2025 Hong Kong Company Tax Guide, a clear understanding of the key points of profits tax returns

Hong Kong adopts a two-tier profits tax system. Enterprises should file annual tax returns and save tax legally by deducting business expenses, depreciation allowances and other strategies to avoid late penalties.

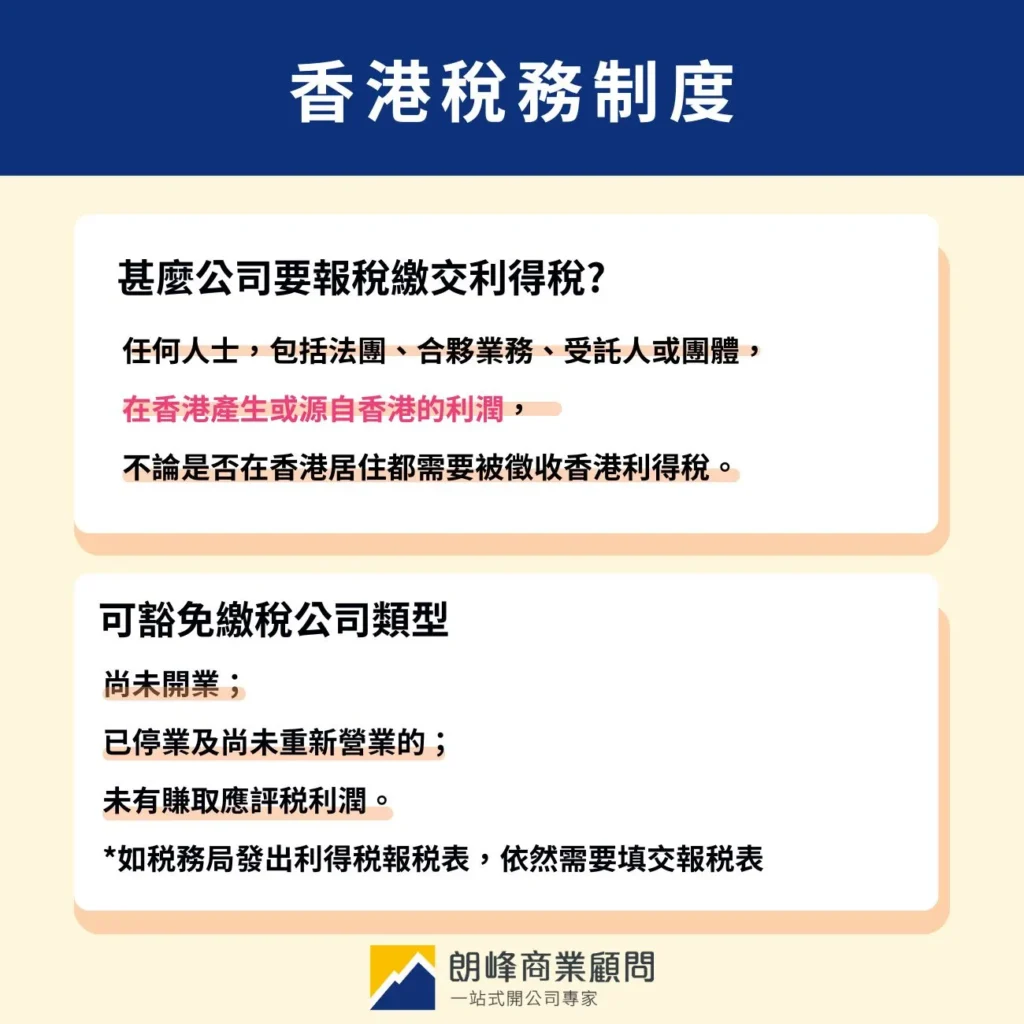

Hong Kong's tax system

Hong Kong applies the territorial source principle to the taxation of profits derived from the carrying on of any trade, profession or business in Hong Kong, which is known as profits tax. Only profits arising in or derived from Hong Kong are chargeable to profits tax.

In short, a person who carries on business in Hong Kong but derives his profits from a place outside Hong Kong is not liable to tax in Hong Kong on those profits. Click on Profits Tax toInland Revenue Department of Hong KongWebsite to learn more.

Who needs to pay profits tax

Under the Inland Revenue Ordinance, Hong Kong profits tax is payable by persons who fulfil the following conditions:

The carrying on in Hong Kong of any trade, profession or business; the deriving of profits from such trade, profession or business; and the production of such profits in or from Hong Kong.

It can be understood that any person, including a corporation, partnership, trustee or body of persons, whose profits arising from or derived from business carried on in Hong Kong are chargeable to Hong Kong profits tax, irrespective of whether or not they are resident in Hong Kong.

