![Cancellation of Business Registration] Procedures for Winding Up a Limited/Unlimited Company, Conditions for Deregistration of a Company in One Article](https://setuphk.com/wp-content/uploads/2025/05/cancellation-of-business-registration-0.webp)

Cancellation of Business Registration] Procedures for Winding Up a Limited/Unlimited Company, Conditions for Deregistration of a Company in One Article

When closing a business, both limited and unlimited companies need to cancel their business registration and may face fines if they fail to do so. This article will provide a complete explanation of the business registration cancellation process, the winding up procedure for unlimited companies, deregistration of companies and frequently asked questions.

How do I cancel my business registration? Is cancellation the same as closing a business?

In Hong Kong."Cancellation of business registration" means applying to the Inland Revenue Department for the termination of the Business Registration Certificate (BR), while "closure" means that the company formally ceases to operate.

For an unlimited company, cancellation of business registration usually means closure of business. However, for a limited company, apart from cancellation of business registration, legal procedures such as deregistration of the company or winding up of the company have to be completed before the company can be formally closed down.

Unlimited Company Winding Up Operations

Unlimited Company Closure 1: Cancellation of Business Registration Certificate

If an unlimited company decides to cease operation, it should pay the business registration fee and submit a Notification of Cessation of Business (Form IRC3113) to the Inland Revenue Department (IRD) and handle the relevant tax matters.Upon completion, the Inland Revenue Department (IRD) will issue a confirmation notice that the business registration has been cancelled.

Unlimited Company Closing 2: Bankruptcy

If the unlimited company fails to repay its debts, the owner may consider filing for bankruptcy.Bankruptcy proceedings are handled by the courts and the Official Receiver's Office is responsible for administering bankruptcy.

Winding up of operations by limited companies

Ltd. closed 1:Deregistration ((cancellation of company)

「Deregistration of companies"Dissolution is a simple way of dissolving a private company or a company limited by guarantee which has ceased operation and is solvent. Provided that the company has settled all its debts and obtained a "Notice of No Objection" from the Inland Revenue Department, the company can be dissolved at a lower cost and in a shorter period of time and formally struck off the register upon expiry of the Gazette notice period.

ApplicationDeregistrationconditions

- All members of the company have consented to the deregistration;

- The company has not yet commenced operation or carried on business, or has not operated or carried on business during the three months immediately preceding the making of the application;

- The company has no outstanding debts;

- The Company is not a party to any legal proceedings;

- The assets of the company do not include immovable property situated in Hong Kong;

- (If the company is a holding company) The assets of all the company's subsidiaries exclude immovable property situated in Hong Kong;

- The Company has obtained a Notice of No Objection to Deregistration of Company from the Commissioner of Inland Revenue (the "Notice of No Objection").

Limited Liability Company Winding Up 2: Liquidation

liquidatorIt refers to the process by which a limited company goes through legal proceedings to realise all its assets for the purpose of repaying its debts and eventually winding up the company and demobilising its business.

Conditions of voluntary winding up of shareholders

When the limited company is able to pay all its debts, the shareholders may pass a special resolution to go into voluntary liquidation.Directors are required to submit a statutory declaration that the company will be able to settle all its debts within 12 months.

Conditions for voluntary creditors' liquidation

If the company is unable to pay its debts, the shareholders may resolve to go into liquidation and convene a meeting of creditors.The liquidator will be responsible for disposing of the company's assets in order to repay creditors.

