2025 Self-Employed Person Tax Teaching: How to file taxes for speculators, part-timers and freelancers? Self-employed persons Tax Returns

Self-employed persons need to clarify their salaries tax or profits tax status, keep proper records of their business income and expenditure for tax deduction purposes, pay attention to the timeframe for filing tax returns and avoid common mistakes, and are advised to seek professional assistance to ensure compliance.

Let us first find out who are self-employed persons.

Self-employed Freelancer Definition

Anyone who sells goods, provides professional services and makes a profit is considered a self-employed person / freelancer.

Typical types of self-employed people include

Entrepreneurs (e.g. online shops, IG shops)

This type of self-employed person refers to those who sell goods and provide professional services in their own name. Whether it's an online or brick-and-mortar business or a sole proprietorship, as long as you're not employed by someone else and you make money by doing business on your own, you're considered a "start-up boss".

Business Partners

If you are running a business with friends, family members or other people, for example, opening a tutorial school, a studio, a nail salon, a photography team, and so on, and there is a partnership share income from this, even if you are not the owner of the company, this kind of partnership business is also a kind of self-employed person.

Freelancer

This is the most typical type of self-employed person, who does not have a regular boss and lives entirely on his or her own. Commonly found in designers, writers, photographers, illustrators, translators, fitness trainers and other industries.

Temporary Part-time Job (Frying)

This group of people may not have permanent employers but will accept short-term jobs such as exhibition organisers, sample distributors, event assistants, supply teaching, and so on. These jobs are usually temporary and time-limited.

Do self-employed people need to file a tax return? What kind of tax do I need to file?

Taxation is mainly divided into "salaries tax" and "tax on income"! Taxation is mainly divided into "Salaries Tax" and "Taxes".profits taxThe "tax filing status" is different for each individual, so here's how you can find out what you should be filing for.

Do you need to file "Salaries Tax" or "Profits Tax"?

Here's a simple form to get you up to speed on what you should be filing:

| Tax Items | identity |

|---|---|

| salaries tax | Employed by a company with an employment contract, fixed salary and MPF contributions |

| profits tax | No employer, self-employed or earning income on a freelance basis |

Using the "contract of employment" as the basis of judgement, self-employed persons are required to pay profits tax, so all you need to do is to know whether you need to pay salaries tax or not.

But what if there is another person who is employed by the company and is making a profit? Here are three examples to help you make a judgement call!

Examples of common tax returns

Alen is a full-time marketer who is employed by a company in a full-time position. After work, he works as a freelancer and is paid directly by the client.

Alen should declare: Salaries tax + Profits tax

Ken is a photographer who works on a freelance basis without any employment relationship. He is proactive in developing clients, setting his own rates and delivery standards.

Ken should report: Profits Tax

Zoe works as a part-time tutor at a language centre two days a week. She does not have any other side jobs and is not free to take on cases.

