What is Provisional Tax? How to apply for holding over the payment of provisional tax and how to calculate provisional tax in one go.

Paying tax is an obligation, but do you know what is provisional tax? How to calculate the amount of provisional tax you need to pay? This article will tell you all about it. It will also tell you the circumstances under which you can apply for holding over of provisional tax, how to apply for holding over of provisional tax, and the deadline for applying for holding over of provisional tax.

What is Provisional Tax (Pre-paid Tax)? Why do I need to pay tax in advance?

Provisional Tax, also known as pre-paid tax, is a tax payable by the Inland Revenue Department (IRD) of Hong Kong on a voluntary basis.Inland Revenue OrdinanceTaxpayers are required to project the amount of tax payable in advance for the following year based on their income for the previous year of assessment.

For the coming year's tax year, the tax payable for that year of assessment will first be deducted from the provisional tax paid in the previous year, and if there is still a surplus after the deduction, it will be carried forward for credit in the next assessment.

Provisional taxes are payable annually, be it salaries tax, corporate profits tax or property tax.

Generally speaking, provisional tax is payable from January to March (for payment of tax payable for the year of assessment covering estimated income tax for the period from April to December of the previous year) and from April to June (for payment of provisional tax for the following year of assessment covering estimated income tax for the period from January to March of the current year).

If you want to know exactly when the provisional tax is due, you can check the date of payment in red on the tax bill.

Calculation of provisional tax

The calculation of provisional tax requires an estimate of the amount of tax payable for the previous year of assessment, and the amount of provisional tax is generally calculated:

Salaries tax: Salaries income of the previous year - various deductions = provisional tax for that year

profits tax: Based on the amount of assessable profits less losses available for set-off in the previous year.

When you receive your tax bill, if you find that the amount of provisional tax is higher than the amount of tax payable for the year of assessment, it is because the Inland Revenue Department (IRD) usually does not deduct the tax concessions for the following year (the 100% tax concession introduced by the Government in recent years) before calculating the provisional tax, and the tax concessions can only be applied after the passage of the Budget, so it is normal that the amount of provisional tax is sometimes higher than the amount of tax payable for that year of assessment.

What will happen if I don't pay the pre-paid tax?

Failure to pay provisional tax on time will have the following consequences:

Penalty

The Inland Revenue Department (IRD) will impose a surcharge on overdue tax. Initially, a surcharge of 5 % of the total amount of tax payable (both first and second instalments) will be imposed as a penalty.

If the tax arrears (including the 5% surcharge) remain unpaid for more than 6 months, an additional surcharge of 10% will be levied.

Recovery of tax from third parties

The Inland Revenue Department (IRD) may issue recovery notices to third parties such as employers, banks and debtors of taxpayers. The third party is required to pay the tax within the statutory time limit, or else he/she will be personally liable to pay the full amount of tax. If the third party is the employer, the deduction of wages still has to comply with the requirement of the Employment Ordinance, i.e. the total amount of wages deductible by the employer in respect of the wage period in question must not exceed half of the wages payable at that time.

Civil Prosecution

The Inland Revenue Department (IRD) may initiate civil proceedings through the District Court against tax defaulters who are too late in paying tax to recover the outstanding amount. The tax defaulter will then be required to pay not only the tax in arrears, but also the court fees, fixed costs and interest.

Prohibition of Departure

If a tax defaulter fails to settle the arrears and intends to leave or has already left Hong Kong, the IRD may apply to the District Court to prevent the tax defaulter from leaving Hong Kong.

The consequences of wilful tax evasion are even more serious, as fines and imprisonment may be imposed.

However, if they are unable to pay the tax on time due to financial difficulties or other reasons, they can apply to the IRD for holding over the payment of provisional tax.

What are the circumstances under which I can apply for holding over the payment of provisional tax?

Usually we can look at the reasons for holding back payment on a tax-by-tax basis:

Application for Holdover of Provisional Tax Reason 1: Profits Tax

- Your assessable profits for the year of assessment are, or are likely to be, less than 90% of the assessable profits for the preceding year or 90% of the assessed profits for the year of provisional tax, but supporting documents (including signed copies of not less than 8 months' draft accounts) are required and must be submitted with the application.

- any omission or inaccuracy in the amount of any loss carried forward for set-off for that year of assessment.

- You have ceased to carry on, or will cease to carry on, your trade, profession or business before the end of that year of assessment and the assessable profits for that year of assessment are, or are likely to be, less than the assessable profits for the preceding year or less than the assessed profits for the provisional year.

