What is Liquidation? Hong Kong limited company liquidation conditions, process and FAQs in one article

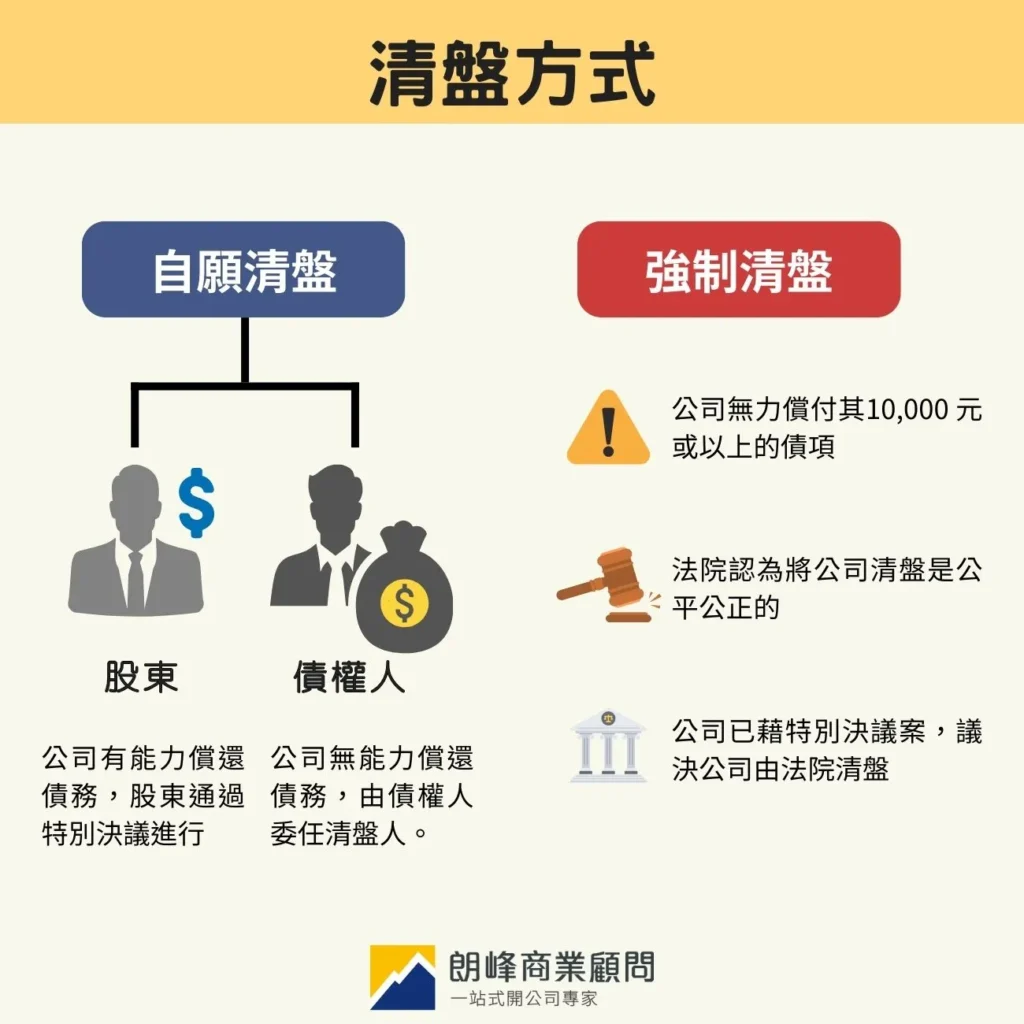

Liquidation of a Hong Kong limited company is a legal process of selling assets to pay debts and winding up a business. There are two main types of liquidation, namely voluntary liquidation by shareholders or creditors and compulsory liquidation by the court, which is a rigorous process and requires directors to fulfil specific obligations.

What is a liquidation?

What is liquidation?

Liquidation is the process by which a limited company goes through legal proceedings to realise all its assets for the purpose of paying off its debts and eventually winding up the company and demobilising its business.