Zoe should declare: Salaries tax

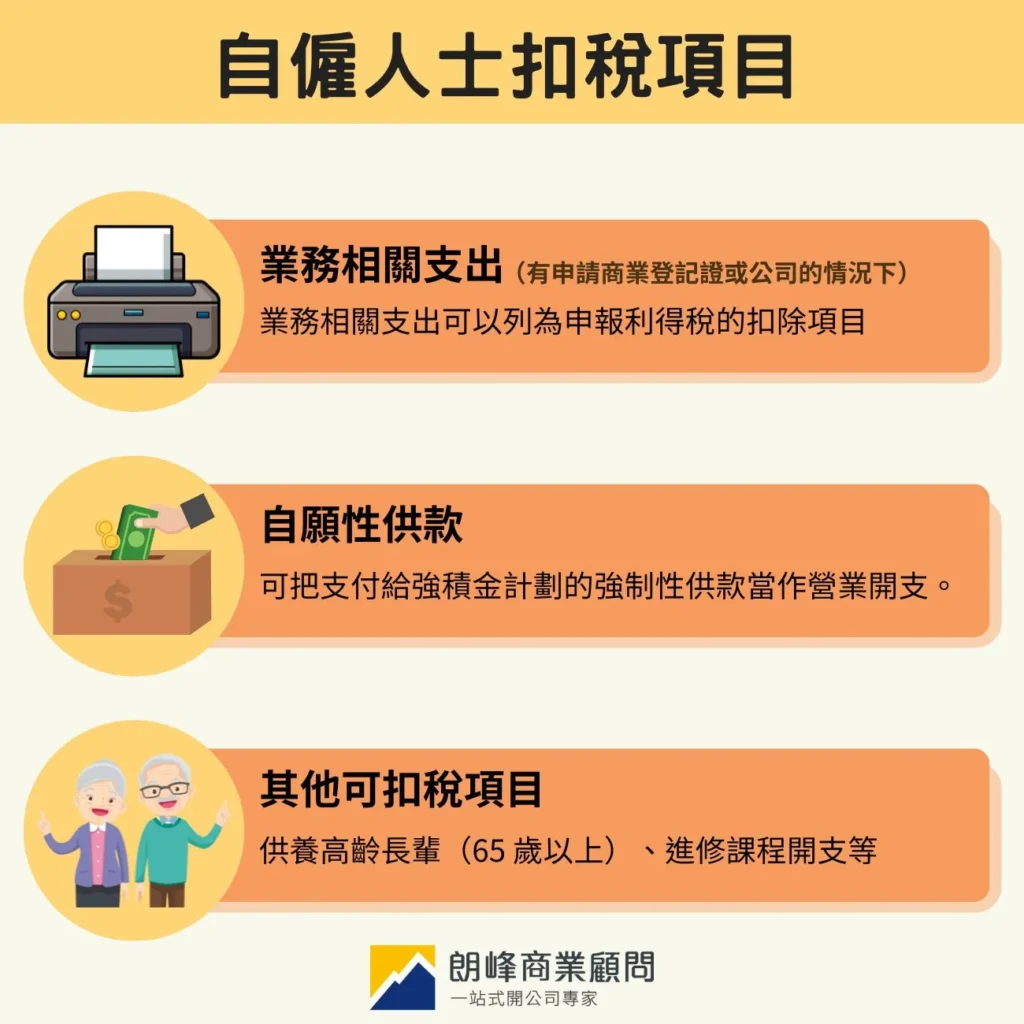

What are the tax deductions for the self-employed?

Business-related expenses

If you have applied for a Business Registration Certificate or have set up a company, you can deduct "expenses and disbursements" related to the operation of your business when filing your profits tax return. As long as you can prove that the expenses are incurred for the purpose of generating business income, they can be classified as tax deductions, and the common ones are listed below:

- Operating Costs for Provision of Services

- Advertising and marketing expenses

- Equipment and Facilities for Business Use

- Incoming goods and related purchase costs

- Accounting and Tax Consultancy Fees

- Office Rental, Utilities and Communication Costs

It is important to keep receipts and payment records! In the event of a random check by the Inland Revenue Department (IRD), you will need to show evidence that the expenditure is related to your business.

Voluntary contributions

According to the information to be implemented by the MPF Schemes Authority, self-employed persons may claim Hong Kong profits tax deduction for mandatory contributions paid to MPF schemes as business expenses. The maximum amount of deduction is as follows: $18,000 for the year of assessment 2015-16 and each subsequent year of assessment. voluntary contributions made by self-employed persons are not deductible;Tax deductible voluntary contributionsException.

Other tax deductible items

Apart from business-related expenses, self-employed persons can also claim some tax deductions related to their personal status, for example, expenses for supporting elderly elders (aged 65 or above), expenses for continuing education programmes, etc. can also be claimed as tax deductions, and more detailed deductions can be found inHong Kong Profits Tax Calculation and DeductionsFor enquiry, or refer to2025 Tax Return] What are the personal allowances? Salaries Tax Deductions and Allowances - Tax Saving Tips。

What is the self-employed person's tax allowance?

According to the latest Hong Kong Inland Revenue Ordinance 2025, self-employed persons have a basic allowance which is divided into single person andMarried Person's Allowance:

| identities | Tax Allowance |

|---|---|

| Singles | HKD 132,000/year |

| married person | HKD 264,000/year (may apply for joint assessment) |

Special attention should be paid to the fact that if the income is below the tax allowance, no tax is payable, but a tax return is still required!