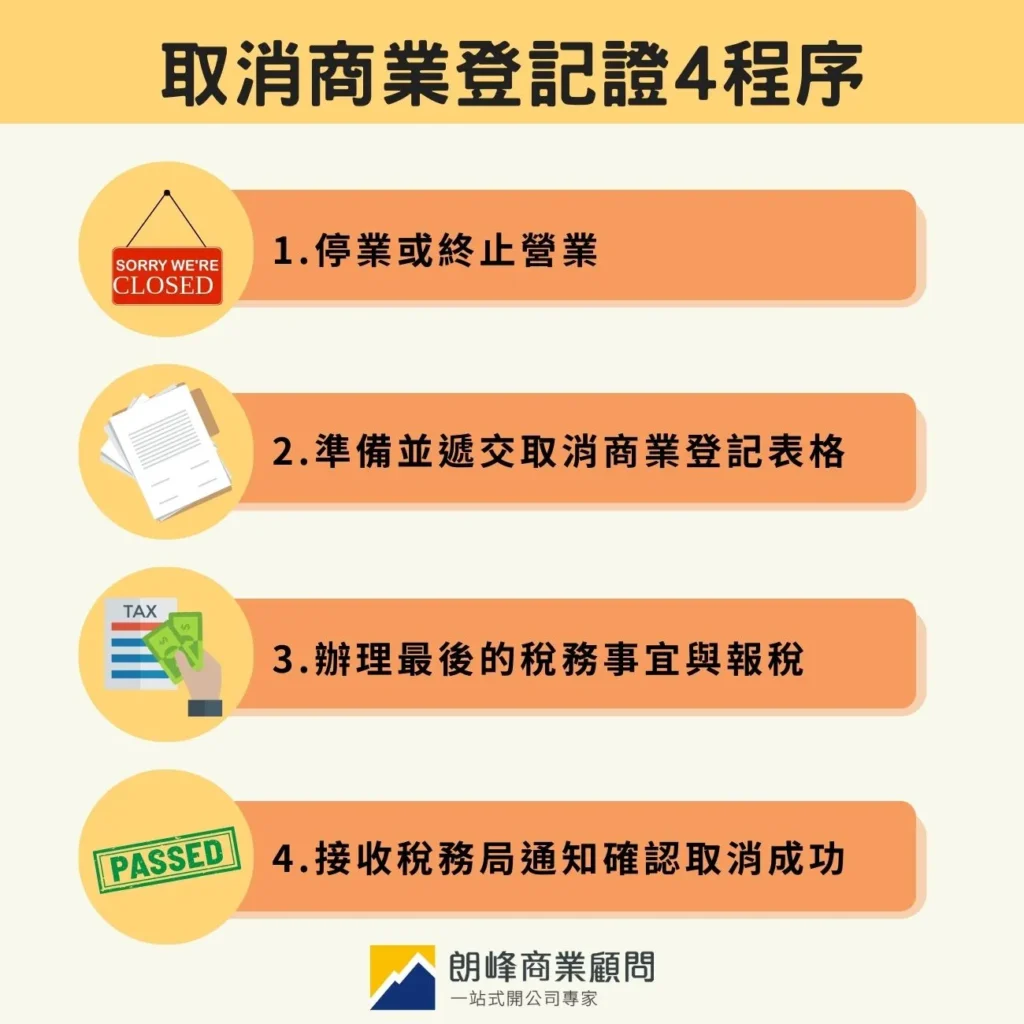

Unlimited Company Closing Procedures: Cancellation of Business Registration Certificate 4 Procedures

When an unlimited company decides to cease operation and confirms that there are no outstanding debts or wages in arrears, the proprietor or partners should notify the Business Registration Office in writing within one month from the date of closure of the company to formally complete the cancellation of the business registration procedure:

Cancellation of Unlimited Company Business Registration 1: Cessation or Discontinuance of Business

The owner should pay allBusiness Registration Certificate FeeAfterwards, the company ceased all business activities and settled all financial matters.

The business registration fee is payable until the year in which the business is wound up, even if the business of the company has been wound up.

Cancellation of Unlimited Company Business Registration 2: Prepare and submit Business Registration Cancellation Form (IRC3113)

Complete and submit the Notice of Cancellation of Business Registration (Form IRC3113) to the IRS with the following information:

Business Registration Number / Branch Registration Number

Company or Branch Name

address

Completion Date

Correspondence address and contact telephone number after close of business

Cancellation of Unlimited Company Business Registration 3: Finalising Tax Matters and Filing Tax Returns

After submitting the cancellation form, the Inland Revenue Department (IRD) will issue the final issue of the Profits Tax Return, which the responsible person of the company is required to complete on time according to the instructions. If the company's accounts involve profits tax or other taxes, they should also be processed and paid at the same time.