The main purpose of a winding up is to liquidate the company's assets, distribute them to creditors in accordance with legal priorities and then formally wind up the company.Liquidation can be in the form of voluntary winding up or compulsory winding up.

What are the types of companies to which the liquidation applies?

Liquidation is only applicable toCompanies Ordinance(A limited company incorporated under the Companies Ordinance (Cap. 622).

As a limited company is a separate legal entity, the debts and liabilities of the company are confined to the company itself and are not normally transferred to individuals.

What is the difference between liquidation and bankruptcy?

Liquidation and bankruptcy are two distinct concepts in the law, with different targets and procedures.

only iflimited companyOnly then can the liquidation process be carried out. A limited company is an independent legal entity with a legal status separate from that of the individual shareholders, and the assets and liabilities of the company are held and assumed in the name of the company. Therefore, if a company fails to pay its debts, the debts will normally be paid out of the company's assets and the shareholders will not be personally liable for the company's debts.

On the contrary.Unlimitedor partnershipAs the entire debt commitment isUnlimited ResponsibilityIf the debt cannot be settled, the application will eventually have to be made in the name of an individual.bankruptcyTackling the debt problem.

Ways to wind up a company: liquidation vs. deregistration of a company

| Project | liquidator | Deregistration of companies |

|---|---|---|

| Application | The company has debts or assets that need to be dealt with | The company is debt-free, asset-free and has ceased operations |

| Legal proceedings | More complicated, need to appoint a liquidator | Simple procedure and lower cost |

Deregistration of companiesSubject to certain conditions, including the company having ceased operation, having no outstanding debts, and the consent of all shareholders.

Liquidation

Voluntary winding up

Also known as "voluntary winding-up", it is a winding-up procedure initiated by the members of a company, usually by shareholders or creditors, and applies when the company is solvent or insolvent. The company must convene a general meeting and pass a special resolution to enter into liquidation. Voluntary liquidation can be subdivided into:

Voluntary liquidation of shareholders

When the company is able to pay its debts, the shareholders may pass a special resolution for voluntary winding up.This procedure is initiated by the directors of the company and requires the submission of a solvency certificate.

Voluntary liquidation of creditors

If the company becomes insolvent, the directors may propose a creditors' voluntary winding up.It is also triggered by a special resolution passed at a general meeting, but because of the company's insolvency, a meeting of creditors is required to be convened for the appointment of a liquidator by the creditors.

Compulsory Winding Up

Compulsory winding up is an action brought by creditors, shareholders or the company itself to seek the intervention of the High Court of the Hong Kong Special Administrative Region to order compulsory winding up when a company is insolvent but has not voluntarily commenced winding up.

Reasons for compulsory liquidation by the court

The Court may, on the basis ofCompanies (Winding Up and Miscellaneous Provisions) OrdinanceA limited company is wound up in one of the situations listed. The more common scenarios are:

- The Company is unable to pay its debts of $10,000 or more;

- the court is of the opinion that it is just and equitable to wind up the company; or

- The Company has resolved by Special Resolution that the Company be wound up by the Court.

Impact of compulsory winding-up

Upon the granting of a winding-up order by the court, the company will cease to operate, the powers of the directors will cease and the liquidator will take possession of the company's assets.All legal proceedings will be stayed unless leave is granted by the court.

Conditions under which a limited company may be wound up

Conditions of voluntary winding up of shareholders

- The accounts of the company shall be clear and complete;

- A special resolution shall be passed at a general meeting and agreed to by a majority of the Shareholders;

- The company itself has the ability to repay all its debts;

- A liquidator will need to be appointed to oversee and handle the liquidation from start to finish.

Conditions for voluntary creditors' liquidation

Company accounts need to be kept complete;

The Company is unable to settle all its debts and is no longer able to continue its operations;

A liquidator is appointed by the creditors to oversee and handle the entire liquidation process;

The liquidator must be a professionally qualified certified public accountant or solicitor.

