![a [Hong Kong open company lazybones package] Hong Kong company formation 6 steps, fees, required documents and notes](https://setuphk.com/wp-content/uploads/2025/03/HK-COMPANY-REGISTER-轉檔前格式-為-jpg.webp)

Hong Kong Company Lazybones Package] Hong Kong Company Formation Process, Fees, Time and Frequently Asked Questions in One Article (2025 Latest Version)

Most people choose to start a business by opening a company first. Is it better to choose a Hong Kong limited company or an unlimited company? What documents are required for company registration and how long does it take? What do you need to prepare for company formation? In this article, we will prepare a lazybones package for you to set up a company in Hong Kong in 2025!

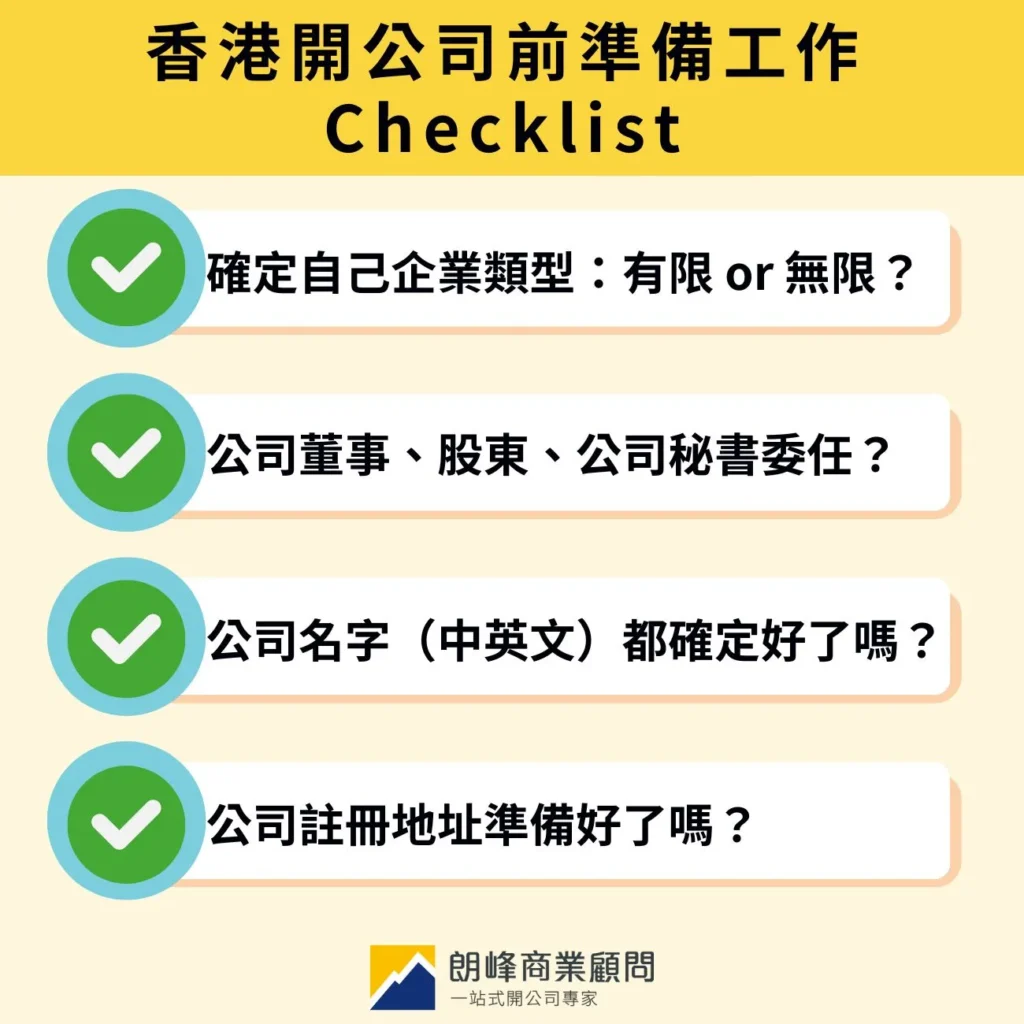

Hong Kong Company Start-up Checklist

Although it is not difficult to set up a company in Hong Kong, there are a lot of things that need to be understood and decided in advance, among others:

