![Company Transfer Strategy] A detailed explanation of the documents, procedures, stamp duty and points to note on the transfer of shares (equity) of Hong Kong limited companies.](https://setuphk.com/wp-content/uploads/2025/12/hk-company-transfer-1.jpg)

Company Transfer Strategy] A detailed explanation of the documents, procedures, stamp duty and points to note on the transfer of shares (equity) of Hong Kong limited companies.

A transfer of shares will take effect once the company information, statutory documents and stamp duty have been paid and the shareholders' register has been updated in accordance with the procedures. As long as you have a good understanding of the documents, procedures and tax filing deadlines, you will be able to complete the transfer safely.

Summary of key points

- Company registration information, articles of association, NAR1/NSC1, financial statements and other documents are required.

- Stamp duty must be paid within the time limit (2 days for domestic; 30 days for overseas).

- The IRD will calculate the tax based on the "higher of the transaction price or net asset value".

- After stamping, the company has to update the register of members and share certificates.

- Change in directorships to be reported within 15 days

- The instrument of transfer should pay particular attention to the consideration, the stock code and the identifying particulars of both parties.

Can I transfer my company? First of all, let's clarify the existing conditions.

The need to identify the type of company and the motive for the transfer before initiating the transfer of shares in a company will involve the complexity of the subsequent process.

Private Limited Company vs Public Limited Company vs Unlimited Company

Different types of companies have different levels of transfer flexibility:

| Company Type | Transfer Method | Restrictions on transfer of shares | Shareholder Approval Requirements | Applicable scenarios | Degree of supervision |

| Private Limited | Transfer of Shares (Equity) | Existing shareholders may have pre-emptive rights, usually subject to constitutional restrictions | Board Approval + Shareholder Consent (as required by the Articles) | Adjustment of SMEs' internal shareholders, introduction of investors or arrangement of retirement handover | Medium. Subject to the Companies Ordinance |

| Public Limited (公眾有限公司) | Shares can be traded freely | Less restrictive. Shares may be offered to the public | Board approval (if required by the bylaws), public transactions generally do not require individual shareholder consent | Listed companies or external fund-raising, more open and transparent share transfers | High. Strictly regulated by the Securities and Futures Ordinance, etc. |

| Unlimited Company | No share transfer | Transfer of ownership through change of partnership agreement or business ownership | Consent of the Board of Directors and the Company's shareholders (as required by the Articles) | Business combinations or internal shareholding adjustments | Low. Shareholders have unlimited liability for the debts of the company |

When is a transfer of shares required?

The following situations are particularly suitable for company transfers:

- Introduction of new investors

- Increase or decrease in shareholders

- Retirement of bosses or succession arrangements

- Acquisitions, mergers and acquisitions

- Withdrawal of Shareholders or Reorganisation of Shareholdings

As long as the company maintains normal operations, the shares can usually be transferred smoothly.