Hong Kong Company Liquidation Procedures: Complete Procedure of Voluntary Liquidation

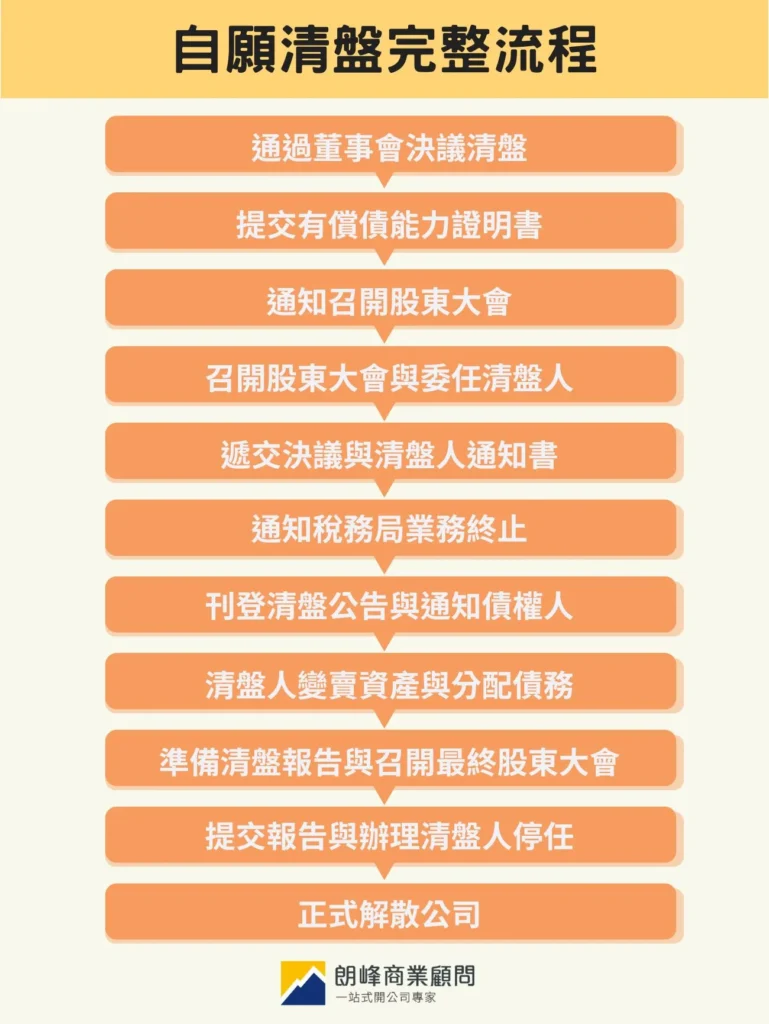

When a Hong Kong limited company decides to wind up its operations voluntarily and is in a position to pay off all its debts, it can do so through the process of "Shareholders' Voluntary Liquidation". The following are the 11 main steps in a voluntary winding up of a company by its shareholders:

Liquidation Procedure 1: Liquidation by resolution of the Board of Directors

The company must first convene a directors' meeting at which more than half of the directors pass a resolution that the company is capable of settling all its liabilities within 12 months of the commencement of the winding-up proceedings and proposes to go into voluntary liquidation. The directors are also required to sign a declaration of solvency document stating the date on which the company will commence liquidation proceedings and file it with the Registrar of Companies within 7 days from that date.

Liquidation Procedure 2: Filing of a Solvency Certificate

A statement of indebtedness signed by the directors must be filed with the Registrar of Companies, together with the accounting statements and balance sheet, certified by an authorised accountant. The statement must state that the directors believe that the company will be able to pay its debts in full within 12 months of the commencement of the winding up and state the date on which the statement is to be made. The declaration needs to be completed within 28 days before the general meeting and must be filed before the commencement of the liquidation.

Liquidation Procedure 3: Notice of General Meeting

The company is required to give notice of a general meeting at least 21 days before the commencement date of the liquidation. The notice must include a draft resolution for liquidation and information on the nomination of liquidators. If the company's articles of association provide otherwise, the notice should be given at the time specified in the articles.

