What documents do I need to bring to open a company account, 3 major types of documents to help you open a company account quickly

After registering a company, many people will think of opening a company bank account to facilitate future business transactions. However, opening a company account is not an easy task for a start-up company, and Lonfon has compiled a list of things to consider when opening a company bank account.

What are the benefits of opening a company bank account?

Many people think that they are not required to set up company accounts when they open a company, so what are the advantages of opening company accounts?

Compliance with regulatory requirements

Although there is no requirement to set up a company account when you start a company, if you use your personal account for business purposes, there is a chance that the bank will freeze your funds. Banks are regulated by the HKMA and have the responsibility to monitor suspicious money transfers and money laundering. Don't leave it to chance and think that the use of your personal account for business purposes will not be detected, as there is a clear distinction between personal and business transactions under the monitoring of the bank.

Convenient for tax filing

For start-ups or one-person companies, it is not difficult to manage funds in a personal account or to distinguish between personal and company funds or purposes, but failing to submit receipts for an accountant's audit when filing a tax return can be confusing and may even result in the need to pay more for the service. However, when the employer or employee's salary certificate comes from a personal account, it is more likely to be investigated by the Inland Revenue Department and other authorities.

More Banking Services

Many people think of corporate lending and credit cards when they think of corporate business account services. Apart from better loan rates, there are also services such as bank service fee waivers, free payroll services, corporate online and mobile banking, and accounting system connectivity that make it easier for companies to manage their business.

Enhancement of corporate trustworthiness

Due to the difficulty of opening a corporate account, a successful opening of a corporate account indicates that the company's background information and operations meet the bank's requirements, and can increase the company's trustworthiness in the minds of customers.

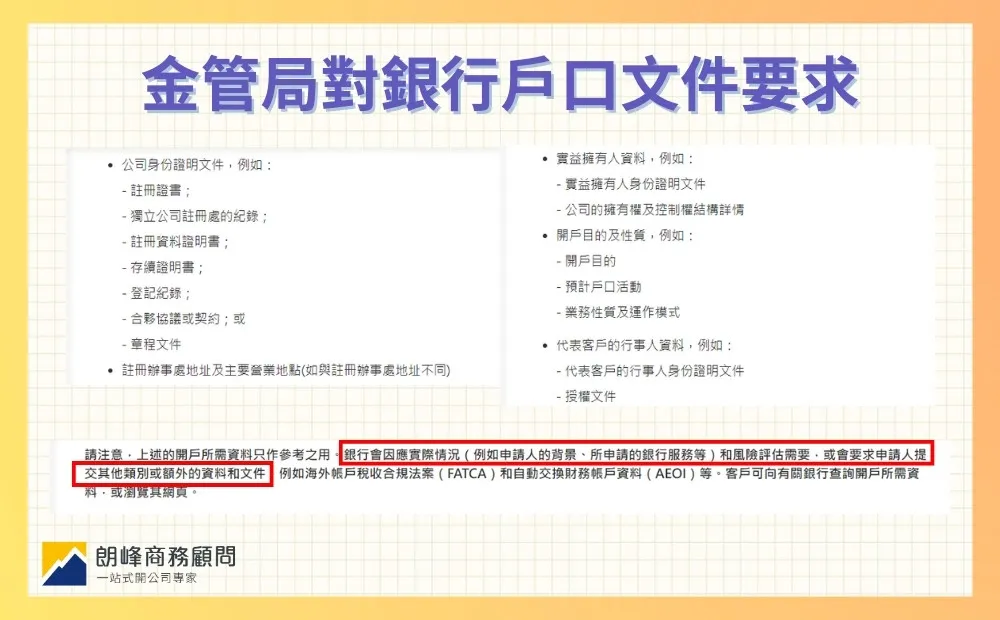

Minimum documentation requirements of the HKMA

Why is it so difficult to open a corporate account? In order to combat money laundering, the HKMA requires banks to conduct Customer Due Diligence (CDD) to understand the background and needs of their customers before providing them with account services, so that they can provide banking services that are suitable for their customers.

Banks are required to establish their own risk assessment policies that comply with the HKMA's requirements and are responsible for doing so, and are subject to fines if they are found to have failed to fulfil their duty to monitor their business relationships on an ongoing basis through customer due diligence. Banks therefore take account opening and account utilisation compliance very seriously and are more rigorous in their control of procedures and account opening qualifications.

When applying for an individual or company account, the HKMA is aware that banks may request the following information or ask customers to produce the original documents:

Company identification documentsExamples include: certificate of incorporation, records of the Registrar of Independent Companies, certificate of incorporation, certificate of continuance, registration records, partnership agreement or deed, constitutional documents.