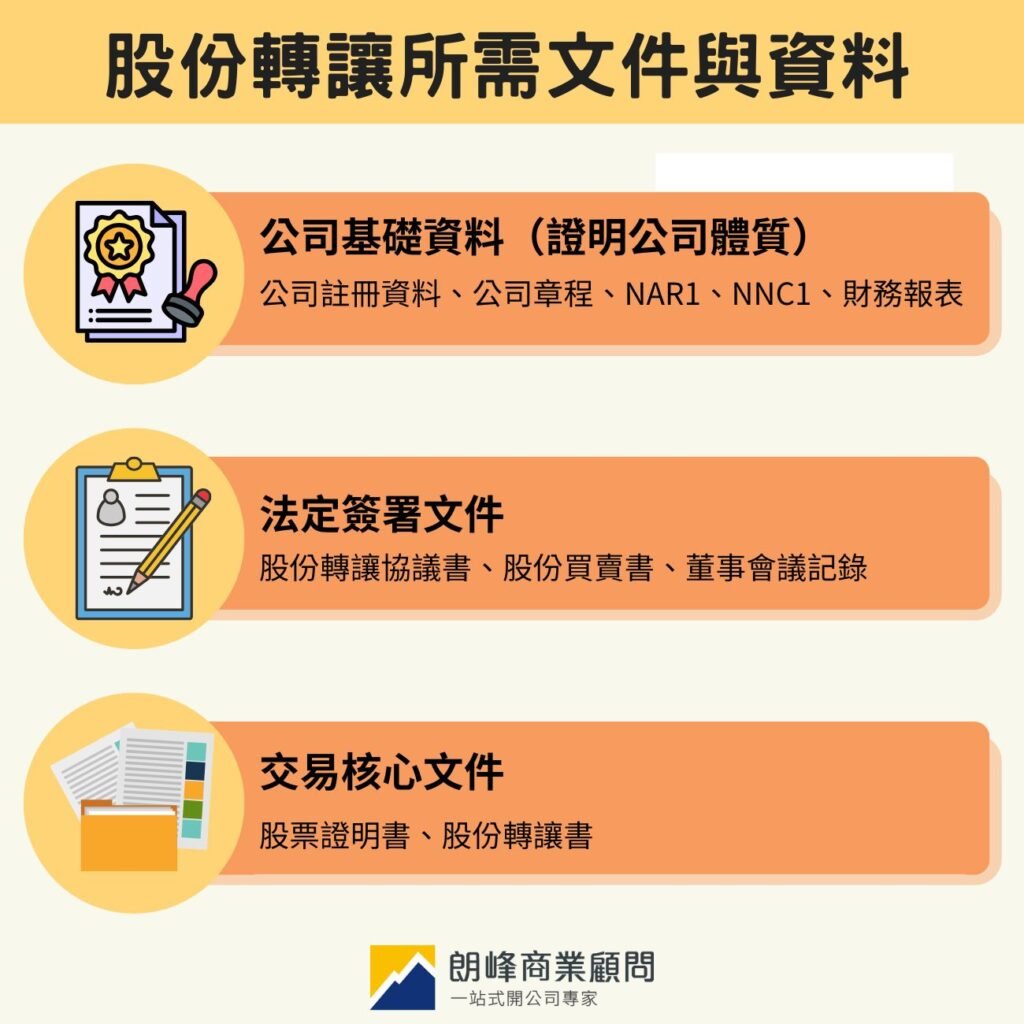

Documents and information required for share transfer

The preparation of transfer documents is the most important part of the transfer process. In order to avoid mistakes that may lead to rejections or late penalties, it is recommended that you prepare the following documents and information in stages:

Basic information of the company (to prove the nature of the company)

It is mainly used to prove the legitimacy of the company andCalculation of Stamp DutyThe basis for this is that it must be properly prepared:

- Company registration information (company name, registration number, date of establishment, etc.)

- Articles of Association

- nearest (of locations)Annual Returns(NAR1) or establishment form (NSC1)

- Form of Incorporation of Limited Company (NNC1, if the first anniversary date has not yet arrived before the transfer of shares)

- Latest audited financial statements or management accounts within 3 months

Statutory Signature

It has to be signed by both the seller and the buyer and drafted by a professional to ensure legal validity:

- Agreement for Transfer of Shares (Instrument of Transfer)

- Bought Note & Sold Note

- Companies Registry Returns (e.g. NAR1 / AR1 to report changes in shareholders or directors)

- Minutes of the Directors' Meeting (Approval of this Transfer)

Transaction core documents

Key documents evidencing transaction details and changes in ownership:

- Share Certificates

- Instrument of Transfer (IT)

