Unlimited company tax filing cheat sheet: Master profit tax calculation, deductible items, tax filing process, and key reporting points in 5 minutes.

Unlimited companies are exempt from audit and only need to pay profits tax. Sole proprietorships fill out BIR60; partnerships fill out BIR52. If the turnover exceeds HKD 2 million, financial statements must be submitted together.

Summary of key points

- Tax rate benefits: Implement a two-tier profits tax system.

- The tax rate for the first HKD 2 million in profits is only 7.51%, and thereafter it is 15%.

- Tax forms are sent out around April each year and can be filed in paper or electronic form.

- Sole proprietorships fill out BIR60; partnerships fill out BIR52.

- Office rent, salaries, and other expenses are tax-deductible.

- Owner's salaries, personal expenses, and fines are not tax-deductible.

What taxes does an unlimited company need to pay? Key points on Hong Kong profits tax.

The tax arrangements for unlimited companies are relatively simple, mainly requiring the payment of profits tax, without the need to handle salaries tax or other corporate-level taxes.

However, when calculating the actual tax payable, it is still necessary to understand how to calculate "assessable profits" and the tiered rules of the "two-tier profits tax."

What are "assessable profits"?

Assessable profits refer to "total income of the company - deductible operating expenses = assessable profits."

The tax authority will calculate how much tax you need to pay based on this figure. Therefore, clearly distinguishing which expenses are deductible is the most important aspect when filing taxes.

Calculation method for the two-tier profits tax.

To alleviate the burden on small and medium-sized enterprises, Hong Kong implements a "two-tier system."profits tax」:

| Profit tiers. | tax rate | Calculation explanation. |

| First tier (first HKD 2 million). | 7.5% | Enjoy a half-price discount, resulting in a very low tax burden. |

| Second tier (the balance exceeding HKD 2 million). | 15% | Only the "excess portion" is calculated at the standard tax rate. |

For example: Suppose the company earned HK$250 million this year.

- First HK$2,000,000 × 7.5% = HK$150,000

- Remaining HK$500,000 × 15% = HK$75,000

- Total tax payable HK$150,000 + HK$75,000 = $225,000

Company tax filing time and actual process

Tax form issuance date and submission deadline

The Hong Kong Inland Revenue Department usually sends out the profits tax return in every year AprilOn the first working day (around April 1 or 2). After receiving the form, there is usually one month to fill it out and submit it.

For management convenience, the Inland Revenue Department categorizes the submission deadlines based on the company's "accounting year-end date":

| Code | Accounting year-end date range | Deadline after applying for an extension |

| Category N | April 1 – November 30 | No extension(Usually in early May) |

| Category D | December 1 – December 31 | Issued tax form by August 15 of that year |

| Category M | January 1 – March 31 | Issued tax form by November 15 of that year |

How to apply for an extension for submission?

Extensions do not take effect automatically. If you qualify for the above Class D or Class M and wish to have more preparation time, you can apply to the Inland Revenue Department.

The following are 2 application methods:

- Self-application: Submit an application to the tax bureau in writing.

- Block Extension: Conduct a collective application through a tax representative.

Declaration method: Paper vs Electronic tax filing

- Paper submission: Fill out the physical form, sign it, and mail it back to the tax bureau.

- Electronic tax filing (eTAX): Submit through the "Tax Easy" online platform.

Sole proprietors who file taxes online (fill out BIR60) can automatically enjoy an additional 1 monthgrace period (for example, N category deadlines can be extended from early May to early June).

Unlimited company tax filing requirements: Differences in form filling between sole proprietorship and partnership

Sole proprietorship: Key points for filling out BIR60

Sole proprietors will not receive a separate company tax return; they only need to combine the business information into the owner's personal "Individual Tax Return" (BIR60).

When filling out, note that the total income as defined by the tax bureau refers to "Total sales"That is, the income figure before any costs and expenses are deducted. Please do not mistakenly fill it in as the "net profit" after deducting costs, to avoid failing to meet the requirement of "business turnover below HK$200 million exempt from submitting financial statements," which may trigger subsequent audits.