Liquidation Procedure 4: Convening of General Meeting and Appointment of Liquidator

At the General Meeting, a special resolution (i.e. with not less than 75% Shareholders present in favour) will be passed by the Shareholders to approve the Voluntary Winding-up and a qualified liquidator (who must be a certified public accountant or solicitor) will be duly appointed to carry out the entire liquidation process.

Upon the formal appointment of a liquidator, all managerial powers of the directors of the Company shall cease immediately unless expressly authorised by the liquidator to continue in the exercise of the relevant powers. In addition, any transfer of shares which has not been approved or sanctioned by the liquidator or any alteration of the membership of the company shall be deemed to be void and of no legal effect from the date of commencement of the voluntary winding up.

Liquidation Procedure 5: Lodgement of Resolution and Liquidator's Notice

After a resolution has been passed at a general meeting, the resolution and the notice of appointment of liquidator must be lodged with the Registrar of Companies for registration within 15 days and must also be published in the Gazette as a formal notice.

Liquidation Procedure 6: Notifying the Inland Revenue that the business is terminated

The company is required to notify the Inland Revenue Department of Hong Kong in writing of the commencement of liquidation of the company and provide the contact information of the last business day and the liquidator to facilitate the subsequent handling of salaries tax, profits tax and other related settlement matters.

Liquidation Procedure 7: Publication of Liquidation Notice and Notification to Creditors

The company is required to publish a notice of commencement of liquidation in the Hong Kong Gazette and in newspapers, and to notify creditors that the company has entered into liquidation and invite them to report their claims to the liquidator. Publication of the notice should normally be completed within 14 days of the resolution.

Liquidation Procedure 8: Liquidator's Disposal of Assets and Distribution of Liabilities

After taking over the company, the liquidator will conduct a detailed inventory of the assets and liabilities, start selling the company's assets, and distribute the liquidated debts, including staff severance payments, taxes and other payables, in the order of priority stipulated by the law.

Liquidation Procedure 9: Preparation of Liquidation Report and Convening of Final General Meeting

Upon completion of the liquidation process, the liquidator is required to prepare a liquidation report detailing the disposal of assets, repayment of debts and the final balance, and to convene a final general meeting to report on the results of the liquidation.

Liquidation Procedure 10: Submission of Reports and Cessation of Office of the Liquidator

After the final general meeting, the liquidator is required to file a winding-up report with the Registrar of Companies within one week of the date of the final general meeting and to file his notice of cessation of office, formally terminating his duties as liquidator.

Liquidation Procedure 11: Formal Dissolution of the Company

The Registrar of Companies will announce the official dissolution of the company within 3 months after the submission of the report. At this time, the company's legal personality is terminated and all legal obligations end.

Compulsory Winding-up Procedures: A Detailed Explanation of the Compulsory Winding-up 6 Process

When a Hong Kong limited company becomes insolvent but does not go into voluntary liquidation, creditors, shareholders or the company itself may apply to the court for compulsory liquidation. This type of liquidation is enforced by the court after a hearing and order. Below are the six steps of compulsory liquidation:

Compulsory Winding-up Process 1: Issuance of Demand for Repayment of Debts to the Company

The creditor may first send a written Demand for Debt to the Company, requesting that the other party send a written Demand for Debt to the Company at the time the notice is sent.Date Count The debt will be repaid within 21 days. If the company fails to settle the debt within the time limit or refuses to acknowledge the debt, the creditors may file a winding-up petition with the Court.

Compulsory Liquidation Process 2: Presentation of Liquidation Petition to the Court

Creditors, shareholders or the company may present a petition to the court, the Official Receiver's Office and the company. Once a petition is presented, the company is considered to be in liquidation, during which time the company is prohibited from disposing of its assets and its bank accounts are usually frozen to protect creditors' interests.

Compulsory Liquidation Process 3: Court Schedules Hearing and Makes Liquidation Order

The Court will arrange for a hearing of the winding-up petition and assign a date. The petitioner is required to send a stamped copy of the petition to the Official Receiver's Office, the Chief Bailiff and the company's registered office respectively. Within 7 days of the hearing of the petition, the petitioner is also required to publish a notice of the winding up once in the Government Gazette and a notice in at least two local newspapers (one in Chinese and one in English) setting out the details of the petition and the arrangements for the hearing.