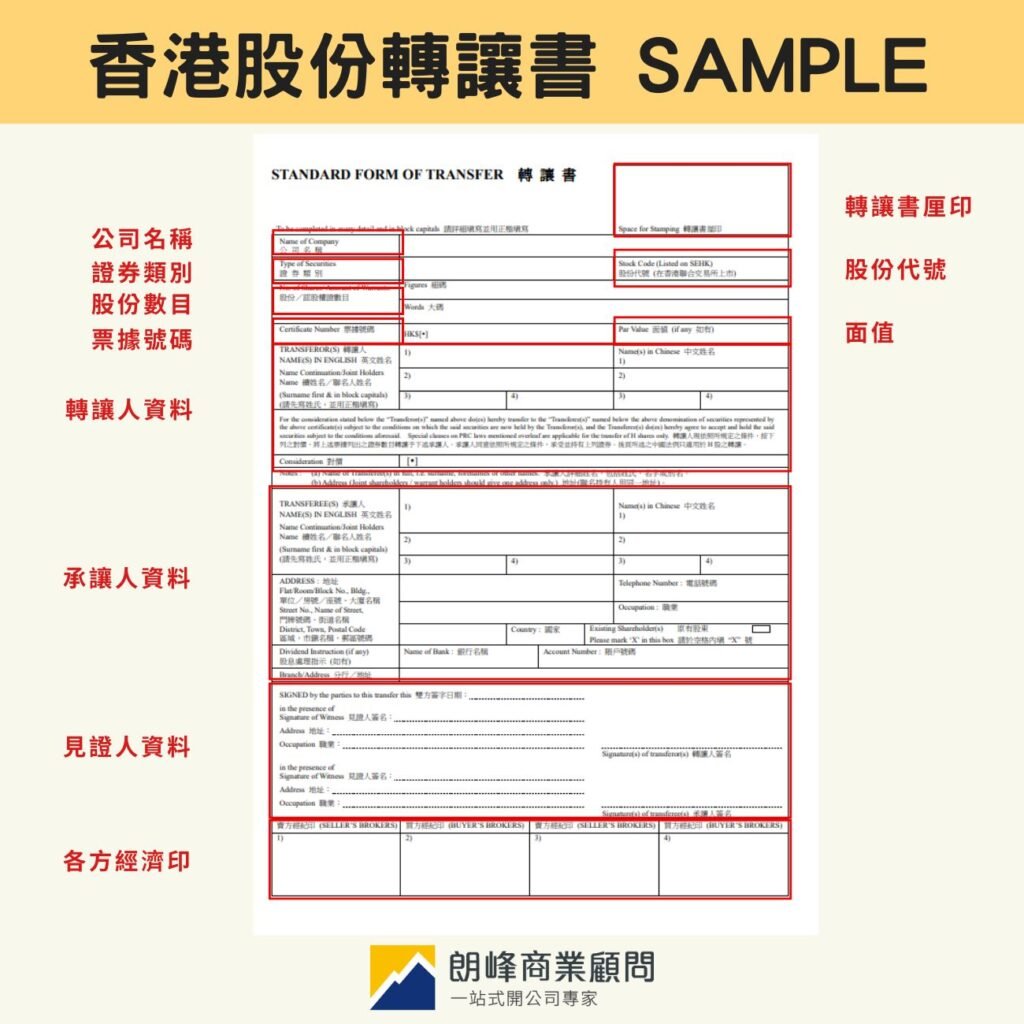

Hong Kong Share Transfer Form Sample Download and Filling Notes

A professional Share Transfer Letter needs to focus on the following points:

- Share Details: The number and class of shares to be transferred, as well as the share number, must be accurately stated.

- Transfer of consideration: The actual transaction price should be filled in. It should be noted that if the declared price is lower than the net asset value, the Inland Revenue Department (IRD) will still calculate the stamp duty on the basis of the higher value.

- Identity and Signature: The full legal name and address of the transferor and transferee must be entered, the signature must be legible, and a qualifiedWitnessesSignature.

- Professional service: It is recommended that the drafting and checking of such documents be entrusted to professional consultants to ensure that every field complies with the legal requirements.