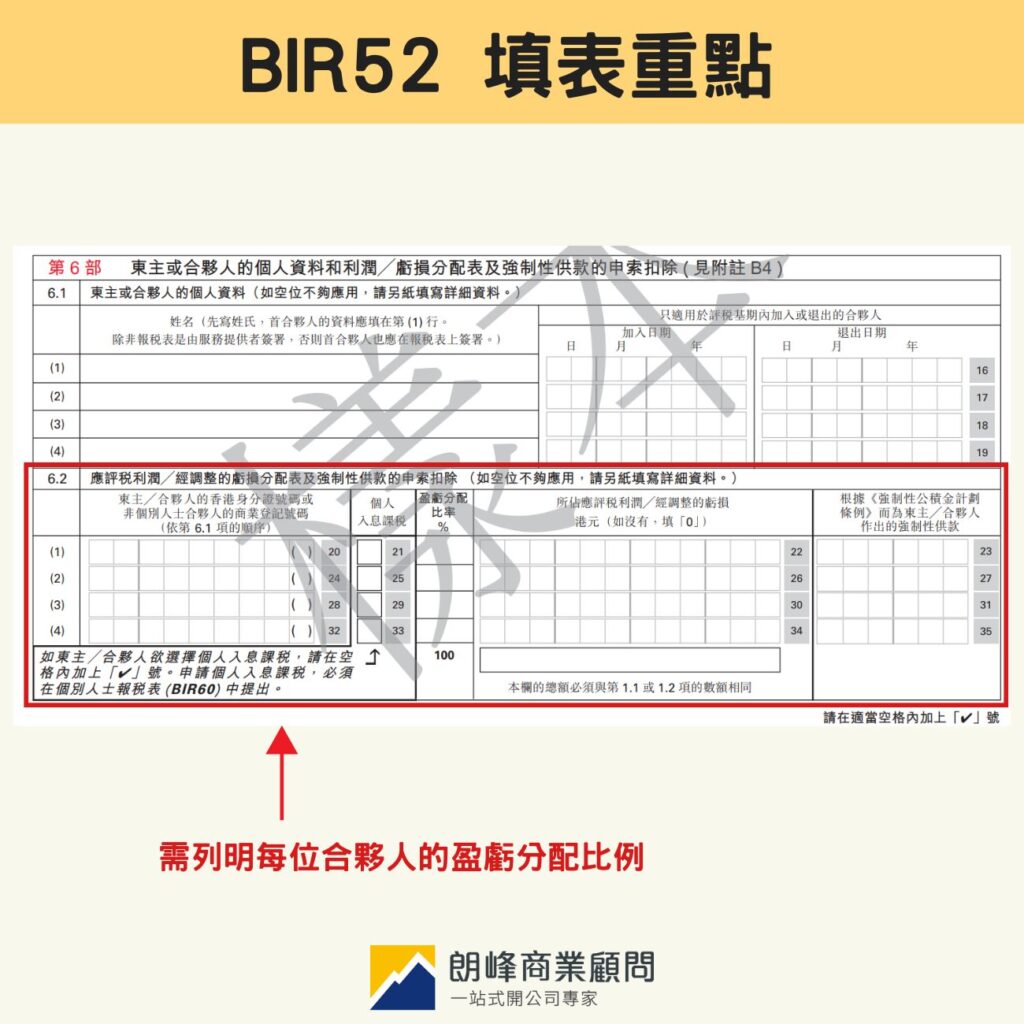

Partnership: BIR52 Key Points for Filling Out the Form

Partnership businesses will receive a separate "Profits Tax Return" (BIR52). This form is specifically for reporting the overall profits and losses of the company, separate from the individual tax returns of the partners.

Special attention should be paid when filling out "Partner Salaries" regarding tax treatment. According to tax regulations, salaries or capital interest received by partners are considered part of profit distribution,and cannot be deducted as company expenses. If the amount has already been listed as an expense in the company's accounts, it must be "added back" to the taxable profits when filing, otherwise it will constitute underreporting of profits.

To more intuitively see the differences in filling out the forms, we have organized a comparison table for your reference:

| Comparison items | Sole Proprietorship | Partnership |

| Filling Out the Form | BIR60 (Individual Tax Return) | BIR52 (Profits Tax Return) |

| Filling Location | In the form's "Section 5" | Entire Form |

| Signatory | Owner himself | First partner |

| Declaration highlights | Fill in "Total Income" and "Net Profit / Loss" | Must specifyThe profit and loss distribution ratio for each partner |

| Multiple businesses | If there are multiple sole proprietorships, they must be listed on the same formListed separatelyIndividual data | Each partnership is an independent entity and mustFill out individuallyOne BIR52 |

| Follow-up actions | Submission of the form completes the process | Partners still need to declare the profits received in their personal BIR60 |

What documents are needed for unlimited company tax filing?

