2026 Hong Kong Accounting Services Guide: Service Content, Process, Charging Standards, and Precautions

Hong Kong accounting services assist companies in organizing accounts, preparing financial statements, tax filing, and payroll management. Outsourcing professional accounting can save costs and risks, ensure compliance and financial transparency, suitable for SMEs.

Summary of key points

- Covering daily bookkeeping, statutory financial statement preparation, tax calculations, and payroll MPF organization.

- Outsourcing services offer the best cost-performance ratio.

- Pricing depends on the number of documents, company type, and completeness of accounts.

- Unclear accounts may face tax bureau estimated tax penalties and bank account freezes.

- Lost documents can be remedied through bank records.

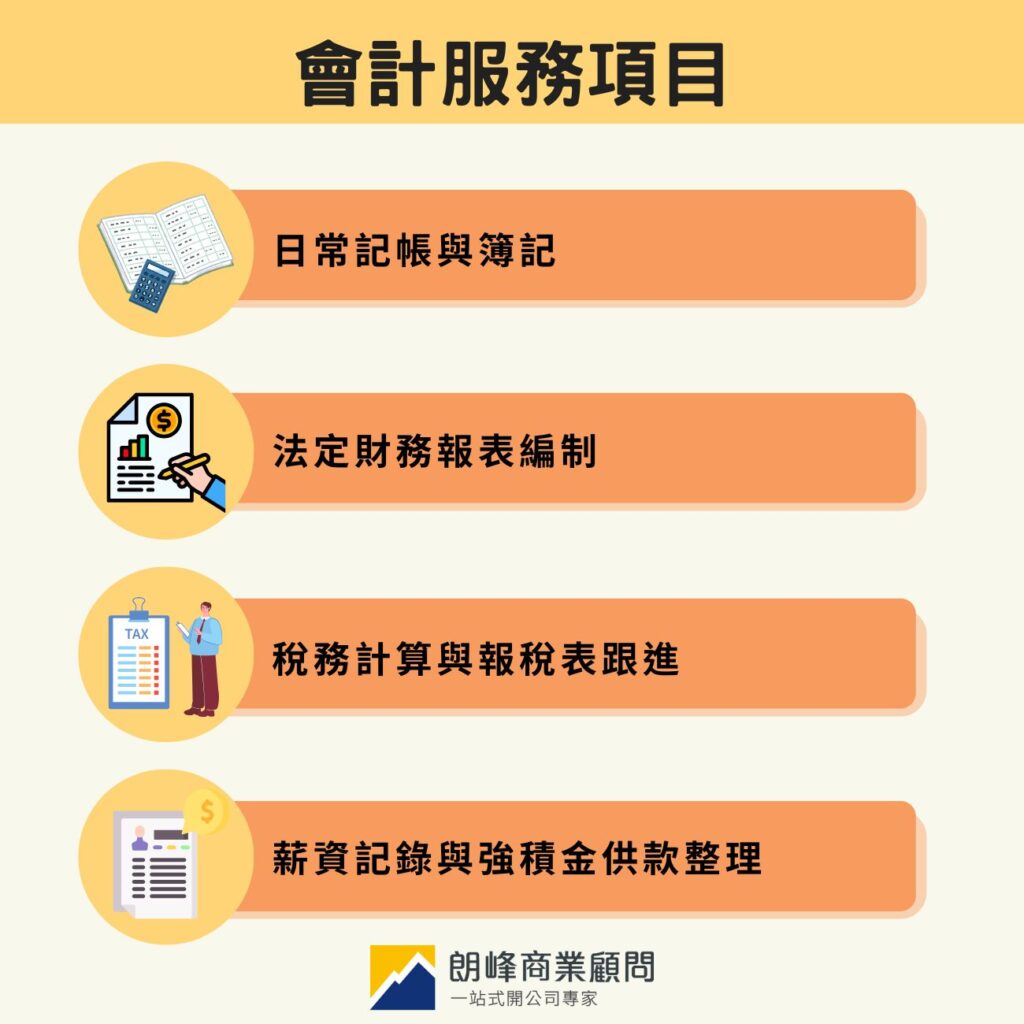

What items are included in accounting services?

Operating a company in Hong Kong, regardless of size, requires regular handling of accounts and related declarations. The core purpose of accounting services is to assist companies in organizing financial data clearly.

Daily bookkeeping and record keeping.

Accountants will assist in organizing the company's daily income, expenses, invoices, and bank transactions into accounts, ensuring that every fund flow is traceable to avoid unclear accounts in the future.

Preparation of statutory financial statements.

According to Hong Kong's 《Companies Ordinance》 and accounting standards (HKFRS), the accounting team will compile accounts into formal financial statements. This includes reports such as balance sheets and income statements, which serve as the company's annual "report card" and are necessary for auditors to conduct reviews.

Tax calculations and tax return follow-up.

Based on the completed accounts, accountants will calculate the "taxable profit" and fill out theprofits taxtax return form (PTR). If the tax bureau raises questions, they will also assist in responding based on experience, ensuring a smooth declaration process and reducing unnecessary misunderstandings.