1. Determine your business type: Limited or Unlimited?

2. Who should be the directors and shareholders of the company? What are the requirements for each of them?

3. Have you confirmed the English and Chinese names of your company?

4. Is the address of the registered limited company ready?

If you are new to Hong Kong companies, you may not understand the above terms and their differences. Don't worry, let's go through each step first.

Extended reading: "TheThings to prepare in advance for opening a company in Hong Kong》

Extended reading: "The7 Advantages of Opening a Company in Hong Kong》

Understanding the difference between a Hong Kong limited company and an unlimited company

Hong Kong Limited

A "limited company" is a company with limited liability, i.e. a company which has the legal status of an independent legal entity in its own right.

Shareholders are only liable for the debts of the company up to the amount of their capital contribution. In other words, when a company is in debt, the shareholders are only liable for the amount of their initial investment at most, and creditors have no right to recover the shareholders' personal assets to repay the company's debts.

There are generally two types of local limited companies registered in Hong Kong to choose from:corporation與The Guarantee Company Limited。

A company limited by shares is the most common form, where shareholders are only liable for the unpaid liability on the shares they hold and the risk is limited, while a company limited by guarantee is mostly used for non-profit making organisations, where there is no share capital and members are only liable for a limited liability on a pre-committed amount in the event of the company's liquidation.

Unlimited Company (Sole Proprietorship/Partnership)

An unlimited company means that the owners or partners have "unlimited liability". When the company incurs debts and has insufficient funds to pay them off, the owners and partners are required to pay the debts out of their personal property.

In addition, an unlimited company does not have the status of a separate legal entity. Therefore, the proprietors or partners cannot enter into contracts in the name of the company and can only perform legal acts in their personal capacity. In other words, when operating an unlimited company, the company and the proprietor are legally inseparable.

Finite vs. Infinite, which one to choose?

When starting a business, what type of business should you choose that suits you?

The most obvious difference between limited and unlimited is the extent of the shareholders' liability to the company in the course of business.

We have also compiled for you the following key points on the differences between the two.

