence under section 80(2)(b) of the Inland Revenue Ordinance (IRO).

It is an offence to make an incorrect statement without reasonable excuse when claiming any deduction or allowance. On conviction, he is liable to a maximum fine of $10,000 and a further fine of three times the amount of tax undercharged. If fraud is involved, in addition to the above penalties, there is a further penalty of imprisonment for three years.

Case in point:Prosecution Cases of the Inland Revenue Department

How to resolve errors or omissions in tax returns

After filing a return and before receiving an assessment: submit amendments in writing to the Assessor.

Upon receipt of the tax assessment: Fill inIR831 Form

After tax payment: Written corrections to the Inland Revenue Department

Calculation of Salaries Tax

salaries taxThere are two types of calculations, namely, progressive rates based on net chargeable income and standard rates based on net income.

Actual taxable income = Total income - Total deductions

Total Allowances Net Income = Total Income - Total Deductions

Standardised two-tier tax rate for 2024/25

Net income is calculated as follows: Gross income - Gross deductions

The net income of the first HK$5,000,000 of the two-tier standard rate for 2024/25 is calculated on the basis of 15% and the balance on the basis of 16%.

Conclusion

In addition to the personal allowance, there are other tax deductions available when filing your tax return. If you are living with your parents, grandparents, the Dependent Parent, Grandparent Allowance can provide you with an allowance of more than $25,000, so please remember to file your tax return truthfully.