Download link:Hong Kong share transfer form sample

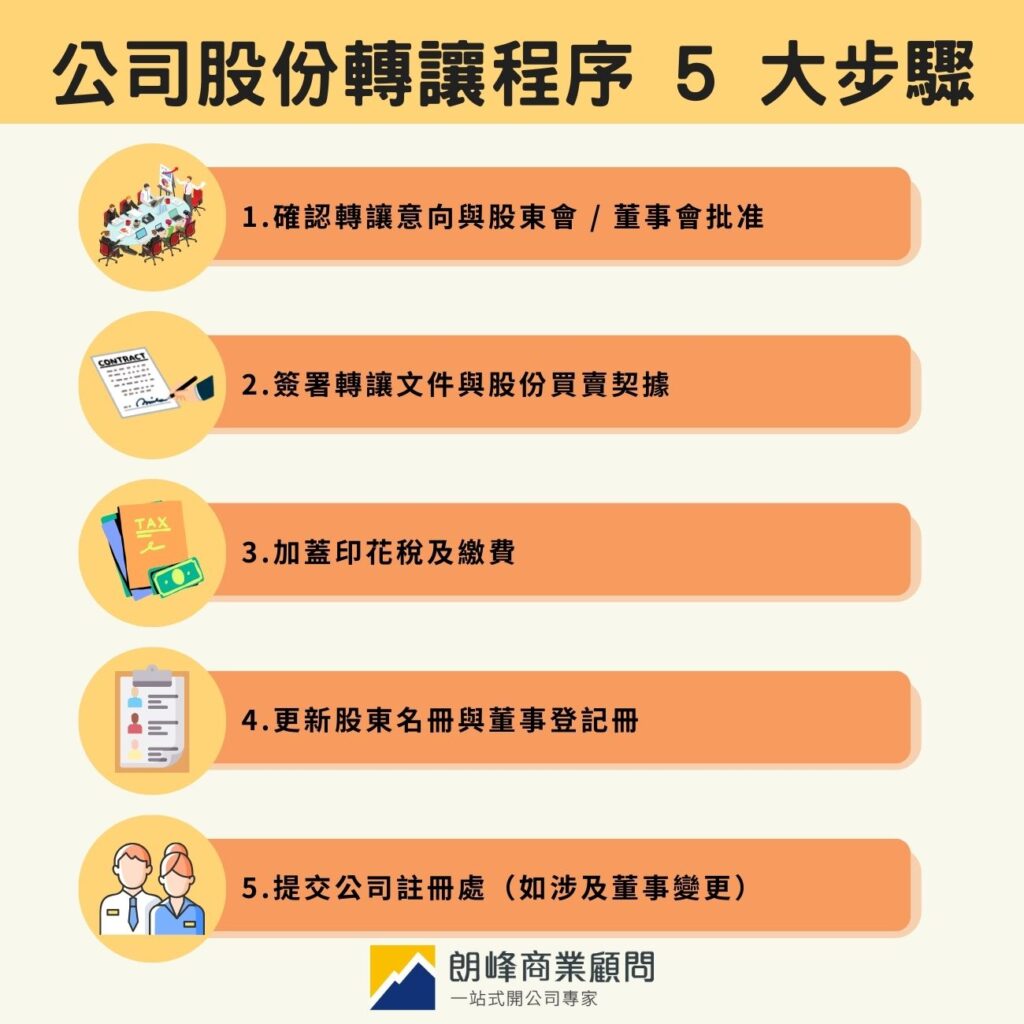

5 Steps in the Procedure for Transfer of Shares in a Company

Process 1: Confirmation of Intention to Transfer and Shareholders' Meeting / Board Approval

RecommendationFirstly, review the articles of association to confirm whether the transfer requires the convening of a board of directors or special shareholders' meeting, and duly approve and record the requiredApproval of ResolutionThis is a legal precursor to initiating the transfer process. This is a legal precursor to initiating the transfer process.

Process 2: Execution of Transfer Document and Bought & Sold Note

Both the buyer and seller (transferor and transferee) are required to sign all the necessary statutory documents, including the Share Transfer Form and the Share Sale and Purchase Form. The date on which these documents are signed is the starting point for calculating the time limit for stamp duty.

Process 3: Stamping and payment of stamp duty

This is the most time-consuming step. An accountant will assist in calculating the exact amount of stamp duty and submit the document to the Inland Revenue Department (Stamp Office) for payment of stamp duty and stamping (commonly known as "stamping"). It is only after this step is completed that the transfer of shares by a limited company becomes legally binding.

Process 4: Updating the Register of Shareholders and the Register of Directors

Immediately after completing the stamping, the company secretary will need to execute internal changes: cancelling the old shares held by the transferor, issuing new shares to the transferee, and updating the company'sRegister of Shareholders與Register of Directors。

Process 5: Submission to Companies Registry (if change of directors is involved)

- Shares change: Changes do not need to be reported immediately, but can be reported with the company's next annual return (NAR1).