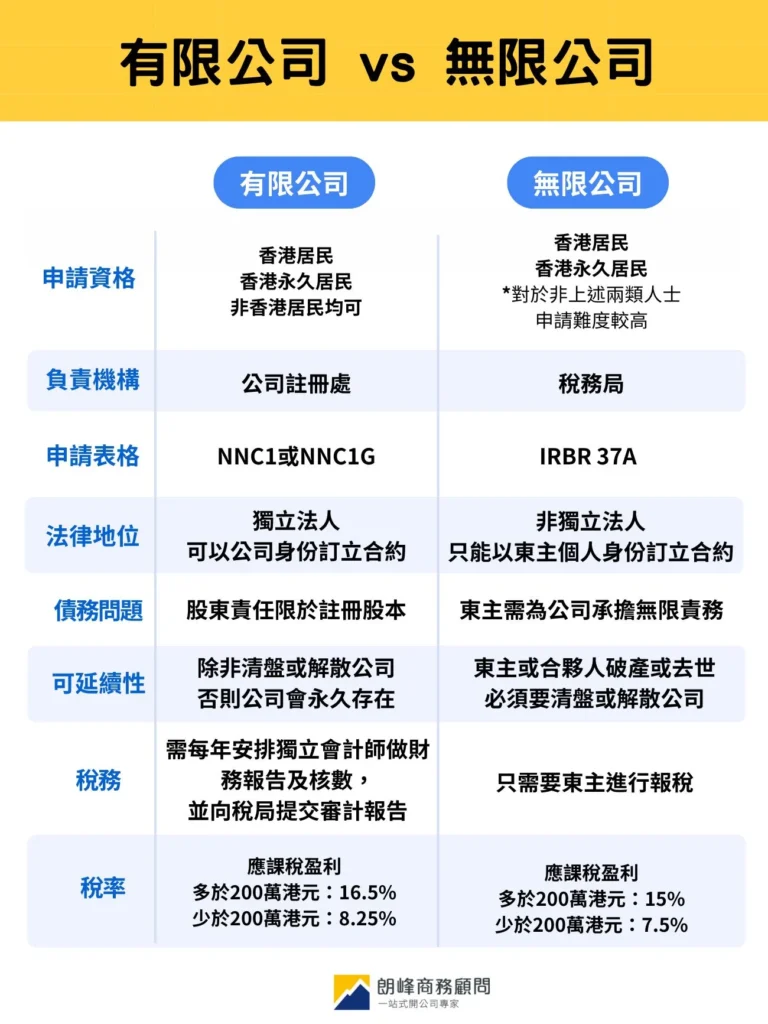

| limited company | Unlimited | |

|---|---|---|

| Eligibility | Hong Kong residents, Hong Kong permanent residents, non-Hong Kong residents | Hong Kong residents, Hong Kong permanent residents,(Higher requirements for non-Hong Kong residents / Hong Kong permanent residents) |

| Responsible Organisations | Companies Registry | Inland Revenue Department |

| Application Form | NNC1 or NNC1G | IRBR 37A |

| legal status | Independent legal person who can enter into contracts as a company | Non-independent legal person who can only enter into contracts in his personal capacity as proprietor |

| Debt problems | Shareholders' liability limited to share capital | The proprietor has unlimited liability for the company. |

| Sustainability | A company has perpetual existence unless it is wound up or dissolved | Bankruptcy or death of the proprietor or partner necessitates liquidation or dissolution of the company |

| taxation | Need to arrange for an independent accountant to do the financial reporting and auditing and submit the audit report to the Inland Revenue Department annually | Only the owner needs to file a tax return |

| tax rate | Taxable profit of more than HK$2 million: 16.5% Taxable profit less than HK$2 million: 8.25% | Taxable profit of more than HK$2 million: 15% Taxable profit less than HK$2 million: 7.5% |

The choice of a limited company or an unlimited company depends on business needs and risk exposure.

A limited company has the status of an independent legal entity, with shareholders separated from the company, limiting the risk of debt and protecting personal property. Higher corporate transparency helps to enhance credibility and attract investment, which is suitable for long-term development.

Unlimited company registration and operating costs are low, simple to start, suitable for small business. No mandatory auditing is required, owners can file their own tax returns to save accounting costs and the low tax rate of 15% applies when the taxable profit exceeds HK$2,000,000, which is more advantageous for tax purposes.

Extended reading: "TheDo I need to choose a limited company or an unlimited company to set up a company? (With a list of company registration process and required documents)》

To ascertain the directors, company secretary and shareholders of the limited company

To set up a private limited company in Hong Kong, the following basic staffing structure must be in place:

At least one director, one shareholder and one company secretary.

A director and a shareholder may be the same person, but it should be noted that if a company has only one director, that director may not at the same time be the company secretary.

Many one-person companies therefore choose to use professional company secretarial services to ensure compliance with regulatory requirements.

Requirements to be a Director

Must be 18 years of age or above, regardless of nationality, and can be a Hong Kong resident or an overseas person.

Company Secretary

Every company in Hong Kong is required to appoint a company secretary, but this secretary is very different from the general secretary in our daily work.

The Company Secretary is responsible for assisting the Company in fulfilling its administrative and statutory obligations, including filing of statutory documents, maintenance of company records, etc., and also plays an advisory role in corporate governance.

Whilst a private company may have one of its directors acting as company secretary, if the company has only one director, another person or a professional firm must be engaged to take up the position of secretary.

