Do Hong Kong companies have to conduct audits? Understand the content, fees, and recommended audit firms (Latest 2026)

Hong Kong limited companies must undergo an audit every year, with services covering statutory audit reports, profit tax calculations, and tax return submissions. Audit fees are determined by the company's size, business complexity, and completeness of accounts.

Summary of key points

- Financial statements of the company are audited by qualified auditors, who issue statutory audit reports.

- All Hong Kong limited companies are required to undergo audits and file tax returns annually.

- Service outputs: statutory audit reports, profit tax calculation forms, and tax return submissions on behalf of clients.

- Required documents: bank statements, purchase and sales invoices, expense receipts, and various contracts.

- Failing to conduct an audit may result in fines from the tax bureau, forced tax assessments, or affect the operation of bank accounts.

What is an audit? Is it mandatory for Hong Kong companies?

Meaning of audit.

An audit (Audit) is a review of a company's financial statements for the past year, usually conducted by a qualified third-party practicing accountant. After completing the audit, the auditor issues a statutory audit report for the company to submit to the tax bureau as a basis for tax filing.

Audit vs. examination.

In Hong Kong."Audit" and "examination" refer to the same thing.(Both refer to Auditing). "Audit" is the term more commonly used in Hong Kong Cantonese, while "examination" is the term more commonly used in written language.

Does every company need to be audited?

According to the Hong KongCompanies OrdinanceAll entities registered in Hong Kong,limited companyregardless of whether they are operating or profitable, must appoint a practicing accountant for an audit every year. If the company is an "unlimited company" (such as a sole proprietorship or partnership), it does not need to undergo a statutory audit and can simply report taxes based on its accounting records.

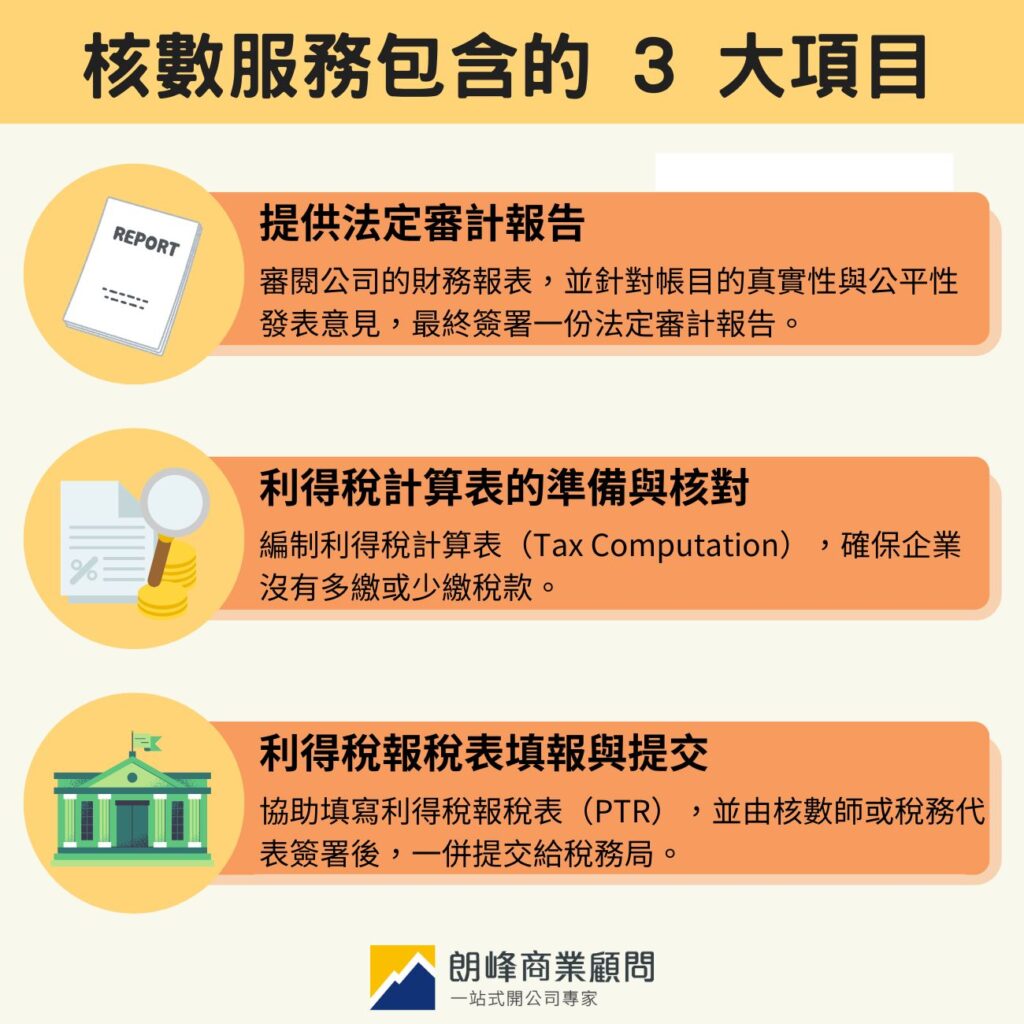

What items are included in audit services?