Before filing taxes for an unlimited company, please ensure the following information is prepared (even if not required to be attached to the form, it should be kept on file for reference):

- Balance sheet(Display the company's assets and liabilities status)

- Income Statement(Display the company's income and expenses)

- All sales and income documents(Invoices, receipts, contracts)

- All expense documents(Lease agreements, purchase orders, miscellaneous expense documents)

- Monthly Bank Statement

- Mandatory Provident Fund (MPF) contribution records

How to legally save on taxes? Overview of deductible expenses for unlimited companies

Types of deductible expenses (business-related)

Generally, any necessary expenses directly related to the business and incurred to generate profit are considered deductible items:

- Office rent, rates, management fees

- Employee salaries, allowances, bonuses

- Employer contributions to the Mandatory Provident Fund (MPF) for employees

- Cost of purchasing goods or raw materials

- Utilities, telephone bills, internet fees (must be proven for business use)

- Repair costs for machinery and equipment

- Accountant fees or other professional service fees

Non-deductible items (owner's salary, personal expenses, fines)

Many new entrepreneurs often mistakenly believe that all expenses are deductible, but in fact, according to tax regulations, the following items cannot be deducted:

- Owner or partner's own salary

- Owner or partner's personal expenses (such as household utilities, personal dining)

- Traffic fines or illegal fines

- Transportation costs between home and workplace

Longfeng Business reminds you: pay attention to these when filling out the profits tax return!

Common filling errors

Based on Longfeng's years of practical experience, improper filling of the tax return may lead to the tax office returning it or triggering an audit; please pay attention to the following common errors when filling out the form:

- Missing signature: This is the most common reason for return.

- Incorrect total income: Mistakenly filling "net profit" in the "total income" field (total income should be turnover).

- Not checking "declare in this section": Forgetting to tick in Part 5 of BIR60.

- Inconsistent data: The numbers on the tax return do not match the company's internal accounts.

In what situations is it advisable to seek a professional accountant or tax advisor?

Although self-declaration is feasible, when the company's turnover approaches or exceeds HK$2 million, the tax office's requirements for financial statements will be stricter; it is more reassuring to leave it to professionals at this time.

If you wish to legally reduce taxes but are unclear about the methods, or if you suddenly receive an inquiry letter from the tax office and feel overwhelmed, seeking professional assistance not only helps ensure compliance of accounts but also reduces the risk of tax disputes and penalties, which is ultimately more secure and cost-effective in the long run.

Frequently Asked Questions

Does a company that incurs losses still need to file taxes?

Even if the company incurs losses, it is still required to submit the profit tax return on time, and the related loss amount can be carried forward to future years to offset future taxable profits.

Can I not file taxes if there is no business activity or zero income?

As long as you receive the tax return form, you must complete and return it by the deadline. If there are no business activities, you can fill in "0" on the form or declare that you have not yet started your business.

What are the penalties for late submission of tax returns?

The tax bureau is quite strict about late submission of tax returns, and may impose late fees or fines, as well as issue estimated assessments that exceed the actual tax amount. Prolonged delays may even affect the company's credit.

How to check the tax filing status or submit additional documents?

You can check the tax filing progress or request for additional documents through the online electronic service (eTAX) of the tax bureau or by calling.

Which unlimited company owners are suitable for considering personal income tax?

If the owner of a limited company has other income or heavier family burdens, they may consider adopting Personal Assessment, which may be more cost-effective than the standard tax rate. It is recommended to consult a professional for a comparative calculation.

Say goodbye to complicated tax forms and account handling | Leave the tax filing for unlimited companies to the Longfeng Business Consulting Team

Facing cumbersome tax regulations, you need a trustworthy professional partner.Langfeng Business ConsultancyFocusing on unlimited company tax filing services, we will assist you in organizing accounts, comprehensively reviewing deductible items, ensuring compliance in declarations, and maximizing benefits. This allows you to focus on business development without worries, entrusting tedious administrative work to us.

Extended reading: "TheWhat does Hong Kong tax filing service include? Understand the company tax filing process, fee standards, and actual benefits in one article.》