Welcome to enquiryCompany Secretarial ServicesWe are here to serve you.

You need to determine the name of the company before incorporation

Company name in English and Chinese

Before setting up a Hong Kong limited company, it is first necessary to choose a compliant company name. The company name can be in Chinese, English or both.

Notes on Company Name

The name of the company must not be duplicated with an existing company, and the name of the company must not be the same as that appearing before the Registrar of Companies ("the Registrar").keepIf the name in the Index of Company Names of the Companies Registry is the same, registration will not be granted. You can check and confirm the availability of the name through the Company Name Search Service of the Companies Registry.

Names must not contain misleading or restricted words, such as words related to government or financial institutions, which may require additional approval.

If "Limited" or "有限公司" is used at the end, it means that the company is a limited company.

Extended reading: "TheCompany Search】Simple 5 steps to confirm the availability of the company name (with free function tutorials)》

Hong Kong company also need to prepare the company address

According toHong Kong Companies OrdinanceA valid registered address must be provided before the commencement of business in order to obtain a Business Registration Certificate, regardless of whether the company is a limited company or an unlimited company. The registered address of a limited company needs to be registered with both the Companies Registry and the Business Registration Office, while an unlimited company only needs to be registered with the Business Registration Office. The registered address is not only the location of the company's legal existence, but also the address used by government departments (e.g. the Inland Revenue Department) for sending important correspondence, such as tax returns, business registration renewal notices, etc. It is important to ensure that the address provided is reliable. It is important to ensure that the address provided is reliable and regularly checked.

Is a virtual office or registered address service legal?

Many entrepreneurs choose to use virtual office or registered address services, which is a legal and common practice in Hong Kong.

When choosing this kind of service, you must make sure that the service provider holds a legal company service provider licence (TCSP licence), otherwise, not only may it be illegal, but also you will need to change your company's address temporarily after the service is interrupted, which will affect your normal operation and increase unnecessary troubles and risks.

Extended reading: "TheWhat is a virtual office and what are the top 2 options you can't afford to miss?》

Extended reading: "TheCan I use a virtual office for my business registration address?》