- You have made an election for Personal Assessment for the year of provisional tax and you may pay less tax under this method.

- You have lodged an objection in respect of your profits tax assessment for the previous year.

Only for these reasons can you apply for a deferral of payment.profits tax。

Application for Holdover of Provisional Tax Reason 2: Salaries Tax

- You are entitled to allowances that have not been calculated in your provisional tax notice. For example, Child Allowance for a child born in the year of provisional tax, or for a parent who reaches the qualifying age.Dependent Parent Allowance。

- Your net assessable income for the provisional year of assessment is, or may be, less than 90 % of your net assessable income for the preceding year, or less than, or may be less than, 90% of your estimated income for the provisional year of assessment.

- You have paid or are likely to pay in the year of assessment for provisional salaries tax expenses for self-education, contributions to a recognised retirement scheme, residential care expenses, home loan interest, premiums eligible under a voluntary medical insurance policy, premiums of an eligible annuity, tax-deductible Mandatory Provident Fund contributions or rent for a residential accommodation that exceeds, or is likely to exceed, the amount specified for the year of assessment for which the provisional salaries tax is payable.

- You have ceased or will cease to earn salaries taxable income before the end of the year of provisional assessment.

- You have lodged an objection to the salaries tax assessment for the previous year.

Only for these reasons can you apply for a deferral of payment.salaries tax。

Reason 3 for Holdover of Provisional Tax: Property tax

- The assessable value of the property for the provisional year of assessment is less than, or is likely to be less than, 90% of the assessable value for the preceding year, or is less than, or is likely to be less than, 90% of the estimated assessable value for the provisional year of assessment.

- You are no longer the owner of a property or will cease to be the owner of the property before the end of the provisional tax year of assessment, thereby reducing the assessable value of the provisional tax. You are required to submit information on the date of ceasing to be a landlord, the rent received and the rent receivable with your application.

- You have made an election for Personal Assessment for the year of provisional tax and you may pay less tax under this method.

- You have filed an objection to the prior year's property tax assessment.

It is for these reasons that an application for holding over of property tax can be made.

