[For Employees & Employers] What is the difference between Long Service Payment (LSP) and Severance Payment (SP), and what is the impact of MPF cancellation on hedging in 2025? Long Service Payment legislation and calculation method in one article.

Labour protection is something that every employer and employee needs to be familiar with. Nowadays, after an employee has left his job, if he meets the requirements, he can receive long service payment and severance payment, but what is the difference between the two? What is the difference between long service payment and severance payment? In the following paragraphs, we will share with you the conditions and calculation methods of long service payment and severance payment.

Long Service Payment and Severance Payment

Labour rights under the Employment Ordinance in Hong Kong enable employees to receive a certain amount of compensation through long service payment and severance payment under specified circumstances as a result of dismissal, redundancy or cessation of work by the company.

However, it should be noted that if you are eligible for severance payment or long service payment at the same time, you will only be entitled to the higher of the two amounts.

What is long service payment?

An employee who has been employed under a continuous contract for not less than 5 years will be eligible for Long Service Payment if he/she fulfils the basic eligibility criteria for Long Service Payment and meets one of the five conditions of separation from service.

Conditions of Long Service Payment

Conditions for Long Service Payment.

- Employees are not summarily dismissed due to redundancy or serious misconduct;

- Employment contracts with fixed terms are not renewed upon expiry;

- Death of an employee in the course of employment;

- Resignation by a registered medical practitioner or a registered Chinese medicine practitioner on the basis of a specified certificate certifying permanent unfitness for the present job;

- Resignation at age 65 or above.

* In the event of death of an employee in the course of employment, the eligible person is required to apply to the employer for long service payment by completing the prescribed form within 30 days after the death of the employee.

What's severance pay?

Severance Payment is payable to an employee who has been employed under a continuous contract for a period of not less than 24 months and who has been dismissed by the company on one of three grounds, such as redundancy or stoppage of work.

Conditions of severance payment

Conditions of entitlement to severance payment:

- Dismissed due to redundancy;

- Non-renewal of contract due to redundancy upon expiry of fixed-term contract;

- Suspended.

An employee will be deemed to have been dismissed for "redundancy" if the dismissal is for the following reasons

- The employer is winding up or preparing to close the business;

- The employer ceases to carry on, or is about to cease to carry on, the business in which the employee is engaged at the place of employment;

- the diminution or cessation of demand by the employer for the work performed by the employee or for the work performed at the place of employment.

If it is provided in the contract of employment that the remuneration of an employee is subject to the amount of work given by the employer, as in the case of remuneration calculated on the basis of the quantity of work units or the volume of production, and the employee does not work and does not receive wages for the total number of days on which he/she is not paid for the work done, he/she is regarded as having ceased to be in employment:

- More than half of the total number of normal working days in any 4 consecutive weeks.

- more than one-third of the total number of normal working days in any 26 consecutive weeks

Normal working days do not include factory closures, rest days, annual leave and statutory holidays.

2025 Latest Long Service Payment Calculation Method and Severance Payment Calculation Method

Before understanding the calculation methodology, it is important to know about the "MPF offsetting mechanism", which affects the calculation of long service payment and severance payment:

Cancellation of the MPF offsetting mechanism

In the past, employers were required to pay severance or long service payments to employees who met the conditions when they were laid off or left their jobs, but this could be partially offset by employers' contributions to the Mandatory Provident Fund (MPF), which is commonly known as the "MPF offsetting mechanism".

However, the Bill was passed by the Legislative Council in 2024 to remove the offsetting mechanism and will take effect from 1 May 2025 onwards.

This means that from 1 May 2025 onwards, employees with accumulated years of service who have been made redundant or who are eligible for long service payment will receive more substantial compensation as this will no longer be offset by the MPF contribution.