Self-employed persons are required to file tax returns! Failure to file a tax return can lead to serious consequences.

When do self-employed people have to file tax returns?

The tax return from the Inland Revenue Department is usually received on the first Sunday of May and needs to be completed within one month.

What should I do if I don't receive my tax return? Can I not file a tax return?

Many self-employed people are under the misconception that they do not need to file a tax return if they have not received a tax bill, which is actually a big mistake!

According to section 51 of the Inland Revenue Ordinance of Hong Kong, "It is the duty of the taxpayer to inform the Inland Revenue Department on his own initiative that he has income subject to tax".

Unless you have received a tax return from IRD, you have to notify IRD in writing within 4 months after the end of the basis period for the year of assessment.

What are the consequences of not filing tax returns for the self-employed?

If you are found to have failed to file a tax return, you will firstly be required to pay all the outstanding tax for the year in which you failed to file the return, as well as penalties and interest. In addition, if you are found to have deliberately evaded tax, the Inland Revenue Department may even institute criminal prosecution and place you on a tax evasion blacklist, which will affect your creditworthiness and your future tax filing records.

Self-employed persons' tax returns under different scenarios

Self-employed persons' tax returns will vary depending on whether they have a business registration or whether they have set up a company. Here are the types of tax returns that correspond to different statuses for you to make a quick comparison:

| identities | Tax Returns |

|---|---|

| Sole proprietorship | BIR60 download |

| Incorporated | BIR51 Download |

| Unlawful Incorporation | BIR52 download |

| Businesses carried on by non-Hong Kong residents | BIR54 download |

| Contract workers | IR56M Download |

Once you know what kind of tax return to fill out, here's how to file your tax return for each situation.

How to report self-employed persons without business registration?

This is because any commercial activity for profit in Hong Kong, regardless of the form of business, requires the issuance of a Business Registration Certificate. Therefore, if a person does not have a Business Registration Certificate, he may have just started to become a self-employed person and has not yet been registered or his turnover is very low, in which case, he still needs to fill in and submit a tax return in order to file a return to the Government.Inland Revenue Department。

If the income is earned without any employment relationship and you do not receive a business registration, you still need to file a "salaries tax return".

How do I report having a Business Registration Certificate?

If you have registered your business, you are officially considered to be operating an industrial business. During the tax payment period, you will receive a Profits Tax Return, which requires you to report your total income, expenses and deductions for the entire year.

You need to prepare business income and expenditure accounts, including invoices, receipts, transfer records, advertising expenses, etc. as the basis for reporting.

Tax returns are audited by an accountant for the opening of a company.

If you run a business in the name of a company, regardless of the actual income, you are required to submit annual audited financial statements in accordance with the Companies Ordinance, which will be audited by a certified public accountant and a tax return will be filed to declare the business profits.

The biggest difference between a corporate tax return and an individual tax return is this:

- More cumbersome tax filing procedures and more documentation (e.g. balance sheet, income statement, breakdown of expenses, etc.)

- A licensed accountant must be appointed to issue an audit report.

- Higher tax filing fees, but more room for tax planning

This mode is suitable for those who have stable turnover, multiple transactions, need to co-operate with enterprises or plan to expand in the future. However, if you are still in the freelance stage, you may not need to start a company in a hurry, and you can focus on stabilising your business with the sole trader model first.

Self-Employed Tax Tutorials: Step by Step and Timeline to Follow

Step 1: Receive the tax return from the Inland Revenue Department (IRD)

Around early May each year, the Inland Revenue Department (IRD) will send out tax returns or notify you to file online via eTAX. Self-employed persons will usually receive a Personal Tax Return (BIR60), while business owners will receive a Profits Tax Return (BIR51).

Step 2: Prepare records of business income and expenses

Before you start filling in your tax form, you need to sort out the last tax year:

- Income from all customer payments (including cash, bank transfers, money transfers, etc.)

- Various business-related expenses (e.g. advertising, equipment, rent, etc.)

- Receipts, invoices, transfer records, quotations and other documents.

Step 3: Calculate Deductible Items and Taxable Profit

After calculating your net profit (total income - operating expenses) for the year based on your income and expenses, and then further listing the deductions you qualify for as described above, and deducting these amounts, you will arrive at your true "taxable profit", which is the basis for calculating whether or not you should pay tax, and how much tax you should pay.