Address of Registered Office and Principal Place of Business(if different from the registered office address)

Beneficial owner information(e.g.: proof of identity of beneficial owner)

Details of the ownership and control structure of the Company Purpose and nature of account opening(e.g. purpose of account opening, expected account activities, nature of business and mode of operation)

Information about the person acting on behalf of the client(e.g. identification documents of the person acting on behalf of the client, authorisation documents)

These are the HKMA's minimum requirements and banks may request other documents from applicants according to their own requirements.

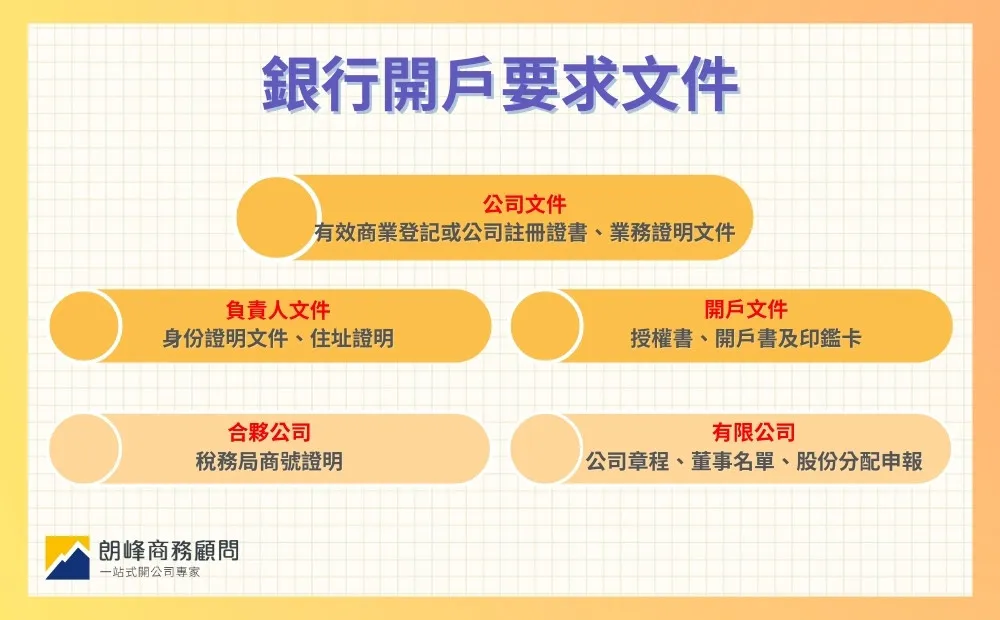

Bank Account Opening Requirements

In practice, both thelimited companyThe requirements for company account application do not differ much from those for sole proprietorship or partnership. You just need to know the bank's requirements well in advance and prepare the following 3 major types of documents:

Corporate Documents:effectiveBusiness Registration Certificate BR、Certificate of Incorporation CIand business supporting documents (e.g. invoices, purchase orders, leases, contracts, etc.)

Person in Charge Documents:Relevant documents provided by the business owner and authorised signatory such as proof of identity, proof of address, etc.

Account Opening Documents:Power of Attorney, Account Opening Form and Chop Card

Partnership companies need to provide the Inland Revenue Department's certificate of business name.

Limited companies are required to provide a certificate of incorporation, articles of association, list of directors and resolutions, and a declaration of share allotment.

In addition to the usual documents mentioned above, you may need to add company background (source of funds), company organisation structure, recent audit report (if any) or company website and product information. If the company is a full-fledged business, it may be necessary to supplement the company's business plan, etc., depending on the requirements of different banks.

Difficulties in opening company accounts

At present, apart from visiting a bank branch in person, bank account opening can also be done online or by mobile phone. However, the difficulty in opening a company account still exists, and the information required for opening a company does not seem to be difficult, but why is it said to be difficult to open an account?

The difficulty in setting up a business account for a company lies in the need to provide proof of business, which can be in the form of invoices for goods, sales contracts, bank financial statements, etc. It is more difficult for a start-up company to provide sufficient proof to enable the bank to open a company account at the initial stage of business.

To address the problem of opening business accounts for start-ups or SMEs, many banks have set up lower account opening thresholds for corporate accounts for SMEs, such as HSBC, Hang Seng Bank, Standard Chartered Bank and Dah Sing Bank, making the account opening procedures more convenient for SMEs.