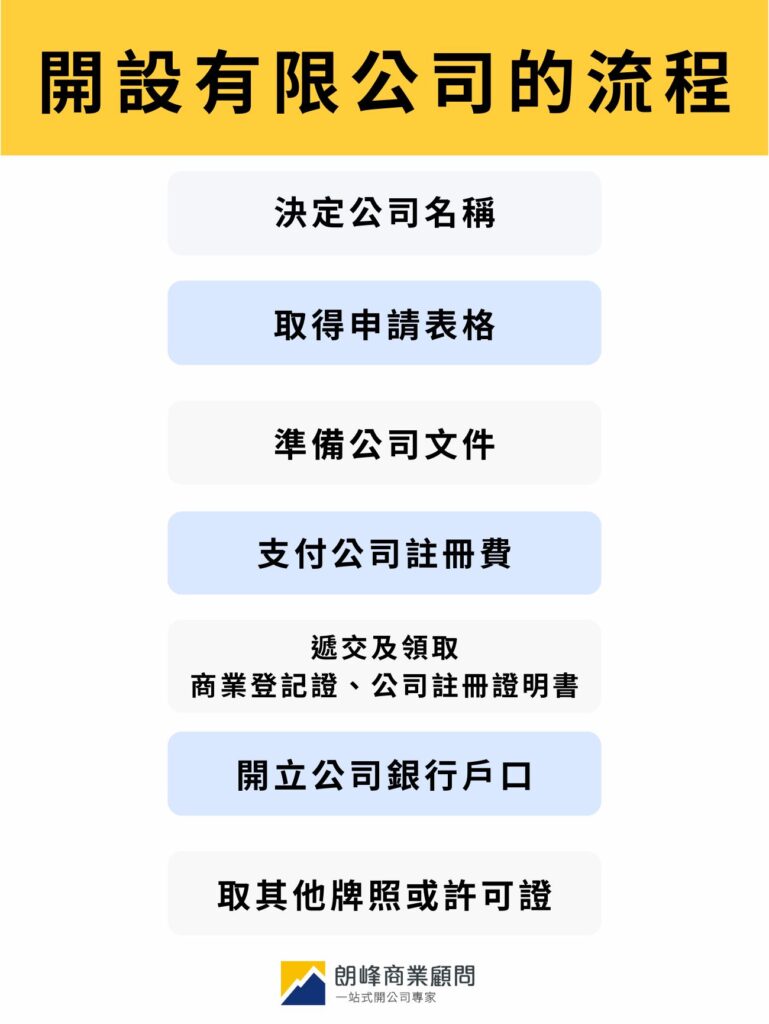

Hong Kong Company Formation Process

To set up a limited company in Hong Kong, there are generally six major steps to be taken:

Step 1: Decide on the company name (search the register first)

Apart from not repeating the name of a company, it is also necessary to ensure that the name of the company complies with the registration requirements. For example, some words and phrases regulated by the law are not allowed to be used, so we may as well conduct a search before confirming the name of the company.

Step 2: Preparation of Company Application Documents

The following documents and forms are required and can be found at the Companies Registry atLocal Companies and Registered Non-Hong Kong Companies PageAcquisition.

Company Incorporation Form (NNC1/NNC1G)

Fill in basic information about the company, share capital, directors and company secretary.

Articles of Association

Under the new Companies Ordinance (Cap. 622), founding members are required to prepare articles of association prior to the registration of a company to provide a legal basis for the future management and operation of the company, although the articles of association are not in a specified form. It is recommended that the template provided by the Companies Registry (Model A) (applicable to private companies) can be used.

Extended reading: "The【Corporate Articles】All in one article to understand the Articles of Association of Hong Kong Company (AA)》

Notification to the Business Registration Office (IRBR1)

Pursuant to Sections 5A(1) and 5D(2) of the Business Registration Ordinance (Chapter 310 of the Laws of Hong Kong), an applicant who proposes to incorporate shall deliver a "Notice to the Business Registration Office" (IRBR1) together with the prescribed business registration fee and levy together with this form, failing which his/her application will not be accepted by the Companies Registry.

To apply for a Business Registration Certificate with IRBR1, you need to apply for and renew a Business Registration Certificate regardless of whether the company is in business or not, as long as the company has not been dissolved. The form is very simple and you only need to choose whether you want to pay for a one-year or three-year business registration certificate.

If a triennium is chosen, tick [是Yes] That's it.

Apply for a Business Registration Certificate and choose between a 1-year or 3-year validity period.

Extended reading: "TheDefinition of Business Registration Certificate, its function and its difference from a company in a single article》

Consent to Appointment as Director (NNC3)

This document is not required. If the founder member signing the incorporation form is also a director, he must sign either Form NNC1 (Incorporation Form) or the Consent to Serve as Director Form NNC1G. Other directors may sign the consent form or register by delivering Form NNC3 "Consent to Initial Directorship" within 15 days of the date of incorporation.

Please note that you are required to provide details of the first director and company secretary of the company together with the address of the registered office in the incorporation form. Uncompleted forms will be regarded as non-compliant and the Companies Registry will reject the application for incorporation.

If not signed by a founder member, it may be submitted within 15 days of its incorporation.

It should be noted that if the applicant chooses to submit the form in person, the information on the form should be inputted on a computer and printed along with the form. Forms with handwritten information may not be accepted by the Companies Registry.

