What does Hong Kong tax filing service include? Understand the company tax filing process, fee standards, and actual benefits in one article.

Hong Kong tax filing services cover account organization, audit coordination, and profits tax declaration, with a professional team assisting in calculating taxes, submitting audit reports, and responding to tax bureau inquiries, reducing the risk of errors and late submissions for businesses.

Summary of key points

- Tax filing services include tax calculations, filling out various tax forms, and following up on correspondence from the tax bureau.

- Engaging professional services can save time, reduce risks, and optimize taxes.

- Commissioning a professional organization can include the "Block Extension Scheme," legally extending the tax filing deadline.

- For limited companies, frequent transactions, financing needs, or those unfamiliar with tax regulations, it is recommended to outsource the filing service.

- The fee structure depends on the type of company, turnover, number of documents, and whether it involves adjustments.

What items are included in tax filing services?

Tax calculations and filling out various tax forms.

The service provider will calculate the "assessable profits" based on the company's financial statements. During this process, non-deductible personal expenses will be excluded, and the depreciation allowances will be accurately calculated to reduce the final tax payable.

The scope of services typically covers the three major taxes: "profits tax, salaries tax, and property tax," as well as filling out various statutory forms:

- Limited company tax return (BIR51): For the profits tax declaration of limited companies, it must be submitted along with the auditor's report.

- Unlimited company tax return (BIR52): For the profits tax declaration of partnerships.

- Employer tax return (BIR56A): To fulfill employer responsibilities, reporting employee remuneration records.

- Individual tax return (BIR60): Assisting sole proprietors in consolidating business profits with personal income.

Acting as a tax representative: applying for extensions and scheduling management.

The greatest administrative advantage of engaging a professional organization is the ability to appoint them as the company's "tax representative."

According to tax bureau regulations, companies with a tax representative can be included in the "Block Extension Scheme." This mechanism allows companies to legally extend the tax filing deadline by several months, giving business owners more time to prepare documents and funds, alleviating administrative pressure during tax season.

Limited company exclusive: Submit auditor's report and supporting documents

Forlimited companysubmitting the profits tax return, it is necessary to attach the financial statements (auditor's report) reviewed by the auditor. The service provider will verify the financial data in the profits tax return to ensure consistency with the contents of the audit report and submit them together as required by the tax authority, reducing the risk of discrepancies or missing documents.

General correspondence follow-up and inquiry response for the tax authority

After the tax return is completed, the tax authority may still send letters to inquire about details. The service provider will assist in drafting compliant response letters for general written inquiries, explaining special circumstances in the accounts. This can significantly reduce the anxiety of business owners facing official documents and ensure smooth communication.

Can a limited company file taxes on its own?

From a regulatory perspective, a limited company can handle tax filing matters on its own, but in practical operation, due to the need to comply with statutory audit procedures and correctly understand various tax deductions and reporting rules, the overall process is relatively complex. If there is insufficient understanding of tax laws, it is easy to make errors in details that affect the reporting results.

Self-filing vs. outsourcing services

To help you evaluate more intuitively, we have organized the following table:

| Comparison items | Self-handling | Outsourced tax filing service |

| Time cost | Higher (need to organize documents personally and study filling instructions) | Lower (only need to provide original documents and confirmation documents) |

| Accuracy and risk | More likely to have errors and face the risk of fines or overestimated taxes | High accuracy, overseen by professionals, compliance is guaranteed |

| Tax optimization | Can only fill in literally, making it harder to discover potential tax deduction opportunities | Can proactively suggest legal deductions and tax-exempt arrangements |

| Extension application | Must apply individually, the process is complicated | Automatically included in the batch extension plan, enjoying a longer grace period |

In which situations is it more suitable to consider professional tax filing assistance?