Payroll records and MPF contribution organization.

Employee salaries and MPF contributions not only involve labor laws but also directly affect the company's tax expenses. Accounting services typically include assistance in recording salary details, ensuring that related expenses are correctly accounted for as proof for future tax deductions.

Should SMEs hire in-house or outsource? A cost-benefit comparison of 3 models.

Hiring a full-time accountant.

For large enterprises with substantial transaction volumes that require real-time cash flow monitoring, establishing an internal team is a common choice, but long-term human resource investment must be considered.

- Features: Highest cost, suitable for large companies.

- Analysis: In addition to basic salaries, companies also need to bear additional hidden costs such as MPF, labor insurance, employee holidays, and office software and hardware. If there are not a large number of documents that need to be recorded daily, this model can easily lead to resource idleness and excessive financial burdens for general SMEs.

Self-use accounting software

With the popularity of cloud technology, subscription-based software has significantly lowered the threshold for bookkeeping, but it is important to note that "being able to operate software" does not equate to "understanding tax compliance."

- Features: Lowest cost, but prone to mistakes leading to fines.

- Analysis: Although tools like Xero or QuickBooks are powerful, a lack of understanding of Hong Kong Financial Reporting Standards (HKFRS) can easily lead to asset classification errors or misreporting of personal expenses. Such unintentional mistakes may save initial service fees but could later trigger tax audits by the tax authority, resulting in a net loss.

Outsourcing professional accounting services

To achieve the best balance between operational costs and compliance quality, hiring external professional consultants has become a trend in modern enterprise lean management.

- Features: High cost-performance ratio, professional team oversight.

- Analysis: This model offers extreme flexibility, as companies only need to pay for actual services rendered (Pay-as-you-go), completely eliminating the pressure of maintaining staff. At the same time, with the dual oversight of senior accountants, it ensures that accounts comply with the latest regulatory requirements, allowing operators to focus on core business without worries.

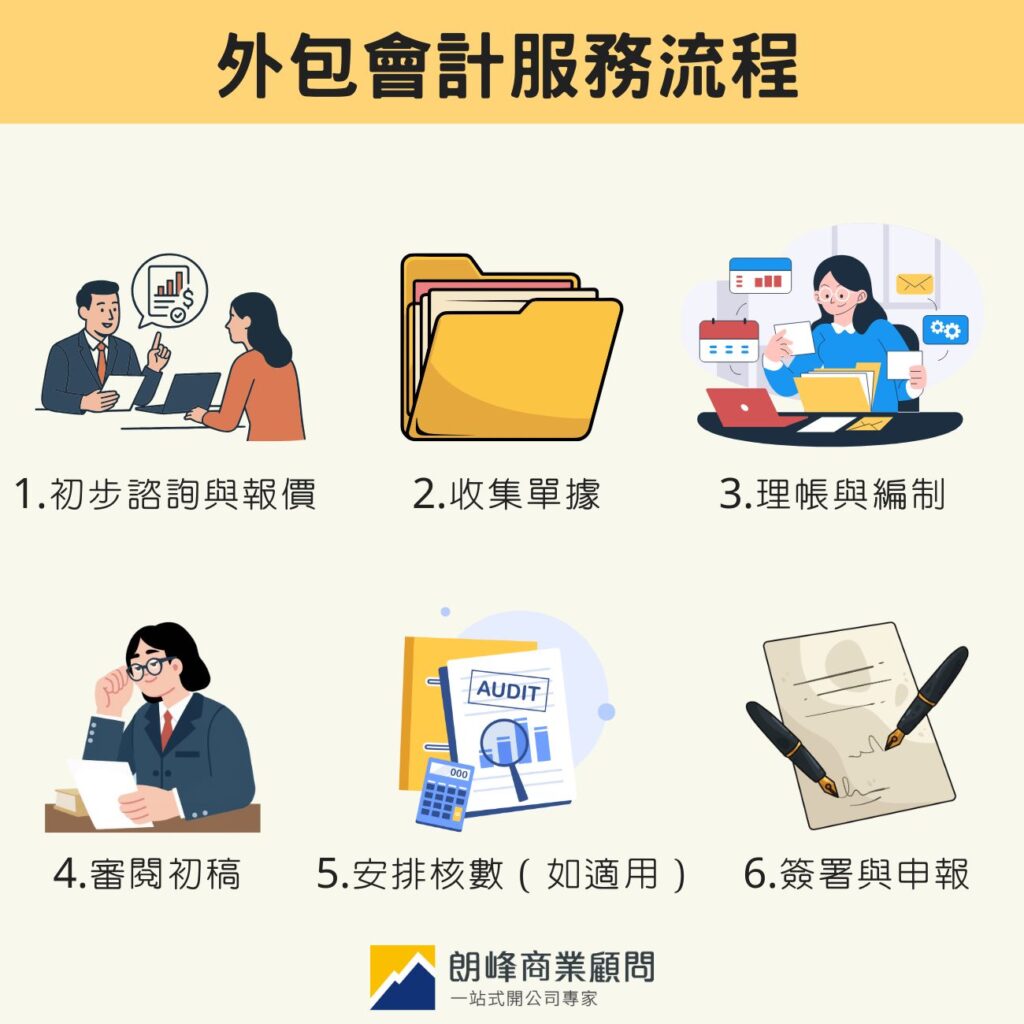

Outsourced accounting service process

Step 1: Initial consultation and quotation

The team will first assess the company's operational scale, document volume, and industry characteristics, providing a clear and transparent quotation plan to ensure that clients understand the scope of services.