Cancellation of Unlimited Company Business Registration 4: Receive notification from the Inland Revenue Department confirming successful cancellation

Once the tax matters have been settled, the Business Registration Office will notify the responsible person in writing to confirm that the business registration of the company has been formally cancelled and there is no need to fulfil the annual reporting and payment obligations. Once the confirmation is received from the Inland Revenue Department, the company can be regarded as officially closed.

Thereafter, the company is no longer required to pay business registration fee or file tax returns or other business documents, but should keep records of its accounts for at least seven years for checking purposes.

Procedures for winding up a limited company: Deregistration of a company

When a limited company ceases to operate, it cannot just cancel its business registration, but must also complete the deregistration procedures with the Inland Revenue Department and the Companies Registry, and apply for a Notice of No Objection in accordance with the law. The following are the standard steps for the deregistration of a limited company:

Deregistration of a limited company Step 1: Call a general meeting and resolve to close the business

The directors and shareholders of the Company are required to convene a general meeting at which all shareholders unanimously approve a resolution to deregister the Company. Whether attending the meeting or signing the resolution in writing, all shareholders must participate and agree before the cancellation process can be formally initiated.

Deregistration of a limited company Step 2: Completion of company's statutory obligations, payment of tax and debts

Before applying for deregistration of a company, the company is required to fulfil all its statutory obligations, including filing with the Inland Revenue Department (IRD) documents such as the latest company tax return, annual return and employer's salary and pension statement. At the same time, it is important to confirm whether there are any unanswered tax enquiries, outstanding tax objections or appeals.

In addition, the company is required to settle all taxes payable (e.g. profits tax, property tax, stamp duty and possible penalties) and to make proper repayment of other debts and charges, including business registration fees. If there are surplus assets, the distribution process should also be completed in accordance with the Articles of Association or shareholders' agreement.

Cancellation of Limited Company Step 3: Apply for cancellation of business registration within 1 month from the date of closure of business

When a company ceases to operate or ceases to carry on business in any branch, it should notify the Business Registration Office in writing within one month from the date of cessation. This may be done in writing or by completing a formIRC3113 (Business Registration Notification of Closure of Business) The information to be submitted to the Inland Revenue Department (IRD) should include the following information:

Business Registration Number / Branch Registration Number

Company/Branch Name

Registered Address

Actual Completion Date

Post-completion mailing address and contact details

Failure to notify by the due date may result in a fine or an offence under the relevant legislation, so special attention should be paid to the reporting deadlines.

Step 4: Apply for a "Notice of No Objection" from the Inland Revenue Department

Before formally applying for deregistration at the Companies Registry, it is necessary to obtain a Notice of No Objection issued by the Inland Revenue Department (IRD) to certify that the company has no outstanding tax. Applicants are required to download and fill in the following form on the IRD's websiteForm IR1263and pay a non-refundable application fee of HK$270.

After the Inland Revenue Department (IRD) has conducted an audit and confirmed that the company does not have any outstanding tax or penalty matters, a "Notice of No Objection" will be issued. This is one of the key documents that are indispensable for the cancellation of a company's registration.

Step 5: Apply to the Companies Registry for Company Deregistration

Upon receipt of the "Notice of No Objection", the company should submit the following information to the Companies Registry to formally apply for deregistration:

"Original or electronically certified copy of the Notice of No Objection

Completed Form NDR1 (Application for Deregistration of Private Company or Company Limited by Guarantee)

Cancellation Application Fee HK$420 (non-refundable)

Please make sure all documents are in order to avoid delay or return of the application.