Step 3: Payment of Company Registration Fee

When applying for company registration, apart from submitting the application documents, you have to pay the company registration fee, business registration fee and levy to the Companies Registry at the same time. (You can visitCompany Registration Enquiry)

At present, the registration fee for a limited company is

- Film format: HK$1,720

- Electronic: HK$1,545

Business Registration Certificate Fee (after 2025.04.01):

- One year: HK$2,200

- Three years: HK$6,020

Step 4: Submit and collect Business Registration Certificate and Certificate of Incorporation

The Business Registration Certificate and Certificate of Incorporation will be issued on the basis of delivery and the e-certificate will have the same legal effect as a printed certificate.

Written

Deliver the form in hard copy form to the Cashier's Office, 14/F, Queensway Government Offices. Hardcopies of certificates will normally be issued within 7 working days. When collecting the certificates in person at the Companies Registry, you should present the "Certificate Collection" notice and the identity document/company chop as stated in the notice.

If the authorisation is given by the authorised person, the collector must produce the authorisation letter signed by the authorised person and the identity document stated in the authorisation letter.

electronic means

Apply through the Companies Registry's "e-Registration" form. If your application is approved, you can download or collect the Certificate of Incorporation CI and Business Registration Certificate BR, which will be issued electronically or in hard copy form depending on the mode of submission.

Both e-certificates and printed certificates have the same legal effect.。

The e-Cert will be issued within 1 hour after submission of the application. An email notification for downloading the certificate will be sent to the information folder and registered email address of the registered user who delivered the application.

Step 5: Open a company bank account

After incorporation, you can open a bank account. To open a company account, you need to submit the Articles of Association, Business Registration Certificate (BR) and Certificate of Incorporation (CI) to the bank.

In addition, different banks may require the account opener to provide company background, source of funds, director's identity documents, business documents, etc. The account opening fee is divided into basic fee and business registration investigation fee. The account opening fee is divided into basic fee and business registration and investigation fee, which ranges from $$1,000 to $$2,000 for Hong Kong local companies.

The Certificate of Incorporation and Business Registration Certificate indicate that the company can operate legally, and you can start your business in the shopping mall after you have successfully opened a company account.

Extended reading: "TheWhat is Company CI? The difference between Certificate of Incorporation (CI) and Business Registration Certificate (BR) in one article.》

Extended reading: "TheWhat documents do I need to bring to open a company account, 3 major types of documents to help you open a company account quickly》

Step 6: Obtain other licences or permits

After opening a bank account, most of the company's business activities can be freely operated in Hong Kong, but some specific industries require specific licences or permits, for details please visitTrade and Industry Department Websitefor details.

Extended reading: "TheA must read for opening a Hong Kong company! What is Company Kit Set? 7 major companies' business certificates are in it.》

Points to note after company registration

Annual General Meeting

Under the Companies Ordinance, a limited company is required to hold an annual general meeting every year within a specified period: the first general meeting of a company is required to be held within 18 months of its incorporation, but an annual general meeting is not required for a company with only one shareholder.

The annual general meeting is mainly for discussing important decisions of the Company, letting shareholders understand the current financial situation of the Company, and allowing shareholders to ask questions freely so as to make the Company's situation more open and transparent.

Requirements for organising annual general meetings

The Company shall in respect of each financial year of the Company hold an Annual General Meeting within the period of

- in the case of a private company that is a company limited by guarantee or a private company that is not a subsidiary of a public company, an annual general meeting shall be held within nine months after the end of the accounting reference period; and

- In the case of any other company, an annual general meeting shall be held within 6 months after the end of the accounting reference period.

The accounting reference period is the period for determining the reference period for the financial year in question.

If the accounting reference period is the first accounting reference period of the company concerned and that reference period is more than 12 months, the company shall hold its annual general meeting within the following periods:

- In the case of a private company that is a company limited by guarantee or a private company that is not a subsidiary public company:

- (a) hold an annual general meeting within 9 months after the first anniversary of the incorporation of the company; or

- (b) hold the annual general meeting within three months of the end of the accounting reference period, whichever is the later; and

- In the case of any other company:

- (a) hold an annual general meeting within 6 months after the first anniversary of the incorporation of the company; or

- An annual general meeting is held within 3 months of the end of the accounting reference period, whichever is later.