What types of business are exempt from tax

Tax-exempt business

Not yet open for business;

Closed and not yet re-opened for business;

Failure to earn assessable profits

Inland Revenue Department (IRD) does not require taxpayers to submit annual profits tax returns for the above businesses.However, if IRD issues a profits tax return to a taxpayer in the course of reviewing a potential tax liability, the taxpayer is still required to comply with the requirements of the tax return and is exempted from subsequent audits.。

Items not deductible from assessed profits

1. household or private expenses and any expenditure not incurred for the purpose of producing assessable profits;

2. the cost of improvements and any capital expenditure;

3. Expenditure recoverable under insurance plans or indemnity contracts;

4. rentals and related charges for the occupation or use of premises not for the production of assessable profits;

5. various taxes under the Inland Revenue Ordinance (which have been paid in respect of the payment of remuneration to employees or directors)salaries tax(except);

6. remuneration, interest on capital, interest expenses on loans paid to the proprietor or his spouse in the case of a sole proprietorship, or to the partners or their spouses in the case of a partnership;

7. Contributions or contributions to unrecognised occupational pension schemes.

Company Tax Returns

Both unlimited companies and limited companies are required to file tax returns, but the way of filing is slightly different. Sole proprietorships of unlimited companies only need to file tax returns on the personal tax returns of the company's proprietors and do not need to file a separate return, while partnerships and limited companies of unlimited companies need to file a separate return.

Company tax filing time

Newly registered business

The first Profits Tax Return will normally be issued about 18 months after the date of commencement of business or incorporation of a new business.

Continuing operations

Profits Tax Returns are sent out on the first working day of April each year.

Deadline for filing tax returns

Under normal circumstances, tax returns should be returned to IRD within one month from the date of issue.Companies filing tax returns for the first time are entitled to a longer period of time, and the Inland Revenue Department (IRD) will take the initiative to give new companies an additional two months for filing tax returns, but they cannot apply for an extension of time.。

The use of e-filing will grant an extension of one month over the normal period.

Late Filing of Profits Tax Returns

It is the taxpayer's obligation to pay tax. Late filing of Profits Tax Return may result in a fine of HK$10,000 and triple the amount of tax payable, as well as the possibility of prosecution.

Failure to fulfil their tax obligations, such as failing to provide adequate records of business income and expenditure, filing incorrect tax returns, or failing to give a reasonable explanation, etc., may result in a fine of up to $50,000, three times the amount of tax paid, and imprisonment for up to three years.

Arrangements for Extension of Tax Returns for 2024/25

At the beginning of each year, the Inland Revenue Department (IRD) will organise the following activities at the IRD's offices.WebsiteThe following are the arrangements for the extension of tax returns for 2024/25 and the extension of e-filing date to one month beyond the normal period. The following are the extension arrangements for the 2024/25 tax year and the electronic filing date can be extended to one month beyond the normal period:

Checkout Date "N"Category: Newly Registered Businesses

Submission date can be extended to: no extension

The e-filing date can be extended to: one month from the day after the normal deadline:

Billing Date "D"Class

Date of submission extendable to: 15 August 2025

Electronic tax return filing date can be extended to: 15 September 2025

Billing Date "M"Class

Date of submission extendable to: 17 November 2025

Electronic tax return filing date can be extended to: 17 November 2025

Billing Date "MLoss for the year in respect of category "Losses for the year" (Note 1)

Date of submission may be extended to: 2 February 2026

Electronic tax return filing date can be extended to: 2 March 2026

Hong Kong Profits Tax Rate

Two-tier system Taxation

In Hong Kong, a two-tier tax system is used for calculating profits tax. There are two types of profits tax calculation methods, namely, limited companies and unlimited companies. In addition, if there are several subsidiaries under a group, a group can only file a two-tier tax return for a maximum of one of its subsidiaries, and the remaining subsidiaries have to be subject to the tax rate of 15% or 16.5%.

Calculation of Profits Tax for Limited Companies

The profits tax rate is 8.251 TP3T for the first HK$2 million of profits and 16.51 TP3T for profits in excess of HK$2 million.

Example 1

Based on the reported profit for the year $1,000,000, for example, has a rate of 8.25% because it is less than HK$2 million.

$1,000,000X8.25% = $82,500

Example 2

Based on the reported profit for the year $3,000,000 For example, since the profit is more than HK$2 million, the calculation is based on 8.25% tax rate for the first HK$2 million and 16.5% tax rate for the remaining HK$1 million.

($2,000,000X8.25%)+($1,000,000×16.5%)=$165,000+$165,000=$330,000

Calculation of Profits Tax for Unlimited Companies

The profits tax rate is 7.51 TP3T for the first HK$2 million of profits and 151 TP3T for profits in excess of HK$2 million.

Example 3

Based on the reported profit for the year $1,000,000, for example, has a rate of 7.5% because it is less than HK$2 million.

$1,000,000X7.5% = $75,000

Deductible items

The 100% of Profits Tax for 2023/24 will be reduced, subject to a ceiling of $3,000 per case, so that taxpayers can enjoy tax relief. In addition to the annual one-off profits tax reduction, more professionals will plan for legitimate tax savings through tax deductible items.