Comparison of company accounts set up by banks

Although it is difficult to open a company account, it is important to prioritise the bank that best suits your company and business, taking into consideration areas such as account opening administration fees, search fees, time required to open an account, fee waiver thresholds and monthly service fees.

Account Opening and Search Fee

Before a bank opens a business account for a company, it needs to check the company's background, registration information and the information of the responsible person. It will also charge an account opening administration fee and a business registration search fee, which is also known as a search fee for checking the company's information. Some banks charge different fees depending on the place of incorporation or the type of company, e.g. the account opening administration fee and search fee for overseas incorporated companies are higher.

Banks also offer special promotions for corporate account opening fees. For example, Hang Seng Bank's Virtual+ Business Account offers a discount on account opening administration fee for online account opening.

Hang Seng Bank Virtual+ Business Account

Account Opening Administration Fee: $1200

Search Fee: Local Company: HK$150, Overseas Company: HK$10,000

Introduction of Hang Seng Bank's banking services fees and charges

HSBC Sprint Account

Account Opening Administration Fee: Local Company: HK$1,300, Overseas Company: HK$11,000

Search Fee: $150

BOC Hong Kong Commercial Banking Account

Account Opening Administration Fee: Local Company: HK$1,200, Mainland Registered Company: HK$3,200, Overseas Registered Company: HK$6,200

Search Fee: Unlimited Company: HK$100, Limited Company: HK$150

Bank of China (Hong Kong) Official Website

DBS Bank

Account Opening Administration Fee: Local Company: HK$1,200, Overseas Company: HK$10,000

Search Fee: Local Company: HK$150, Overseas Company: HK$2,000

Standard Chartered Bank Ease of Opening Accounts

Account Opening Administration Fee: Local Company: Nil, Overseas Company: HK$5,000

Search Fee: Local Company: HK$150, Overseas Company: HK$2,000 onwards (based on actual fee)

Standard Chartered Bank Service Charges

Dah Sing Bank 328 Commercial Banking Account

Account Opening Administration Fee: Local Company: HK$1,200, Overseas Company: HK$10,000

Search Fee: HKD Account: HK$150, USD Account: US$19

Dah Sing Bank General Service Charges

Bank of East Asia

Account Opening Administration Fee: Special Trade or Organisation Company: HK$10,000, Overseas Company: HK$10,000

Search Fee: HK$200

General Charges of The Bank of East Asia

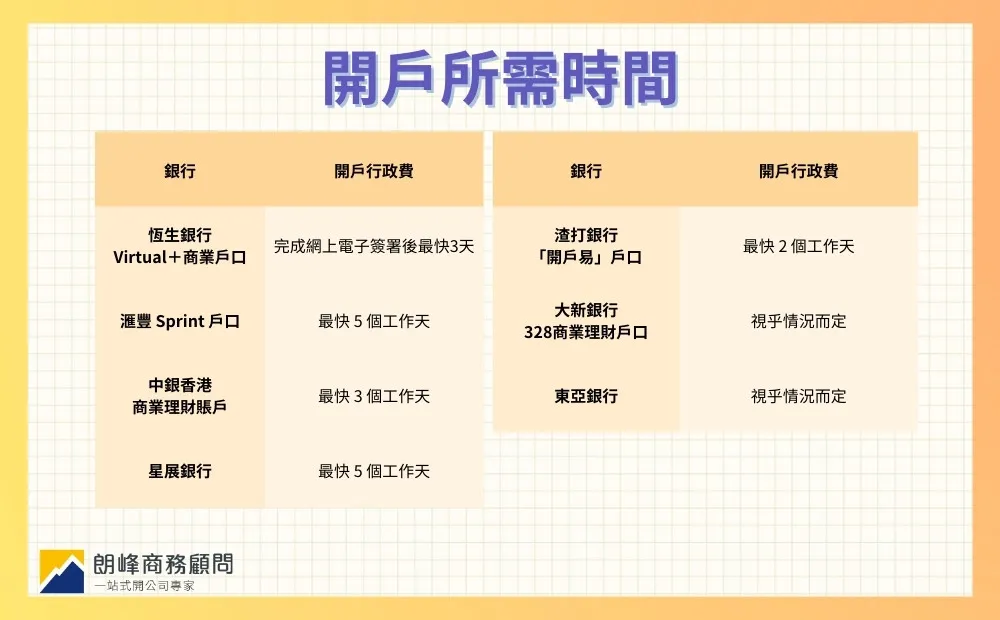

Time required to open an account

Currently, there are three ways to open a bank account: in-person application at a branch, remote account opening services such as online application and mobile application. The number of days required to prepare the documents varies from person to person, and the time required listed below is the speed of approval after all the documents have been submitted, and it may take more time if the documents are not yet complete.