Compulsory Liquidation Process 4: Appointment of Liquidator and Convening of First Meeting of Creditors and Contributors

A compulsory winding-up order will be made if the Court determines after trial that the company is insolvent, or if other circumstances set out in the Companies (Winding-up and Miscellaneous Provisions) Ordinance are met, such as prolonged failure to operate, impairment of shareholders' interests or by special resolution of shareholders. The Company has since formally entered into statutory liquidation.

Upon the promulgation of the winding-up order.The petitioner will normally employA solicitor or professional accountant will be invited to act as the provisional liquidator, or if a provisional liquidator has not been appointed, the Official Receiver will act in his place. The liquidator will convene the first meeting of creditors and contributories within three months from the date of the winding-up order to deal with matters relating to the liquidation, including valuation of assets, examination of liabilities and planning of subsequent proceedings, and to allow creditors to vote on important matters.

Compulsory Liquidation Process 5: Disposal and Realisation of Company Assets

The liquidator will deal with the realisation of the company's assets and the settlement of costs and debts in order of priority. The order of priority is liquidation costs (e.g. solicitor's fees, court fees, administrative expenses) → preferential creditors → general unsecured creditors → interest on debts → distribution to shareholders. If the liquidator is of the opinion that the total value of the company's assets does not exceed HK$200,000, he/she may apply to the court for summary proceedings to reduce the cost of the proceedings and speed up the dissolution process.

Compulsory Winding-up Process 6: Liquidator's Application for Dissolution of Company after Completion of Duties

When all the assets of the company have been disposed of, the debts have been settled and the necessary investigations have been completed, the final amortisation, if any, has been paid and if there is no objection, the Court will grant a discharge to the Liquidator. The Liquidator will then file a "Certificate of Discharge of Liquidator" with the Companies Registry. After two years from the filing date of the Certificate, the Company will be formally dissolved according to the law.

What are the responsibilities of a director of a liquidated company?

The power to act as a director of a company ceases when a provisional liquidator is appointed or a winding-up order is made. However, directors are still subject to a range of obligations under the law, including:

- Deliver to the provisional liquidator or liquidator all assets, books of account, legal documents and the common seal of the Company.

- Appointments with the provisional liquidator or liquidator's office to provide information about the company's assets and transactions

- within 28 days from the date of appointment or the date of the winding-up order, file a sworn statement of the company's assets and liabilities (similar to a balance sheet), or file a supplementary affidavit as required

- Attendance at meetings of creditors and contributories on notice

- Continuously co-operating with the provisional liquidator or liquidator's investigation and handling throughout the liquidation process

- To take the initiative to notify the provisional liquidator or liquidator of any change of address

A director who fails to fulfil the above statutory duties, such as failing to keep or maintain accounting records in compliance with section 373(2) and (3) of the Companies Ordinance (Cap. 622) or failing to file a statement of affairs and supplementary affidavit in a timely manner, will be liable to prosecution and may be disqualified from holding office as a director of the company by a court order.

Liquidation FAQs Q&A

How long does it usually take to complete the liquidation process?

The time taken to complete the liquidation process varies depending on the type of liquidation and the complexity of the company. A voluntary winding-up usually takes 6 months to 1 year, and may be completed more quickly if the assets and liabilities are simple; or 1-2 years if the assets and liabilities are insolvent, or if complex asset realisations or legal disputes are involved. Compulsory liquidation usually takes 2-3 years from the filing of a winding-up petition to the dissolution of the company.

As the liquidation process involves a number of legal steps and submissions, which are often cumbersome and time-consuming, it is advisable to seek the assistance of a professional organisation to minimise the risk of errors and delays, and to enable the company to complete the dissolution process smoothly.

Company Liquidation Fee?