If the company meets any of the following characteristics, seeking external assistance is usually the most cost-effective option:

- Limited company structureMust undergo statutory audit, cannot be completed independently

- Frequent transactions or numerous documentsLack of dedicated accounting personnel to organize accounts internally

- Wish to apply for financingBanks place great importance on the compliance of financial statements and tax records

- Unfamiliar with tax regulationsConcerned about filling out forms incorrectly leading to hefty fines or unnecessary tax investigations

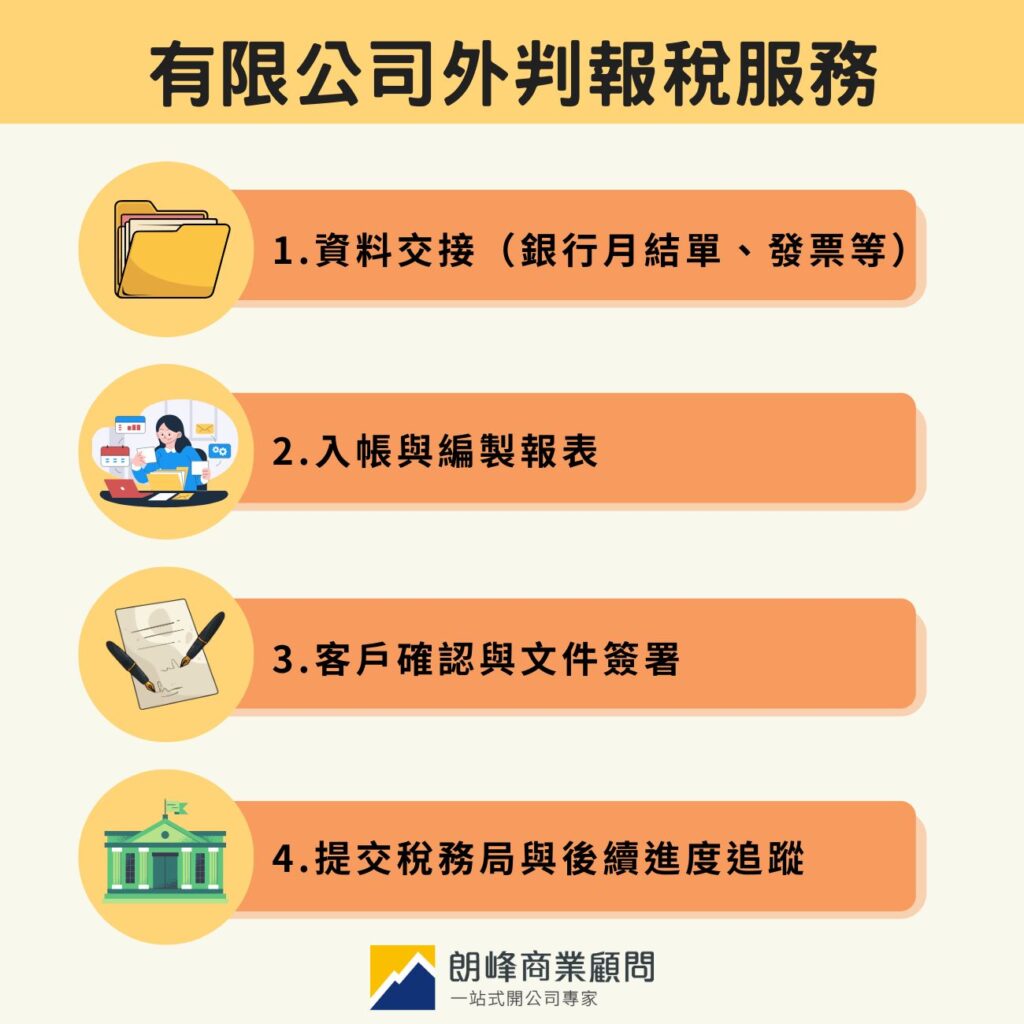

Four steps for outsourcing tax filing services for limited companies

Step 1: Data handover (bank statements, invoices, etc.)