Hang Seng Bank Virtual+ Business Account: as fast as 3 days after completion of online e-signature

HSBC Sprint Account: as fast as 5 working days

BOC Hong Kong Commercial Banking Account: As soon as 3 working days

DBS: As soon as 5 working days

Standard Chartered Bank Ease of Opening Account: as fast as 2 working days

Dah Sing Bank 328 Business Banking Account: Subject to availability

Bank of East Asia: Subject to availability

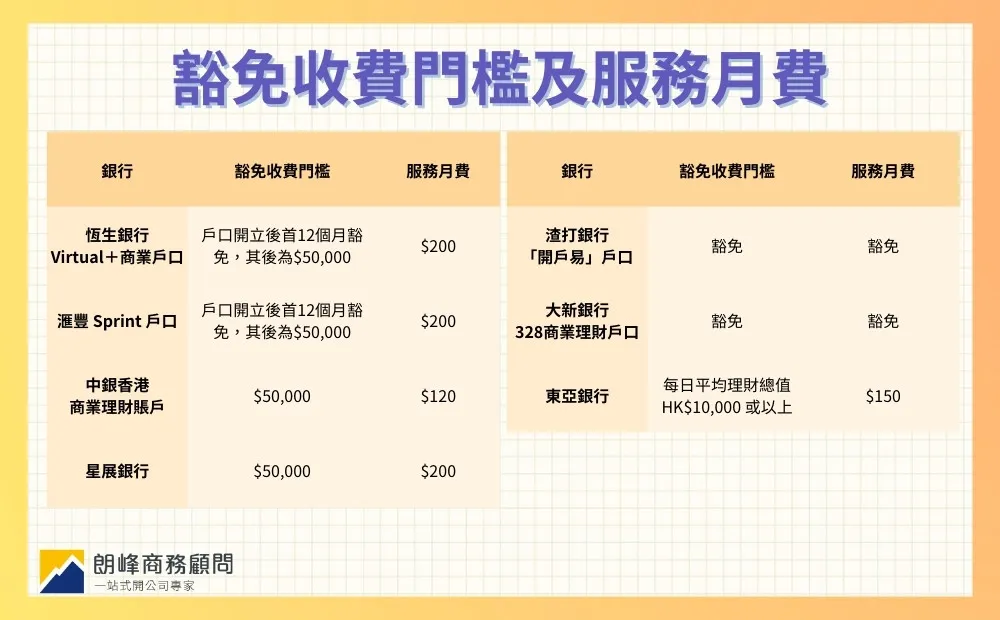

Exemption Threshold and Monthly Fee Payment

Many SMEs pay more attention to the monthly service fee of their corporate bank account, after all, a few hundred dollars a month is a burden. Unlike personal accounts, banks will set the monthly service fee based on the amount of deposit in the company account and the type of company account, and the fee will be waived if the minimum deposit requirement is met. In addition to the amount of deposit, some banks will also take into account the company's other assets in assessing whether the fee will be waived or not.

Hang Seng Bank Virtual+ Business Account

Fee waiver threshold: Fee waiver for the first 12 months after account opening, thereafter the threshold is HK$$50,000.

Monthly Service Fee: HK$200

HSBC Sprint Account

Fee waiver threshold: Monthly fee waiver for the first 12 months after account opening, thereafter the threshold is HK$50,000

Monthly Service Fee: HK$200

BOC Hong Kong Commercial Banking Account

Fee Exemption Threshold: HK$50,000

Monthly Service Fee: HK$120

DBS Bank

Fee Exemption Threshold: HK$50,000

Monthly Service Fee: HK$200

Standard Chartered Bank Ease of Opening Accounts

Threshold for exemption from charging: exemption

Monthly Service Fee: Waived

Dah Sing Bank 328 Commercial Banking Account

Threshold for exemption from charging: exemption

Monthly Service Fee: Waived

Bank of East Asia

Fee waiver threshold: Average daily total wealth management value of HK$10,000 or above

Monthly Service Fee: HK$150

Conclusion

In fact, it is not difficult to open a company account as long as you understand clearly the requirements for opening a bank account and prepare the documents. If you have any questions about opening a bank account for your company or would like to seek help in this area, why not contact the Langfeng Business Consultancy team? We provide one-stop business consultancy services, offering services such as company set-up, bank account opening, virtual office, and office representation, so that you can focus on developing your business blueprint!

Extended reading: "TheHong Kong Company Lazybones】Hong Kong Company Formation Process, Fees, Time and Frequently Asked Questions in One Article》