Step 4: Fill out and submit your tax return

The IRD offers two ways to file tax returns. You can choose to fill out the form in paper form and send it back, or you can complete the form through the IRD's eTAX online tax return filing system.

Those who use the paper-based method should pay special attention to the time of sending the letter. If the letter is sent before the deadline for filing but is received by the Inland Revenue Department after the deadline, it will be regarded as a late filing as well!

Step 5: Waiting for tax bill and paying tax

After filing your tax return, the Inland Revenue Department (IRD) will consider whether you are liable to tax based on the information in your return and send you an official tax bill within two months, which is usually paid in two instalments:

| first tranche | Usually by mid-January |

|---|---|

| second phase | Usually by early April. |

Step 6: Remember to Prepare for Next Year's Accounts

Unlike companies, many self-employed people do not have a clear SOP for filing tax returns, and they are usually in a hurry only during the tax season. However, in fact, the correct approach is to keep regular accounts and vouchers from the very beginning of each year, so as to build up a complete system of income and expenditure.

Keeping up with your bookkeeping habits not only makes your tax return faster and less stressful, it also helps you keep track of your monthly operations and gives you a better direction for doing business.

Frequently Asked Questions on Self-employed Persons Taxation

Do I still need to declare my income below the tax allowance?

Required! According to the Inland Revenue Ordinance, you are obliged to file a return with the Inland Revenue Department (IRD) as long as you have carried out business activities such as the provision of professional or personal services.

Allowance only means that you may not have to pay tax, it does not mean that you may not file a tax return.

Simply put, filing a tax return is an obligation and paying or not paying tax is the result. Even if you only have a few thousand dollars left after deducting your expenses, or if you have no profit at all, you should take the initiative to file a tax return, otherwise you may be regarded as an evader.

I am a business owner, do I have to pay tax even if my company suffers a loss?

The need! An accountant still has to write your audit report and submit your profits tax return to the Inland Revenue Department. This is a basic legal obligation under the company system and does not change depending on whether the company is loss-making or not.

My part-time company filed my tax return, do I still need to file a tax return?

Required! If you also have freelance work, you will need to file an additional tax return for your self-employment even if your part-time company has already filed a salaries tax return for you. The Inland Revenue Department (IRD) does not automatically combine the two incomes, so you need to clearly list out and pay both Salaries Tax and Profits Tax in your tax return.

If you only have part-time income and no other income at all, you still have to fill in the tax return and tick the no self-employment income box to complete the tax filing process.

Can I amend the wrong information after submitting the tax form?

Yes! If you realise that you have filled in the wrong information after you have submitted it, there are two ways to make corrections:

- Send an official change notice (with incorrect and correct information)

- Log on to the "Correct Tax Return Information" function on the eTAX platform to submit your application.

It is recommended to handle the matter as early as possible to avoid the IRD to calculate the tax bill based on the incorrect information, which will make the amendment procedure even more cumbersome.

Hong Kong Professional Tax Returns Agent Service: Longford Business Consultants

If you are a self-employed person who wants to save time, avoid mistakes and red tape, and seek professional assistance in filing tax returns, Longmont Business Consultants is the most favourable choice for you.

Since our establishment in 2014, we have successfully assisted many freelancers, sole proprietors and small entrepreneurs to complete the tax filing process, and have been highly praised by our clients for our rich experience and professional handling mechanism. Our team upholds the highest standards in the industry and provides you with the following professional services:

- Dedicated follow-up: From income calculation, expenditure classification, tax deduction checking to tax return filling and submission, the whole process is handled by dedicated staff.

- One-stop full-process support: Whether you are a sole proprietor (with or without business registration), a freelance caseworker or a part-time income earner in a portfolio, we can provide tailor-made tax filing solutions.

- Efficiency and timeliness: Helping you to file your tax return on time and within the legal deadline, avoiding the risk of penalties or back payments.

Whether you are a self-employed person who is just starting out, an individual who has established a studio, or a novice who is new to filing tax returns, you only need to provide the basic information on your income and expenses, and we can handle the whole process on your behalf, so that you can easily complete your Hong Kong tax returns and leave your time for your creation and operation.