Step 6: Waiting for Gazette Notice and Company Deregistration to Take Effect

Upon receipt of a complete application, the Registrar will publish a notice in the Gazette and issue a notice of acceptance within about one month. If no objection is raised within three months after the publication of the notice, the company will be formally deregistered and its name will be struck off the register, and the deregistration process will be completed.

Frequently Asked Questions on Cancellation of Business Registration

Can I cancel my business registration online?

No. The current closure or cessation of any branch business must be within 1 month from the date of closure.writeInform the Business Registration Office that online application service is not yet available.

How long does it take to cancel a business registration?

For cancellation of business registration only, it is usually sufficient to notify the Inland Revenue Department (IRD) within one month from the date of cessation of business and the processing time is not long. However, if an application for deregistration of a limited company is made at the same time, the whole process will take about 6 to 12 months, including notification in the Gazette and waiting for the deregistration to take effect.

Will my business be cancelled automatically if I don't pay the business registration fee?

No, it will not. Even if a company has not paid the business registration fee for a long period of time, the business registration will not be cancelled automatically, but the company will be subject to recovery of the outstanding fee and possible penalties. As long as the company has not taken the initiative to apply for cancellation, the Inland Revenue Department (IRD) will continue to treat the company as an operating company and will continue to issue Business Registration Certificate renewals, tax returns and notices of renewal, and the Companies Registry (CR) will require the filing of an annual return each year.

Do I need to apply for a BR cancellation if my company has never been in business?

Required. Even if the company has never actually operated, it does not mean that the business registration will be cancelled automatically and the person in charge still needs to take the initiative to apply for cancellation from the IRD.

After applying for cancellation of Business Registration Certificate (BR), do I have to pay the outstanding BR fees in the past?

Required. The company must settle all outstanding business registration fees, otherwise it will affect the issuance of the Notice of No Objection by the Inland Revenue Department, which will further delay the whole deregistration process.

Do I need to file a NAR1 and tax return after cancelling my business registration?

Required. All outstanding business registration fees must be cleared, otherwise it will affect the progress of the company's deregistration or cancellation.

What do I need to do after cancellation of business registration?

Upon cancellation of business registration, the company should close all bank accounts in its name as soon as possible to avoid abuse and to ensure the safety of the funds, and the relevant proof of cancellation of registration should be presented during the process. At the same time, the company should also handle its assets and liabilities properly, including repayment of debts and distribution of assets, to avoid subsequent disputes.

What should I do if my Business Registration Certificate has expired?

If the Business Registration Certificate has expired, whether it is due to non-receipt of demand note, loss of documents, or other reasons, you can apply for a replacement in person or by mail. To apply in person, please bring the old Business Registration Certificate to the Business Registration Office. If you send the application by post, you should enclose a photocopy of the registration certificate and a crossed cheque, and you will receive the renewed Business Registration Certificate upon completion of the application.

Professional cancellation of business registration agency services: Langfeng Business Consultants

If you want to save time and reduce the complexity of the process, and seek professional assistance in completing the Hong Kong company cancellation of business registration, company deregistration and other procedures, we are a reliable choice.

Since our establishment in 2014, we have assisted many clients to successfully close their companies, and are recognised by our clients for our extensive experience and well-established processes. Our team upholds the highest standards in the industry to provide you with:

Professional and reliable service: From the preparation of documents, through the legal process, to government submissions, the entire process is handled with dedicated assistance to ensure accuracy.

Comprehensive one-stop programme: Covering all aspects of cancellation of business registration, application for notice of no objection by the Inland Revenue Department and application to the Companies Registry.

Efficiency and Timeliness: Quick response and immediate reply to help you complete the cancellation process in the shortest possible time.

Whether you are a small or medium-sized business owner, or an individual entrepreneur, simply provide your basic information and contact Lafont Business Consultants on whatsapp to help you complete the deregistration of your Hong Kong company, so that you can focus on your future development without any worries!

Extended reading: "TheWhat is a company secretary? Definition, duties and conditions of appointment in one article》