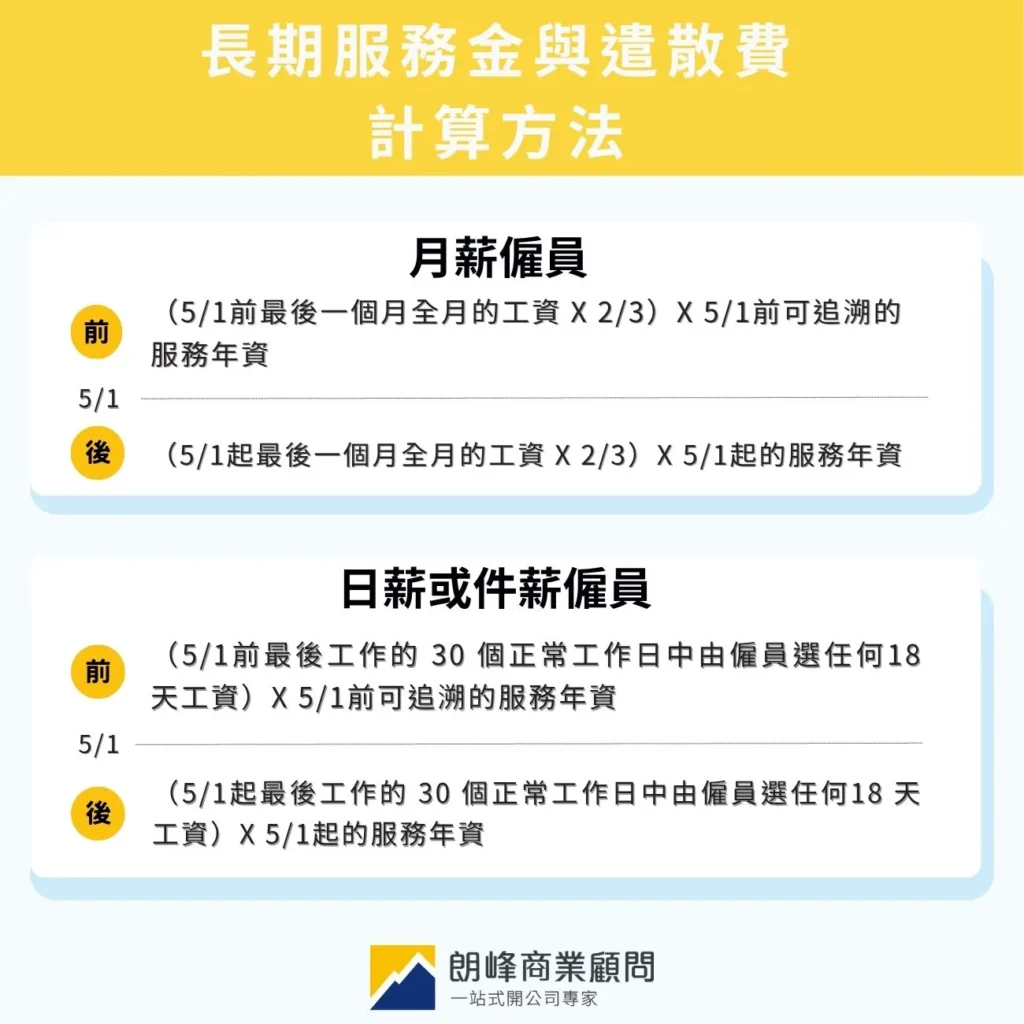

Latest Long Service Payment and Severance Payment Calculations

Long service payment and severance payment are calculated in the same way:

| By 1 May 2025 | 1 May 2025 onwards | |

| Employees with monthly salary | (Last full month before 5/1)

(Wages X 2/3) X 5/1 before Traceable years of service |

(Last full month from 5/1)

(Wages X 2/3) X 5/1 onwards. Years of service |

| Daily rate or

Salaried employees |

(30 of the last jobs before 5/1)

Any election by the Employee during a normal working day 18 Tiangong Capital) X 5/1 ago Traceable years of service |

(30 last jobs from 5/1 onwards)

Any election by the Employee during a normal working day (18 days' wages) X 5/1 onwards. Years of service |

*Wages for the last full month may be calculated on the basis of the average wages for the 12 months immediately preceding the termination date of his/her contract, with the final amount capped at two-thirds of $22,500 (i.e. $15,000).

