Comprehensive Audit Accounting: 4 Major Differences and Legal Key Points in Accounting and Auditing that Hong Kong Companies Must Know

Accounting is responsible for recording financial data; auditing is responsible for verifying reports. Hong Kong limited companies must complete these two processes every year. If not audited, they will face risks such as tax penalties, criminal liability for directors, and bank account freezes.

Summary of key points

- Accounting: Recording data and preparing statements

- Auditing: Verification of the authenticity of reports by a third party

- Limited companies must legally complete accounting and auditing every year, both are essential.

- Accounting and auditing should generally be performed by different personnel.

Confused between auditing and accounting?

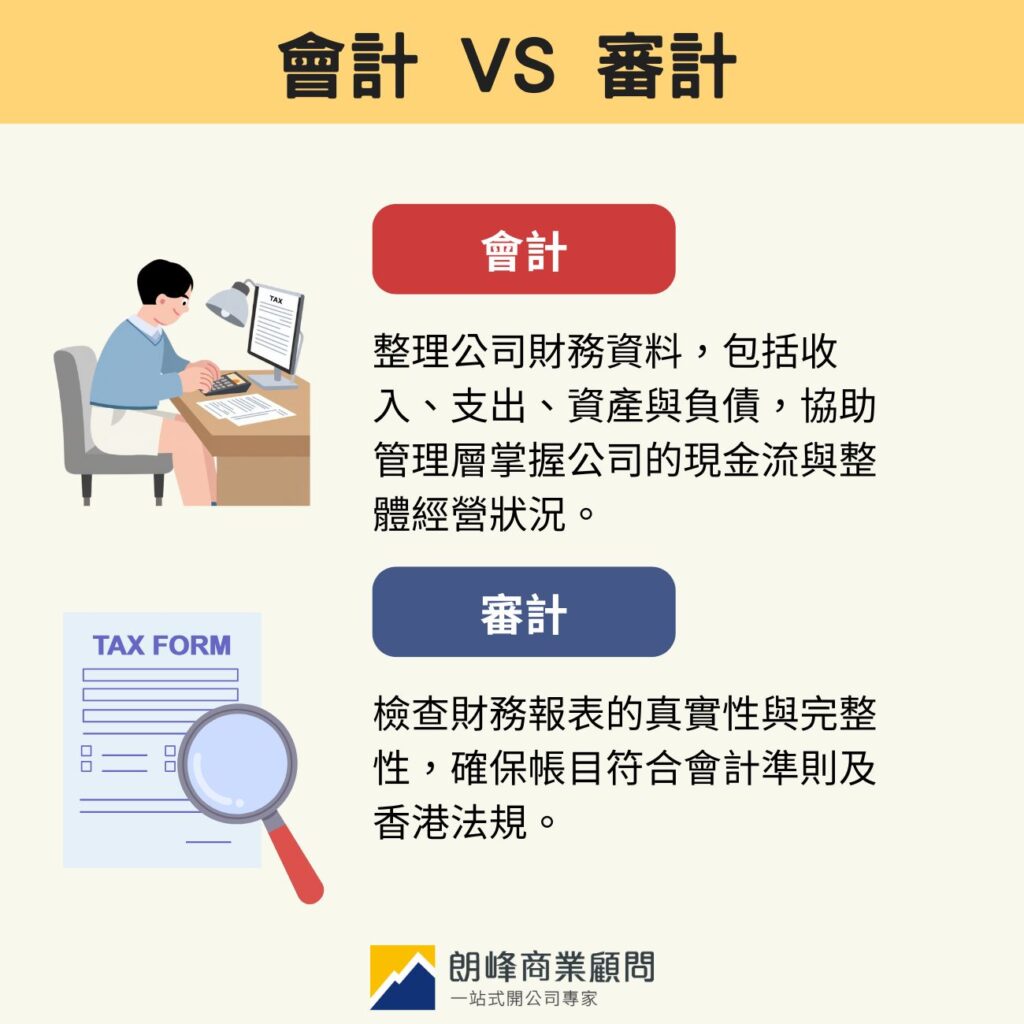

Accounting: The financial record keeper of the enterprise

Accountants are responsible for organizing the company's financial information, including income, expenses, assets, and liabilities, such as invoices, receipts, and bank transaction records. Accountants integrate these scattered data into complete financial statements, such as balance sheets and income statements, helping management clearly understand the company's cash flow and overall business situation.

Auditing: The inspector of financial statements

The main responsibility of auditing (commonly known as auditing) is to check the authenticity and completeness of financial statements, ensuring that accounts comply with accounting standards and Hong Kong regulations. Auditors issue a legally binding "auditor's report" based on the audit results, giving shareholders, banks, and investors confidence in the company's financial status.

Do Hong Kong companies have to do both auditing and accounting?

According to the Hong KongCompanies OrdinanceThe regulations state that the annual financial statements of limited companies must be audited. If only accounting is done without auditing, this report is considered an "internal company document" in the eyes of the tax bureau and banks, lacking credibility and legal effect.