Application Procedure for Holdover of Provisional Tax

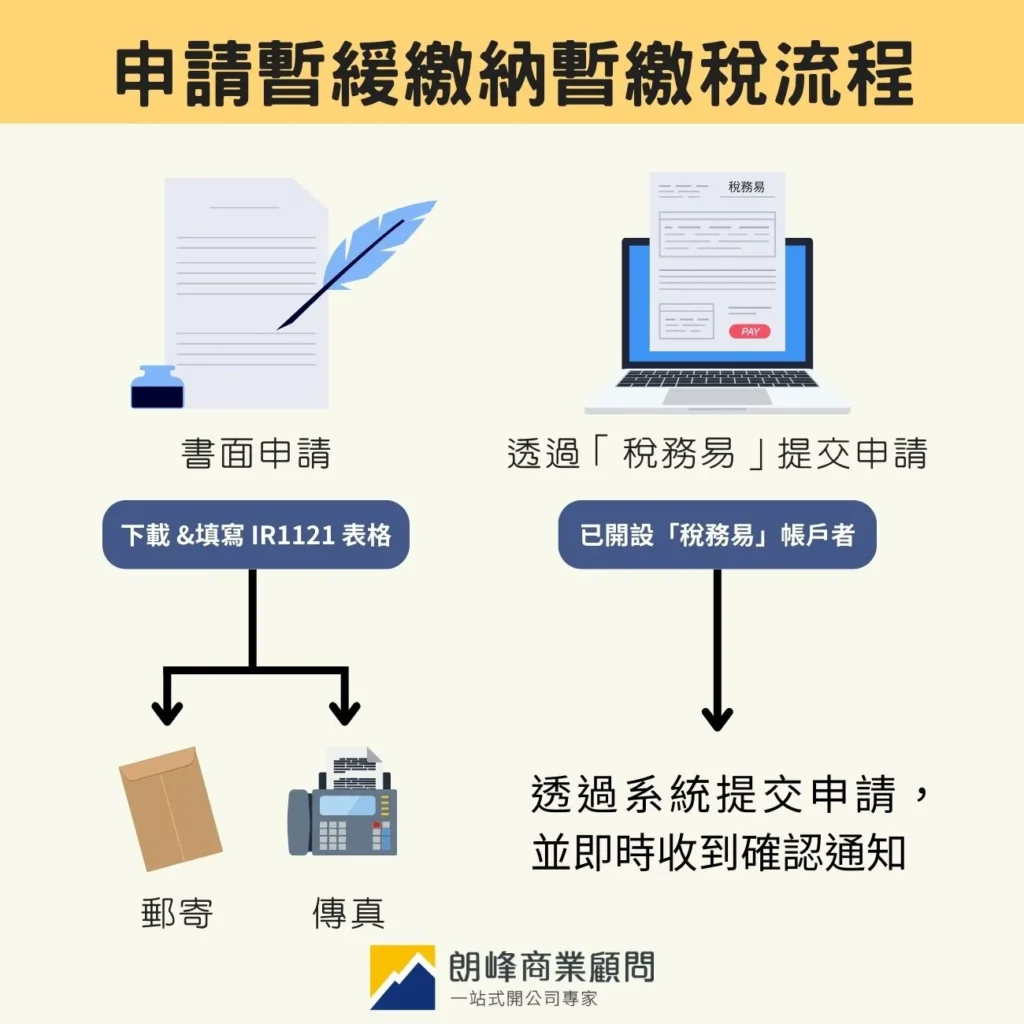

The method of applying for holding over of provisional tax is very simple. Taxpayers can choose to submit the application in writing or through the eTAX system.

Written form

Taxpayers can visit the IRD websiteDownload Form IR1121Please fill in the following basic information:

- Tax Bill Number

- Tax Payment Date

- Reasons for Application

After completing the form, you can submit it in the following ways:

[Mail]

Address: Tax Centre, 5 Concorde Road, Kai Tak, Kowloon, Hong Kong

Attn: Commissioner of Inland Revenue

[Fax] No.: 2519 6896

Submit your application through eTax

If the taxpayer has set up aTax EaseYou can submit your application directly through the system and receive instant notification of confirmation.

Application for Holdover of Provisional Tax Frequently Asked Questions

How much can be reduced by holding over the payment of provisional tax?

The amount by which your withholding tax can be reduced depends on how much your income is reduced. The amount of the withholding tax is reduced by a percentage of the reduction in your income. In other words, if your income is reduced by 201 TP3T, the amount of the deferred payment will be reduced by 201 TP3T.

It is important to note that meeting the eligibility criteria does not mean that you will be exempted from paying provisional tax. The Inland Revenue Department (IRD) will assess your application on the basis of the information and justifications provided by you and determine the final amount of provisional tax that can be held over.

What is the deadline for applying for provisional tax?

There are two ways of calculating the period for applying for deferred payment, whichever is the later:

- 28 days before the due date for payment of provisional tax.

- Within 14 days after the date of issue of the notice of payment of provisional tax.

If your provisional tax is stated to be payable in two instalments, even if you have paid the first instalment before the deadline, you may still apply for holding over the whole or part of the second instalment, subject to the deadline and reasons for the application as specified in the Inland Revenue Ordinance.

Pre-paid tax refund?

Basically, provisional tax will not be refunded directly because it is an advance tax payment made by the IRD on the basis of estimated revenue. However, if the actual income is lower than the estimated amount, the taxpayer may apply for an adjustment of the provisional tax or receive a refund at the close of the annual tax return.

In addition, if a taxpayer becomes unemployed, retires or has a break in employment in the coming year, resulting in a reduction in taxable income, the excess provisional tax may be available for offsetting against the following year's tax.

What will happen if I make a false application for holding over of provisional tax?

False declaration of provisional payment is an act of tax evasion. Under the Inland Revenue Ordinance, taxpayers may apply to the Inland Revenue Department (IRD) for holding over of provisional tax on specified grounds, provided that correct information is provided in the application. Tax evasion is a criminal offence and is liable on conviction to a maximum penalty of three years' imprisonment and a fine of $50,000 for each charge, and a further fine of three times the amount of tax underpaid.

Conclusion

Provisional tax is the estimated amount of tax to be paid by the Inland Revenue Department (IRD) based on the previous year's income and is applicable to salaries tax, profits tax and property tax. In case of financial difficulties or other reasons that make it impossible to pay the tax on time, an application can be made to the IRD for holding over the payment of provisional tax in order to avoid penalties or legal actions.

Further tax planning and advice can be obtained from a Longford business advisor, contact us today on Whatsapp by clicking on the bottom right!