Business owners only need to collect the operating documents for the year, including bank statements, sales invoices, purchase receipts, and expense receipts, and categorize them monthly to hand over to the service provider's team.

Step 2: Bookkeeping and report preparation

The service provider will transform the messy documents into accounts that comply with accounting standards, preparing the income statement and balance sheet. This stage is the foundation for tax filing, ensuring that the data accurately reflects the company's operational status.

Step 3: Client confirmation and document signing (including audit report)

Once the accounts are completed, arrangements will be made for a practicing accountant to conduct an audit (applicable to limited companies), producing an audit report and filling out the tax return. After the business owner confirms that the content is correct, they will sign the documents.

Step 4: Submit to the tax bureau and follow up on progress

The service provider will submit the signed documents to the tax bureau and monitor the receipt confirmation and assessment results to ensure the entire declaration process is successfully completed.

Hong Kong tax filing service fee market

There is no fixed standard for tax filing service fees, which are usually adjusted based on the following factors:

| Influencing factors | Description |

| Company Type | UnlimitedNo audit required, lower fees; limited companies are legally required to submit an auditor's report, and the quotation usually includes the audit fees of a practicing accountant. |

| Annual turnover | Turnover reflects the scale of the business and potential risks. The market usually sets fee tiers based on the amount; the higher the turnover, the broader the scope of the auditor's review. |

| Number of documents | The number of bank statements and invoices directly determines the accounting hours. If transactions are frequent or documents are complex, more manpower is needed for organization. |

| Whether it involves back accounting | Handling backlog accounts requires tracing old data and confirming asset continuity, with technical difficulty and time costs far exceeding annual declarations. |

Which tax filing service is good? Recommended: Longfeng Business Consulting

Longfeng Business Consulting (SetupHK) has been assisting hundreds of clients in solving business challenges every year since its establishment in 2014, and has won the Economic Weekly Strength Brand Award for four consecutive years, making it a trusted tax support for small and medium-sized enterprises.

Unlike some intermediary models in the market, Long Peak insists on "full process follow-up by our own team," with internal professional consultants personally overseeing everything from account organization, audit coordination to tax filing, effectively ensuring data security and improving processing efficiency. The team excels at explaining complex tax cases in simple terms and proactively alerts clients to potential tax risks and benefits, allowing business owners to focus on business development without administrative burdens.

Frequently Asked Questions

Do I need to file taxes even if there is no business operation?

Even if the company has no actual operations, it still needs to submit a tax return to the tax bureau, which is usually a "zero declaration." Ignoring this will result in fines.

If I have lost past documents, can the service provider assist in handling it?

In some cases, bank records or other documents can assist in reconstructing accounts, but the actual feasibility still depends on the completeness of the data.

How long after receiving the tax form do I need to submit it? What happens if it's overdue?

The profits tax return usually needs to be submitted within one month of receipt. If a tax representative is appointed, a few months' extension can be applied based on the year-end date. Late submissions may incur fines (up to HK$10,000 and an additional tax of three times), and the tax bureau may also estimate tax collection first and then allow the company to appeal.

The company is in a loss situation; is it still necessary to file taxes and audit?

According to tax regulations, companies must submit tax returns and audit reports even if they incur losses.

Afraid of making mistakes or missing deadlines in tax filing? Long Peak Business Consultants provides you with professional services.

Tax filing involves multiple procedures and document requirements; if businesses handle it themselves, they may increase risks due to overlooked details. Having an experienced professional team assist can ensure timely completion of declarations and reduce the impact of procedural errors.Langfeng Business ConsultancyProviding a complete solution to assist businesses in operating legally and compliantly, allowing you to easily cope with every tax year.

Extended reading: "TheComprehensive Audit Accounting: 4 Major Differences and Legal Key Points in Accounting and Auditing that Hong Kong Companies Must Know》

Extended reading: "TheUnlimited company tax filing cheat sheet: Master profit tax calculation, deductible items, tax filing process, and key reporting points in 5 minutes.》