Step 2: Collecting documents

Companies need to organize the year's bank statements, sales invoices, expense receipts, and purchase orders, and submit them to the service provider (via physical courier or electronic cloud upload).

Step 3: Accounting and preparation

Accounting professionals will begin data entry, classification of accounts, and bank balance verification, and will prepare the balance sheet and income statement according to accounting standards.

Step 4: Review draft

After preparation is complete, the draft report will be submitted to the client for confirmation, checking for any special transaction items that may have been omitted or require additional explanation.

Step 5: Arrange for audit (if applicable)

After confirming that the report is correct, for limited companies, the accounting team will hand over the report to an independent auditor for statutory audit work.

Step 6: Signing and declaration

After the final audit report is signed and confirmed by the board of directors, the team will assist in filling out the tax return and submitting it to the tax authority, completing the annual tax filing process.

What is the market rate for accounting services in Hong Kong?

The cost range for accounting services is HK$1,000-10,000, usually depending on the workload and complexity. The following factors that affect pricing are also summarized for your reference:

| Influencing factors | Description | Impact on price |

| Number of documents | Total number of transactions including bank inflows and outflows, invoices, and receipts. | The more documents there are, the longer the processing time, and the higher the cost. |

| Company Type | Unlimited company vs limited company. | Limited companies require audits, have more regulations, and the costs are usually higher than those of unlimited companies. |

| Completeness of accounts | Whether the documents are complete and whether old accounts need to be cleaned up (finalizing). | If the accounts are messy and require time to reorganize, it usually incurs additional service fees. |

| Frequency of reports | Accounting can be done annually, quarterly, or monthly. | Annual accounting is the most economical; monthly accounting has higher costs but allows for immediate understanding of financial status. |

Recommended accounting services in Hong Kong: Longfeng Business Consulting

Faced with complicated accounting standards and potential tax risks, many business owners often feel at a loss.

Since its establishment in 2014, Longfeng Business Consulting has focused on solving the pain points of small and medium-sized enterprises regarding "difficult bookkeeping and troublesome tax reporting," and has won the Economic Weekly's Strength Brand Award for four consecutive years, with its professionalism highly recognized. By entrusting accounting to Longfeng, business owners receive not only a compliant financial statement but also a strong financial support that can answer tax-related questions at any time and help them respond to tax bureau audits with peace of mind.

Frequently Asked Questions

What risks do companies face if they do not engage accounting services?

The most direct risk comes from the tax bureau's "estimated tax" and fines. If there is no accounting evidence to support the reported content, the tax bureau can overturn the declaration and directly assess a higher tax amount. In addition, if banks find that a company cannot provide financial statements for a long time, they may freeze the company's account, severely affecting cash flow.

Can accounting records still be made up if past documents are lost?

Generally, records can be supplemented through bank statements and other data, but it requires additional time for organization. It is usually recommended to first apply to the bank for reissuing past monthly statements as basic proof of cash flow.

What is the difference between accounting and auditing services?

"Accounting" is responsible for "bookkeeping," compiling documents into reports; "auditing" is responsible for "checking accounts," where an independent third-party accountant reviews the authenticity of the reports.

Will changing accounting service companies midway be very troublesome?

As long as the data handover is clear, it can usually be smoothly connected, with the key being the completeness of the accounts.

Does accounting service include acting as a "company secretary"?

These are two different positions. Accountants focus on finance and taxation; company secretaries (Com Sec) are responsible for reporting company changes to the registry and submitting annual returns (NAR1) and other administrative compliance tasks. They are usually listed separately on the quotation.

How long does it generally take to complete accounting bookkeeping?

Under the condition of complete data, annual bookkeeping usually takes 2-4 working weeks. If it includes auditing procedures, additional time is required. It is recommended that business operators reserve a buffer period of 1.5-2 months before the tax reporting deadline to avoid being too rushed.

Don't want to worry about company accounting anymore? Leave it to the professional team at Longfeng Business Consulting.

Each profession has its expertise, and business operators' time is better spent on profit planning and key decision-making. The details involved in accounting processing are numerous, so it is advisable to leave it to professionals, which can help reduce management burdens.

Langfeng Business ConsultancyThe team is deeply engaged in Hong Kong's tax and accounting practices, dedicated to assisting businesses in organizing their accounts clearly and completing reports in compliance, allowing operators to focus more confidently on business growth.

Extended reading: "TheDo Hong Kong companies need to conduct audits? Understand the content, fees, and recommended audit firms in this article.》

Extended reading: "TheWhat does Hong Kong tax filing service include? Understand the company tax filing process, fee standards, and actual benefits in one article.》