What is a credit rating? A detailed explanation of Hong Kong TU ratings, influences, how to check credit reports, and key ways to improve scores.

Credit ratings are an important basis for banks to assess lending risks, calculated by TransUnion (TU) and divided into grades A–J. The score will affect loan interest rates, mortgage approvals, and immigration reviews, and can be queried through official or bank channels.

Summary of key points

- The score ranges from 1,000 to 4,000 points and is divided into levels A to J.

- The higher the rating, the lower the loan interest rate, and the greater the chances of mortgage and loan approval.

- Late repayments, high credit utilization, and frequent loans in a short period will lower the score.

- Credit ratings can be checked through TransUnion's official website or banking/financial apps.

- If you find an error in your credit report, you should promptly apply for a correction with TransUnion.

What is a credit rating? Interpreting the core indicators of the TU report.

Definition of credit rating.

A credit rating (Credit Rating, commonly known as TU rating) is a score calculated based on an individual's credit history, ranging from 1,000 to 4,000 points, reflecting the person's financial habits and credit status.

In Hong Kong, the credit database is mainly managed byTransUnion Limited.(TransUnion). When the public applies for credit cards, loans, or mortgages, financial institutions will request this TU reportto assess lending risks. A higher score indicates better credit quality and lower default risk.

Who will check your credit rating?

Besides yourself, the following organizations may conduct checks after obtaining authorization:

- Banks and financial companies: This is a necessary review step when approving credit cards, mortgages, and personal loans.

- Employers: Financial institutions, law enforcement agencies, or sensitive industries like jewelry may check during recruitment to ensure the applicant's financial stability.

- Leasing agencies or landlords: Used to assess whether tenants have the ability to pay rent on time.

- Immigration Bureau: Some countries (such as the UK, Australia, Canada) require applicants to provide a credit report from their home country when approving visa or immigration applications.

Credit Rating Level Table (A–J)

Credit Union divides credit scores into 10 levels from A to J:

| Rating | Score Range | Credit Status | General Attitude of Banks |

| A | 3,526 – 4,000 | Excellent | Usually enjoys the lowest actual annual percentage rate (APR) across the board. |

| B | 3,417 – 3,525 | Good | Interest rates are generally quite favorable. |

| C | 3,240 – 3,416 | Average | Approval chances are high, but the interest rate may not be the most favorable option. |

| D – F | 2,883 – 3,239 | Average | Requires strict review, higher interest rates, or may have loan amounts reduced. |

| G – H | 2,505 – 2,882 | Poor (high risk) | Banks are highly likely to reject applications or only approve loans with extremely high interest rates. |

| I – J | 1,000 – 2,504 | Near bankruptcy / Bankrupt | Basically unable to apply for any mainstream bank loans or credit cards. |

What impact does credit score have?

Credit ratingIt is not just a number; it has concrete effects on real life and financial costs:

- Significant differences in borrowing costs: When an A-rated and an H-rated person apply for the same personal loan, the actual annual percentage rate (APR) may differ by over 10%. For large loans, interest expenses may differ by tens of thousands.

- Mortgage application threshold: If the rating is too low (e.g., below F), banks may require additional guarantors or even directly reject the mortgage application, which will directly affect property acquisition plans.

- Job seeking and immigration review: Poor credit records may become obstacles to entering certain industries or moving abroad.