There are a number of costs involved in the winding up of a Hong Kong limited company, which vary according to the actual circumstances and type of proceedings (e.g. whether the court is involved, whether a provisional liquidator needs to be appointed, etc.). Below is a list of common costs:

Deposits from the Official Receiver's Office: HK$12,150 (to cover the administrative and basic expenses of the Official Receiver in carrying out the liquidation)

Court Costs: Approximately HK$$1,045 payable at the High Court Registry as costs of the underlying judicial proceedings for the lodging of the Liquidation Petition.

Appointment of Provisional Liquidator: HK$3,500 or above, depending on the complexity of the case and the time required, payable to the Official Receiver's Office.

Solicitors' fees: Depending on the circumstances of the case, covering services such as preparation of petitions, representation in court, etc.

Costs Risk: If the winding-up application is unsuccessful, the relevant litigation costs will be borne by the petitioner in an undetermined amount.

What can a company do before it goes into liquidation?

Liquidation is not the only way out for a company. There are still a number of strategies that a company can proactively adopt to try to improve its financial position or even avoid liquidation before the formal liquidation process begins:

Negotiation of repayment arrangements with creditors: The company may take the initiative to negotiate a repayment plan with its creditors, such as extending the repayment period or paying by instalments, in order to secure the withdrawal of the winding-up petition by the creditors.

Proposing a debt restructuring programme: Under section 674 of the Companies Ordinance (Cap. 622), a company may, through its solicitor or financial adviser, draw up a scheme of reorganisation, which may include adjusting the terms of its debts, waiving interest, restructuring its shares or effecting a transfer of assets. If the scheme is approved by the court and passed by a majority of creditors, it will be legally binding on all creditors.

Business Reorganisation and Resource Consolidation: The Company may review its internal structure, abolish loss-making departments and merge functional units to enhance operational efficiency and liquidity.

Securing external financing: If a company has the potential to be revitalised, it may take the initiative to seek investment or loans to inject capital into its operations and reduce debt pressure.

Disposal of assets or profitable operations: Liquidation of non-core assets or high value business units to raise funds for contingency or debt repayment.

By doing so, the Company has the opportunity to gradually resolve its financial difficulties and regain room to operate without entering into liquidation proceedings.

What should employees do if their company is wound up?

When a company goes into liquidation, the original employees will be deemed to beSenior CreditorsIn addition, the Company may make a claim against the Company for unpaid wages. Under Hong Kong law, the following are eligible for priority repayment:

wages arrears

Payment in lieu of notice (i.e. compensation for termination without notice)

severance payment

The above three items in totalPriority Repayment Limit of HK$18,000In addition, there is a shortfall in the payment of paid leave. In addition, the arrears of paid leave salaryNo upper limitIn addition, they can also be included in priority claims.

However, if an employee's entitlement exceeds the statutory limit, the excess will be deemed to beOrdinary unsecured debtsIn addition, the chance of repayment is relatively low as the liquidation proceeds will have to be distributed pro rata with other creditors.

Compulsory winding up can be initiatedIs a petition for the winding up of a company filed?

Yes, any of the company's creditors, shareholders, or the company itself can present a petition to wind up the company.

Hong Kong Professional Liquidation Services: Longford Business Consultants

If you want to save time, reduce complexity and seek professional assistance in completing the liquidation of your Hong Kong company, we are a reliable choice.

Since our establishment in 2014, we have assisted many clients in the successful liquidation of their companies, and are well recognised by our clients for our extensive experience and well-established processes. Our team upholds the highest standards in the industry to provide you with:

Professional and reliable service: From the preparation of documents, through the legal process, to government submissions, the entire process is handled with dedicated assistance to ensure accuracy.

Comprehensive one-stop programme: CulvertCancellation of Business RegistrationThe Inland Revenue Department has no objection to all aspects of the notice application and Companies Registry application.

Efficiency and Timeliness: Quick response and immediate reply to help you complete the cancellation process in the shortest possible time.

Whether you are a small or medium-sized business owner, or an individual entrepreneur, simply provide basic information and contact a Lafont business consultant today to help you complete your liquidation with ease, so you can focus on your future growth without worrying about the future!

Extended reading: "TheWhat is a company secretary? Definition, duties and conditions of appointment in one article》