2024/25 Budget Profits Tax Concessions

In the latest Budget, it is proposed to reduce profits tax for the year of assessment 2024/25 for 100%, subject to a ceiling of HK$1,500, and the profits tax concession is also applicable to Hong Kong companies, not just individuals.

However, it is important to note that the 100% reduction in profits tax for 2023/24 is subject to a cap of $3,000 per case, and the cap for this year's Budget reduction is further reduced by half.

As tax is calculated on the basis of profitability, company expenses and expenses incurred for profitability are deductible for tax purposes, and equipment and fittings are also deductible for depreciation allowances.

Company's Daily Expenditure Items

Company office, warehouse or shop rental;

Electricity, water, internet and telephone bills for company offices, warehouses or shops;

Staff salaries, allowances, bonuses;

Mandatory and voluntary contributions to MPF;

Severance or long service payments made on termination of an employee's employment;

Insurance premiums related to business, e.g. labour insurance, company group medical insurance;

The cost of importing goods;

Entertainment and socialising expenses;

Bad and doubtful debts;

2024/25 Budget Tax Optimisation

Two new types of profits tax deductions will be introduced from the year of assessment 2024/25 onwards, including the reversion of rented properties and the abolition of the time limit for claiming industrial and commercial buildings and structures allowances.

The Financial Secretary has proposed to provide tax deduction for expenses incurred in restoring the leased property to its pre-leasing condition, the details of which will be known only after the completion of the legislative process.

The time limit for claiming tax allowances for industrial and commercial buildings and structures will be abolished. Depending on factors such as the construction cost of the property and the previous owner's balancing charge at the time of the change of ownership, the new owner can still claim tax allowances for the property.

Other special tax deductible expenses

Expenditure on building renovation

Capital expenditure incurred on refurbishment of commercial premises is deductible in equal instalments over a period of five years starting from the basis of assessment in which the amount is actually paid.

Expenditure on computer hardware and software

A lump sum deduction is allowed for the basis period in which the expenditure is incurred.

Expenditure on procurement of green facilities, e.g. electric vehicles, food waste machines, etc.

A lump sum deduction for the purchase of environmentally friendly machinery and installations is allowed in the basis period in which the expenditure is incurred.

Allowances for commercial and industrial buildings and structures

Industrial Building Initial Allowance: 20% of construction cost; Annual Allowance: 4% of construction cost

The annual allowance for commercial buildings is 4% of the construction cost.

If the relevant interest in the building or structure has been sold, the seller will be granted a balancing allowance or the seller will be subject to a balancing charge (collectively referred to as "balancing adjustment") as follows:

- If the proceeds of sale exceed the residual amount of expenditure incurred immediately prior to the sale, the excess is taxable as a balancing charge (subject to the aggregate of the initial and annual allowances previously granted to the vendor).

- If the remaining balance of expenditure immediately before the sale exceeds the proceeds of sale, the difference between the two is a balancing allowance and is deductible.

Machinery and Industrial Installations

Initial Allowance : 60% of the cost of the asset

Annual Allowance : Calculated on the basis of the diminishing value of the asset. The depreciation rates are prescribed by the Board of Inland Revenue and are 10%, 20% and 30%. Assets with the same depreciation rates for annual allowances are included in the same "aggregation group".

A 'balancing allowance' is granted if the taxpayer closes the business and there is no successor to the business. A 'balancing charge' is levied if, in any year, the proceeds from the disposal of one or more assets exceed the aggregate diminishing value of the 'aggregated group' to which those assets belong.

Donation deduction

Deduction is allowed for donations made to a charitable institution or trust of a recognised public character or to the Government for charitable purposes. However, the aggregate of the donations is required to be not less than $100 and not more than 35% of the adjusted assessable profits before deduction of the donations.

Frequently Asked Questions

Why do enterprises need to file profits tax returns annually?

It is a mandatory requirement under Hong Kong's tax laws for enterprises to file annual profits tax returns to ensure that all companies operating in Hong Kong fulfil their tax obligations.

Do self-employed persons also need to pay profits tax?

Yes, a self-employed person who carries on a business in Hong Kong and makes profits is also liable to profits tax on his assessable profits.

Do I need to pay tax on overseas income?

Hong Kong adopts the territorial source principle of taxation, whereby taxpayers may apply for exemption of offshore income if the profits are derived solely from outside Hong Kong.

Conclusion

The calculation of Hong Kong profits tax is not difficult, but the calculation of tax saving methods requires a more careful and professional approach, so as to save unnecessary tax payments, which should not be automatically deducted just because the proprietor thinks that the item can save tax, or even violate the law if the tax is incorrectly filed.

Leave it to the professionals, Lonfon Business Consultants provides you with professional tax analysis and planning, tailor-made tax planning for you to save tax legally. Contact us now by clicking the Whatsapp button on the bottom right!