Providing statutory audit reports.

The auditor will review the company's financial statements (including balance sheets, income statements, etc.) and express opinions on the authenticity and fairness of the accounts, ultimately signing a statutory audit report. This report is an important document submitted to the tax bureau and shareholders.

Preparation and verification of profit tax calculation forms.

The calculation of "profit" on accounting records often differs from the "assessable profit" recognized by the tax bureau (for example, certain expenses may be deducted in accounting but are not deductible for tax purposes). Audit services typically include the preparation ofprofits taxTax Computationto ensure that the company does not overpay or underpay taxes.

Profit Tax Return Form Filling and Submission

Once the audit report and tax computation are completed, the service team will assist in filling out the Profit Tax Return (PTR), which will be signed by the auditor or tax representative and submitted to the tax authority, completing the annual reporting process.

Complete Process of Audit Services and Reporting Timeline

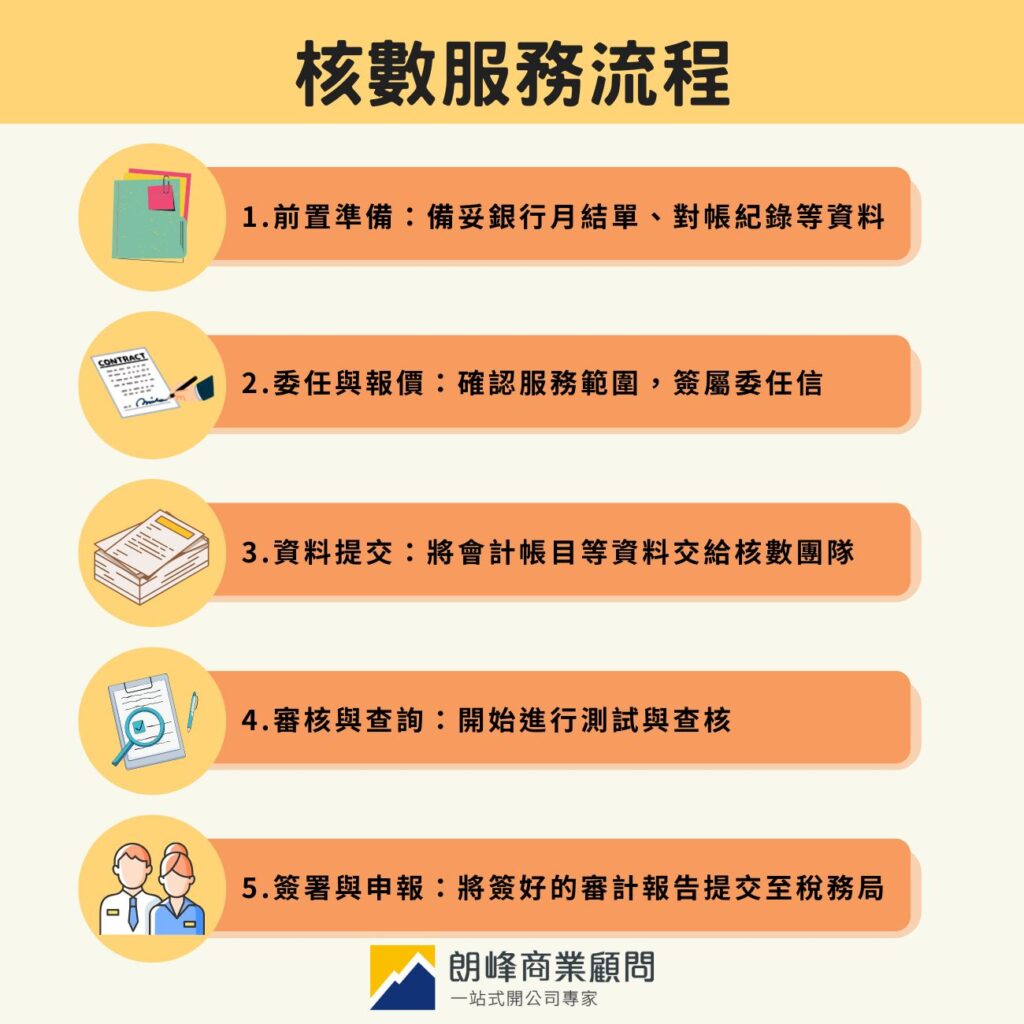

Preliminary Preparation: Required Document List

General audit services will require the company to provide the following information:

- Bank statements and reconciliation records

- Sales and purchase documents (invoices, contracts)

- Administrative expense records (rent, salaries, MPF)

- Last year's audit report (if available)

Step 1: Engagement and Quotation

After both parties confirm the scope of services and fees, the company needs to sign an engagement letter. This document establishes the responsibilities and rights between the auditor and the client.