- Director Change: In the case of a resignation or appointment of a Director, the resignation or appointment must take place within 30 days after the date on which the change takes place. Within 15 daysFiling with the Companies Registry ND2A Forms.

Transfer Stamp Duty Calculation and Payment Time Limits

Stamp duty rates and formulae

Hong Kong Transfer of shares Gross stamp duty is:Transferred Share Value x 0.2% + Documentation Fee. The Inland Revenue Department (IRD) will choose between the following two optionsHigher amountas the basis for calculating stamp duty:

- The actual price at which the shares are traded (the Consideration).

- The pro rata net asset value of the shares.

Assume a transfer of shares in a company where the actual transaction amount of the shares is HK$1.5 million and the net asset value of the shares is HK$1 million. Since "actual transaction price > net asset value", $1.5 million is taken as the basis for stamp duty. The following table illustrates the calculation of stamp duty and the amount payable:

| Fee Type | Fee Calculation | Amount payable | Remarks |

| stamp duty on shares | $ 1,500,000 x 0.2% | HK$ 3,000 | 50% to be borne by the seller and the buyer (i.e. $1,500) |

| Memorandum of Sale and Purchase Clerical Fee | $ 5 x 2 copies | HK$ 10 | The Purchaser and the Seller are each required to pay $ 5 for the Clerical Fee. |

| Total stamp duty payable | $ 3,000 + $ 10 | HK$ 3,010 | Total amount payable to the Inland Revenue Department (IRD) |

Stamp Duty Payment Time Limits and Late Penalties

Statutory period:

- The sale or purchase is completed in Hong Kong:Within 2 working days。

- The sale or purchase is completed outside the country:30 days。

- Shares cannot be formally transferred without the stamp duty being stamped.

Late penalties: The Inland Revenue Department will impose high penalties of up to 50% of the amount of stamp duty payable. 2x to 10xNot equal. (10% → 20% → 30% progressive)

Frequently Asked Questions

What are the consequences of an incomplete or incorrectly signed company transfer document?

The transfer may be delayed or returned, requiring a new signature or replacement document, or even affecting the stamp duty return and incurring unavoidable late penalties.

What are the risks of not checking the company's debts before the transfer?

The buyer may be liable for unpaid taxes, contractual obligations or employee disputes, and it is recommended that a financial and legal review (Due Diligence, DD) be conducted in advance.

Will the transfer of shares affect my bank account?

If there is a change in the company's directors, the bank may require an update of the KYC documents to ensure that the account is operating legally. The proposed transfer should beNotify the bank immediatelyThe Bank will also prepare the Board Resolution and the identification documents of the new shareholders/directors as required by the Bank and co-operate with the Bank in conducting the re-examination.

Can a company carry out a share transfer if it does not have audited financial statements?

Yes, but a management account or director's confirmation is required to demonstrate the company's financial position.

Can a company's articles of association restrict the transfer of shares?

You can. The articles of association of most private limited companies usually contain restrictive clauses such as "board approval" or "pre-emptive rights of existing shareholders", which are intended to protect the existing shareholders' control of the company.RecommendationThe articles of association must be carefully checked before transfer.

Is there any difference in signing the transfer form within/outside Hong Kong?

The main difference is thatTime limit for payment of stamp dutyThe following is a list of all the signatures that can be made in the country. Domestic signatures are only 2 working daysThe very short period of time for which offshore signatures are available 30 daysThis has a direct impact on your time pressure to process documents. This will have a direct impact on your time pressure to process documents.

Worried about the complexity of the company transfer process? Lafont's business consultants can help you to complete the process smoothly

Lafont Business Consultancy provides full support from shareholder structure checking, document preparation, board resolution, stamp duty declaration to updating of shareholders' register and company registry, providing professional advice and risk alerts. We help SME owners to complete the company transfer with peace of mind, saving time and legal risks.

Extended reading: "TheWhat is a company secretary? Definition, duties and conditions of appointment in one article》