** Traceable years of service Prorated if less than 1 year of service.

Long Service Payment, Severance Payment Ceiling

If the relevant date of termination of the employment contract is on or after 1 October 2003, the maximum amount of long service payment or severance payment is $390,000.

Employee Traceability Years of Service

If you have been with the company for more than 30 years, fully retrospective years of service will need to be calculated in the following way.

- Manual labour employees who terminate their employment contracts after 1/10/2004, regardless of any remuneration, with fully retrospective years of service.

- Non-manual employees whose employment contracts were terminated after 1/10/2004 and whose average monthly wages for the 12 months before 8 June 1990 did not exceed $15,000, with retrospective length of service

- Non-manual employees whose employment contracts were terminated after 1/10/2004 and whose average monthly salary for the 12 months before 8 June 1990 was more than $15,000 with retrospective service up to 1980

Long Service Payment Calculator, Severance Payment Calculator

For a trial run of the Long Service Payment and Severance Payment items, use theStatutory Employment Benefits Reference Calculator.

Duration of long service payment or severance payment

Severance payment period

Under the Employment Ordinance, if an employee wishes to claim severance payment, he must give notice in writing to the employer of his claim for severance payment within three months of his dismissal or cessation of employment, and the employer is required to pay the severance payment to the employee within two months of receipt of the notice.

Long Service Payment Period

Long Service Payment is payable within 7 days after termination of the employment contract.

Frequently Asked Questions

If an employee has completed 5 years of service and is dismissed due to redundancy, does the company need to pay severance payment and long service payment at the same time?

Only one of the severance payment or long service payment and MPF employer's contribution accrued benefits can be received, whichever is the highest.

Can an employee who has completed 5 years of service and resigns before the age of 65 due to ill-health receive long service payment?

Yes, after five years of service, if the employee resigns for health reasons, he/she will be eligible for long service payment conditions, but he/she should provide the employer with a certificate issued by a registered medical practitioner or a registered Chinese medicine practitioner certifying that he/she is permanently unfit for his/her present job, and the employer has the right to arrange for the employee to be re-examined by a designated medical practitioner at his/her own expense.

What are the consequences if an employer fails to pay long service payment and severance payment to his employees?

Severance payment: An employer who fails to pay severance payment on time is liable on conviction to a maximum fine of $50,000.

Long service payment: An employer who fails to pay long service payment is liable on conviction to a maximum fine of $200,000 and imprisonment for one year.

If an employee does not renew his/her contract before the expiry date, will he/she be entitled to long service payment or severance payment?

An employee is not entitled to long service payment or severance payment if the employer requests the employee in writing, not less than 7 days before the date of termination or expiry of the contract, to renew the contract or to be re-employed under a new contract and the employee unreasonably refuses the request.

Can severance payments or long service payments be offset by MPF contributions now?

No, the Legislative Council has abolished the MPF offsetting mechanism, and there are now two scenarios after the conversion:

- Years of service before 1 May 2025: Employers can still offset the amount of compensation against the MPF contribution as usual.

- Seniority after 1 May 2025: no more offsetting! The employer must pay a separate severance or long service payment, which cannot be deducted from the MPF contribution.

Professional Accounting Services in Hong Kong: Langfeng Business Consultants

We have many years of experience in assisting employers to handle the termination of employment procedures, and we are familiar with the Employment Ordinance and the changes in MPF hedging policy, and we can assist you in completing the calculation and declaration process in accordance with the law, so as to ensure that your company's operation is free from any worries. We provide the following professional services:

- Specialist assistance in calculating and reporting amounts: Accurately calculating severance or long service payments based on length of employment, reasons for leaving, payroll and MPF records, and confirming the availability of hedges.

- One-stop documentation and procedural support: Whether the employee is about to leave, has been dismissed, or has died, we can provide a complete response and clerical advice.

- Compliance Risk Control: Remind the legal time limit, assist in the preparation of certificates, and handle employee enquiries or complaints to avoid legal disputes or labour disputes in the future.

Simply provide us with basic employee information and employment records, and we can fully handle the compensation calculation process for you, so that you can properly handle the exit arrangements under legal compliance, and stabilise your company's reputation and internal management.