Submission of Annual Return (Anuual Return)

An annual return must be filed with the Registrar of Companies within 42 days from the date of incorporation of the company in each year, containing basic information on the directors, shareholders and company secretary.

- The normal submission fee is HK$$105.

- Late submission will incur a fine of up to HK$$3,480.

- Responsible persons (e.g. directors or company secretaries) must be aware of the deadline for filing annual returns.

Renewal of Business Registration

Every year before the expiry of the Business Registration Certificate, the Inland Revenue Department (IRD) will automatically send a renewal demand note to the company's registered address.

- Upon completion of the paymentThe notice shall be a valid business registration certificate.The following are some examples of the types of products that can be purchased at a discounted rate.

- One-year or three-year registration option

Annual Audit and Hong Kong Company Tax Returns

The first profits tax return for a newly incorporated company will normally be received 18 months after the date of commencement of the new business or incorporation, when a letter is received from the company for an inspection or audit of the company's accounts and financial statements, and the company will be required to submit an annual audit and income tax return for each financial year.

Required for each financial yearAudit AccountsIt is audited by a certified public accountant and is then submitted to the Registrar of Companies for approval.The tax return will be submitted to the Inland Revenue Department (IRD).

Hong Kong Company Formation Frequently Asked Questions

How much does it cost to set up a company in Hong Kong?

The cost of setting up a company depends on the type of company and the services required. For example, the basic fee for setting up a limited company includes company registration fee, business registration fee and other administrative expenses. If additional services are required (e.g. virtual address, company secretary, accounting, etc.), the fees will increase accordingly.

What are the usual extra costs of setting up a company?

In addition to the basic government fees, the following items may be included:

- Renting a Registered Address or Virtual Office

- Employment of Company Secretary

- Administrative fee for opening a company account

- Auditing, tax preparation, accounting services, etc.

How long does it take to set up a limited company? How soon can I set up?

If all the information is in order, registration can be completed within 1 working day at the earliest through online application.

If you choose to submit hardcopies in person, the processing time will be approximately需 4 to 5 working daysThe actual time will be affected by the working days of government departments and the readiness of documents.

Is it better to register a new company on my own or on behalf of the company?

Whether you want to register a company in Hong Kong on your own or with a professional agent, the key lies in your familiarity with the process and the cost of time.

Registering your own company requires more care

If you have a good understanding of the company registration process, required documents and statutory requirements, you can indeed choose to apply for company registration on your own to save some of the agency fees. However, it is important to note that company registration involves a number of procedures, such as filling out forms, submitting documents, processing tax returns, choosing appropriate articles of association, etc. Each step has its own legal requirements. Any errors or omissions in information may result in delay or rejection of the application.

Hong Kong Company Opening

If you are a first-time entrepreneur, unfamiliar with the company registration process, or wish to focus on developing your business and save time, you should seek forProfessional RepresentationIt's a more efficient and reassuring choice.

LFB is a holder of the followingTCSPlicenceThe company is a professional company service provider that offersOne-stop registration and aftercare support, included:

- Assist in the preparation and submission of documents required for company registration

- Provision of qualified registered address and company secretarial services

- Assisting in the opening of company bank accounts, tax filing and audit arrangements

- Reduce the risk of application errors and ensure a smooth process

Whether you are a local entrepreneur or an expatriate planning to enter the Hong Kong market.LFB can provide you with a tailor-made registration solution that meets your exact needs.The company has been designed to make it easy for you to start your own business without any worries.

Conclusion

The process of registering a company in Hong Kong is not complicated, as long as you know the required forms, steps and fees in advance, you can do it on your own. However, if you want to save more energy and time, and register a Hong Kong company in the fastest and easiest way, you can contact Lonfon Business Services team, we provide one-stop business consultancy services, from registering a Hong Kong company, opening a bank account, and secretarial services, so that you can focus on opening your business blueprint!