Step 2: Data Submission

Submit the prepared accounting records, financial statements, and related documents (physical or electronic) to the audit team. If accounting services are usually outsourced, this step can typically be directly handled by the accounting personnel.

Step 3: Review and Inquiry

The auditor will begin testing and verification. If unclear documents or questionable accounts are found during the process, the auditor will issue audit queries. There is no need to be nervous; this is just a normal clarification process, and the company only needs to provide additional explanations or missing documents.

Step 4: Signing and Reporting

Once the audit work is completed, the auditor will issue a draft report for the directors to sign for confirmation. After confirming that there are no errors, the team will submit the signed audit report and tax return to the tax authority and return the original report to the company for retention.

Comparison of Year-End Date and Tax Filing Deadline

The tax filing deadline depends on the company's "fiscal year-end date." Here are the three most common reporting periods:

| Account category | Fiscal year-end date | Usually tax filing deadline (after extension) |

| Category N | April 1 – November 30 | No extension (usually early May) |

| Category D | December 1 – December 31 | Can be extended to August 15 of the following year |

| Category M | January 1 – March 31 | Can be extended to November 15 of the same year |

What is the audit fee point for limited companies?

The current market audit fees generally range from HK$3,000 to 35,000. This is not a fixed price; the final quote mainly depends on the actual hours the auditor needs to invest, and is usually adjusted based on the following three major factors:

Company turnover and number of transactions

The higher the turnover, and the more bank transactions and invoices, the more sample sizes the auditor needs to check, thus the fees will also be adjusted accordingly.

Complexity of business nature and organizational structure

A simple trading company that only buys and sells is much less complex than a group with a large inventory, foreign currency transactions, and even subsidiaries that require consolidated financial statements; thus, the audit procedures for the latter are much more complicated, requiring higher professional judgment, and therefore the fees will also be higher.

Completeness of accounts and completeness of documents

If the company's accounting records are clear and the documents are well organized, the auditor can complete the work quickly, and the fees are usually more favorable. Conversely, if the accounts are chaotic and the numbers do not match, the auditor will need additional assistance to "wrap things up" or adjust the accounts, which often incurs extra time costs.

Recommended auditing service company in Hong Kong: Long Peak Business Consultants

Long Peak Business Consultants (SetupHK) Since its establishment in 2014, it has adhered to the service philosophy of "simplifying the complex." We understand the pain points of entrepreneurs, especially emphasizing the auditing procedures that cause headaches for bosses:

- Transparent fees: Assess the accounts in advance, and if adjustments are needed, provide a quote first, with the budget completely transparent.

- Easy to understand: Avoid complex terminology and clearly explain audit adjustments and tax implications.

- Risk prediction: Review missing documents in advance to avoid the report having a "qualified opinion."

Choosing Long Peak means that business owners receive not just an audit report, but also a reassuring solution that saves communication costs and eliminates hidden expenses.

Frequently Asked Questions

What is the difference between auditing and internal auditing?

Auditing (external auditing) is a legal requirement, primarily aimed at proving the authenticity of financial statements to the public (shareholders, tax authorities); internal auditing is conducted by the company itself (or outsourced) to improve internal operations and monitoring, with different purposes for each.

What risks might a company face if it does not conduct an audit?

Risks may include obstacles in tax reporting, inquiries from tax authorities, and even fines or compliance issues. Additionally, a long-term lack of audit reports can affect eligibility for bank account openings, loan applications, or government funding.

If dissatisfied with the current auditor, can they be replaced midway?

Under legal procedures, a company can replace its auditor at an appropriate time. The new auditor will issue a "professional inquiry letter" to the old auditor according to the code, confirming that there are no reasons preventing the takeover (such as unpaid fees or violations), and then a smooth handover can occur.

How should one handle a tax authority's tax demand letter or fine notice?

It is recommended to first clarify the content of the letter and the response deadline, then organize the information as needed. If necessary, a professional can assist in drafting an explanation letter or objection notice to seek a reduction of the fine or installment payment.

Will the loss of some documents or invoices lead to a qualified opinion in the audit report?

If the missing items are small miscellaneous expenses, the impact is usually minimal. However, if significant transaction vouchers are lost and the auditor cannot verify the transaction through other means (such as bank records or contracts), they may include a "qualified opinion" in the report to comply with the standards.

Longfeng Business Consulting | Annual Audit and Tax Filing Experts

If you are worried about the upcoming year-end date or want to understand which audit service plan is suitable for your company's scale, feel free to contact us anytime.Langfeng Business ConsultancyThe team will provide a preliminary assessment for the company and plan the most suitable audit and tax filing arrangements to help businesses handle each annual milestone with peace of mind and stability.

Extended reading: "TheWhat does Hong Kong tax filing service include? Understand the company tax filing process, fee standards, and actual benefits in one article.》

Extended reading: "TheHong Kong Accounting Services Guide: Service content, process, fee standards, and precautions.》