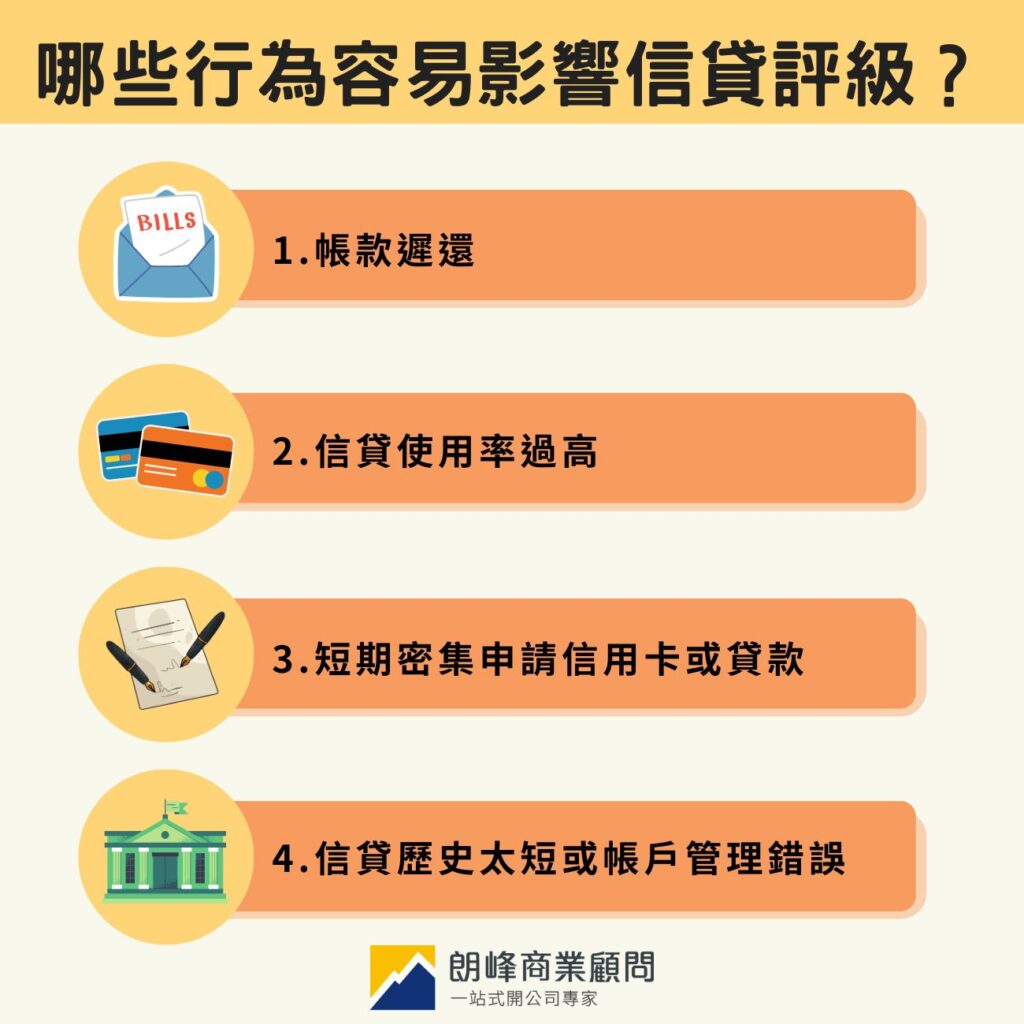

What behaviors are likely to affect credit ratings?

Late payment

Credit scores are most easily affected by repayment records. If you frequently delay payments or fail to meet the minimum payment, these records will be reported to TransUnion, and continuous accumulation will significantly lower your score.

High credit utilization

"Credit utilization" refers to the ratio of the credit amount used to the total credit limit. Even if you make timely payments each month, if the utilization rate is too high for a long time (close to 100%), the system will determine that there is greater financial pressure. It is generally recommended to maintain it below 30% to 50%.

Short-term intensive applications

Each time you apply for a credit card or loan with a bank, the bank will conduct a "hard inquiry" with TransUnion. If multiple inquiries occur in a short period, the system may interpret this as an increase in financial pressure, leading to a decline in credit scores.

Credit history too short or account management errors

Having a credit card that has been used for many years and maintaining a good repayment record is more helpful in building a high score than having no borrowing record at all (commonly known as Clean Credit). A lack of credit history makes it difficult for banks to fully assess risk, resulting in a generally lower score.

How do Hong Kong people check their credit records? Two main methods for credit rating inquiry

Method 1: Official inquiry from TransUnion

Obtaining an official inquiry is the way to get the most complete credit report. The public can subscribe to credit reports and monitoring services on the TransUnion website or mobile app.

- Features: The report is detailed, including past repayment records, inquiry records, and scoring trends.

- Cost: Usually requires a monthly fee (about HK$280, depending on current promotions).

Method 2: Banks or third-party financial apps

Some banks and financial platforms offer credit rating inquiry services, allowing for quick understanding of personal credit status.

- Features: Free, convenient, and fast, suitable for daily monitoring.

- Note:Data may be delayed or only provide partial indicators.

Want to improve your credit score? Avoid these pitfalls first.

Timely repayments and reducing credit utilization.

To avoid late payments, setting up autopay can help ensure timely repayments. If funds allow, it's best to pay off the full amount before the statement due date to avoid only paying the minimum payment, which may negatively impact your credit score.

Avoid excessive loan applications in a short period.

In the 3-6 months before formally applying for a mortgage or large loan, try to avoid applying for new credit cards or personal loans to reduce the record of "hard inquiries" and protect the stability of your credit rating.

Regularly check reports and correct erroneous information.

Credit reports can sometimes contain errors, such as canceled credit cards still showing as active or accounts being misused by others. It is recommended to regularly check your credit report, and if you find any anomalies, you should immediately contact TransUnion for corrections to avoid unnecessary score drops.

Frequently Asked Questions

What is considered a normal credit score for an average person?

Generally speaking, a C grade or above is considered a qualifying level, and most bank products can be applied for. If you can maintain an A or B grade, you will have a better chance of obtaining the best rates in the market.

Will checking my own credit rating result in a deduction of points?

No. Checking your report through TransUnion or the bank app is considered a "soft inquiry," and it will not affect your score regardless of how many times you check it.

How to correct data errors found in the credit report?

If you find any incorrect information, you need to contact TransUnion directly and provide relevant supporting documents (such as bank settlement proof). TransUnion will correct the information after verification, which usually takes a few weeks.

How long will negative records or bankruptcy information be retained in the report?

Generally, negative records are retained for 5-7 years, while bankruptcy information is retained for 8 years as per legal requirements, but specific details still depend on TransUnion and relevant laws.

Will canceling unused credit cards affect my credit score?

Canceling a credit card may slightly change the credit utilization ratio, but the impact on the credit rating is usually minimal; the focus remains on overall credit management.

Longfeng Business Consulting: Helping you avoid credit risks at critical points.

Credit ratings are an important basis for banks to assess the financial risks of individuals or businesses, affecting key decisions such as mortgage purchases, business financing, and immigration applications. Even occasional oversights can impact your score. It is recommended to regularly check your credit report, maintain a good repayment record, and keep a reasonable credit utilization ratio.

If you have questions about your credit situation or wish to plan for long-term finances,Langfeng Business Consultancythe team offers one-on-one consultations to help you grasp important financial milestones and maintain your credit history.