Comparison of the four core differences between auditing and accounting

To help you better understand the differences between accounting and auditing, we have organized the following comparison table:

| Comparison items | Accounting | Auditing |

| Main functions | Recording and organizing financial data | Checking and verifying financial statements |

| Execution frequency | Continuity: Daily, monthly, or quarterly | Periodicity: Usually once a year (in line with tax filing) |

| Regulatory basis | Accounting standards | Company regulations, tax regulations |

| Output documents | Financial statements | Audit report |

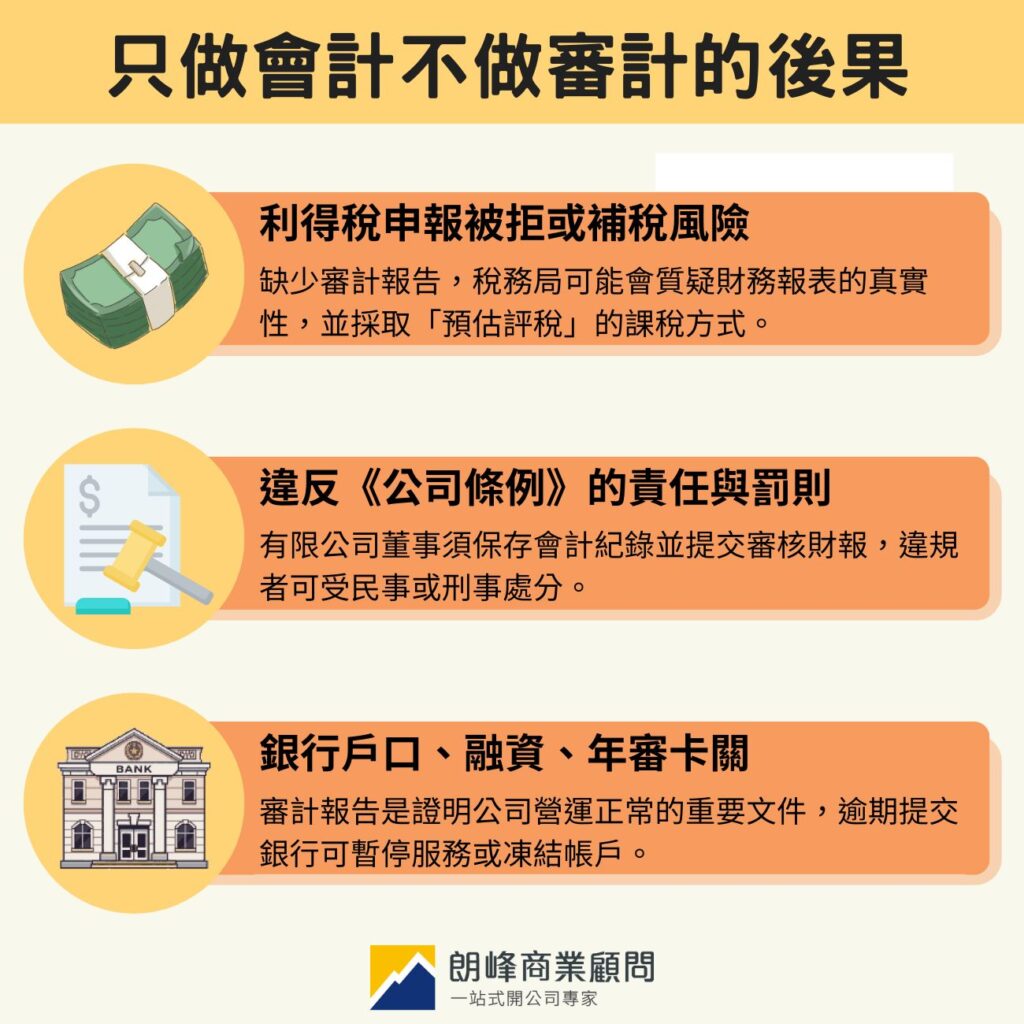

What are the consequences if only accounting is done and not auditing?

Tax aspect: Risk of profit tax declaration being rejected or additional tax

If a company only submits a tax return without an audit report, the tax authority may question the authenticity of the financial statements and adopt an "Estimated Assessment" method of taxation, which calculates the tax payable based on estimated profits, usually much higher than the company's actual earnings.

In addition, delaying the submission of tax returns or audit reports may also face a risk of fines up to three times the amount.

Legal aspect: Responsibilities and penalties for violating the Companies Ordinance

According to the Hong Kong Companies Ordinance, directors of a limited company have a statutory responsibility to properly maintain accounting records and submit audited financial statements at the annual general meeting.

Failure to comply with this requirement may result in civil fines for the company's directors, and in severe cases, even criminal liability.

Practical aspect: Bank accounts, financing, annual review bottlenecks

Based on anti-money laundering (AML) and customerDue diligence(KYC) regulatory requirements, banks must regularly update customers' financial information.

The audit report is an important document that proves the company's operations are normal. If it is not submitted on time, the bank has the right to take risk control measures, including suspending online banking services or even freezing or closing accounts.

Frequently Asked Questions

Can the same person do bookkeeping and auditing?

In principle, no. To ensure independence and compliance, accounting and auditing should be handled by different professionals.

How often is an audit conducted?

Usually once a year. Some large or listed companies may require semi-annual or quarterly internal audits.

What types of companies are required to undergo mandatory audits?

Any limited company registered under the Companies Ordinance must undergo a statutory audit every year. As for unlimited companies (such as sole proprietorships and partnerships), they only need to keep accounts for tax purposes and usually do not require an audit.

What does an audit report include?

It usually includes: auditor's report, balance sheet, income statement, statement of changes in equity, cash flow statement, and relevant accounting notes.

Can I conduct an internal audit myself?

Internal bookkeeping is allowed, but not for tax purposes. The law requires that it must be completed and signed by a third-party licensed auditor to have legal effect.

Want to reduce audit risks and time costs? Feel free to consult Langfeng Business Consultants.

Facing tedious bookkeeping and complex regulatory requirements,Langfeng Business Consultancyour team provides professional auditing and accounting services, from bookkeeping and financial statement verification to potential tax and banking risk assessments. We comprehensively ensure that the company is legal and compliant, helping you reduce operational risks and save time, allowing you to focus on driving the company's continuous growth.

Extended reading: "TheDo Hong Kong companies need to conduct audits? Understand the content, fees, and recommended audit firms in this article.》

Extended reading: "TheHong Kong Accounting Services Guide: Service content, process, fee standards, and precautions.》