Tax Returns for Employees] What is the difference between BIR56A and IR56B? Bring you to understand the tax responsibility to file correctly

It is the statutory responsibility of employers to file tax returns for their employees. They are required to submit the BIR56A Summary Table and IR56B Individual Remuneration Report on time, covering any employees with remuneration income, to avoid late penalties and legal risks and to ensure tax compliance.

What is an employer tax return?

The Employer's Return is a mandatory document for employers in Hong Kong to report to the Inland Revenue Department (IRD) every year on the salaries and pensions of their employees.

Employer's tax return including BIR56A and IR56B

Once the tax season arrives every year, apart from theprofits taxIn addition, the company will receive an Employer's Tax Return from the Inland Revenue Department (IRD), which consists of two common forms: BIR56A and IR56B.

- BIR56A: The concept of a master schedule allows companies to file a uniform return on what employees are subject to tax.

- IR56B: Detailed income report for each employee, including their salary, allowances, etc. for the year.

These two tax returns are in one set, and the Inland Revenue Department will ask you to return them together, so you should remember to submit both of them!

Employers are required to make timely returns

The Inland Revenue Department (IRD) requires completion and return within one month from the date of receipt, and you may choose to submit the form in paper form or by using the [ ] option.Tax Ease (eTAX)] Submit e-forms on the One-Stop Tax Payment website.

When will I receive my employer's tax return? What should I do if I don't receive it?

Normally, a company will receive a tax return from the Inland Revenue Department (IRD) in the first week of April each year. The IRD will send out the documents according to the registered address of the company, so as long as there is no change in the address of the company, it will not be missed in general.

However, in case you really haven't received it by mid-April, you can call IRD to enquire about it, fill in the application form, or log on to eTax to check it directly.

What will happen if I am late in filing my employer's tax return?

According to thetaxationOrdinance.in the event thatfirmsNo, it's not.在deadlines內submit (a report etc) BIR56A 及 IR56B, will face the problem of fines.

What is more troublesome is that once a company has a record of late payment, the Inland Revenue Department (IRD) may be more stringent in scrutinising the company in the future, and the tax risk will be relatively higher.

By submitting your tax return on time, you are not only complying with the law, but also avoiding unnecessary troubles in the future.

Does every company need to submit an employer's tax return?

That's right! As long as you are a legally established company in Hong Kong, you are required to file an Employer's Tax Return regardless of the size of your company.

Provisions relating to the Inland Revenue Ordinance

According to thetaxationThe Ordinance第49條及第52Clause.ownership在Mainland有employee的Employers.all haveResponsibility在Inland Revenue Departmentrequest的Time內submit (a report etc)related toemployeeremunerations的Returns.

All employees (including part-time employees, posted and seconded employees, retired employees)

在Fill in IR56B Time.enough人會considerOnly theFull-timeStaff才needInclusion.ActuallyNot!provided that該famous employee在該Tax Returnsyear (e.g. school year, fiscal year)packed withaccept the offerfirmsrelease的Remuneration.be going toincorporatereport (to the authorities)Scope.

這Included:

- Part-time employees (e.g. those who work only 2-3 days a week)

- Staff seconded/deployed from other departments or companies (even if the main employing unit is not our company)

- Former employees who have retired but are still in receipt of pension or consultancy payments

taxation局valueIt's.is or isn't有remunerationsincomesFrom you.Company".而非Staff的ContractNature.

company director

Even if the companyboard memberNo, it's not.officially僱傭Contract.As long as there's收Salary.taxation上就regarded as a "good"受僱persons".Similarlyneed向Inland Revenue DepartmentDeclaration!The tax liabilities of directors' remuneration are the same as those of ordinary employees and should not be omitted just because of their special status.

Beneficiary shareholders

「BenefitsShareholders" (beneficial owner)in general是雖未掛be known asboard member或High level.但PracticalOwnershipfirmspartShareholding,並Participationdividend或decision的People.in the event that有從firms領Salary,Bonus,Consultancy費或the restRemuneration.就needreport (to the authorities) IR56B.

Do companies without employees have to file tax returns?

If the company在該Tax Returnsyear (e.g. school year, fiscal year)whollyNo, it's not.employmentwhicheverStaff.theories上possiblerepliesInland Revenue Department「No, it's not.Employee".但This one.replies也Must be submitted BIR56A tabularofficiallyDeclaration.

That is to say, theEven if you don't need to submit IR56BIf you are a taxpayer, you will still need to return the BIR56A and mark "No taxpayer required" on the form.

What you need to know to file a tax return! Employer Tax Liability at a Glance

Tax liabilities include in-service, out-of-service and out-of-hong Kong situations. The following are the forms that need to be submitted according to each situation:

|

tabular |

use |

Deadline for submission |

Fill in the sample |

|

BIR56A / IR56B |

Annual remuneration declaration |

1 month after issue |

BIR56A / IR56B |

|

IR56E |

New staff declaration |

3 months after joining |

IR56E |

|

IR56F |

Imminent Departure Declaration |

1 month prior to departure |

IR56F |

|

IR56G |

Declaration of Absence from Hong Kong (Subject to Payroll Deduction) |

1 month before departure |

IR56G |

|

IR6036A / IR56M |

Declaration of Expenditure on Outsourced Labour/Commission |

Submitted at the same time as BIR56A |

IR6036B / IR56M |

What is the difference between IR56B and BIR56A? Both should be submitted!

IR56B vs. BIR56A

Although IR56B and BIR56A often appear together, they actually have different functions. IR56B reports the payroll information of each employee individually, while BIR56A reports the payroll of individual employees and is responsible for the consolidation of the company's master list of employees who are liable to file tax returns.

To put it simply, one IR56B is for one person and one BIR56A is for the whole company, so both are required.

IR56B Teaching and Learning

IR56B 是In response to "Theeach of位受employeeWork"fill in a form的IndividualTables.use forreport (to the authorities)該year (e.g. school year, fiscal year)的Remuneration,Allowances,Bonus等incomesInformation.in generaleach year(math.) linear (of degree one)Declaration.也likelihood因Departure或離港anotherSubmitted.

Documents required for IR56B

Prepare the basic information of your staff before filling in the form:

- Staff Information

- Marital Status and Spouse Information

- Employment

- Duration of Employment

- Total payroll

- Other Information

- Information on Housing Subsidies

Guide to Filing IR56B

RememberAccurateFill inEachColumn.Special是remunerationsPeriod,總incomes與holidayremunerations等欄Table of Contents.avoidance與firmsInternal出糧RecordsAppearanceIn and out.

The Inland Revenue Department (IRD) has also provided information on how to fill in the form. IR56B DemoReference.

Who can sign the IR56B form?

Form IR56B is usually signed and filed by the company's responsible person, authorised finance or human resources department.

BIR56A Teaching and Learning

BIR56A is usually issued by the Inland Revenue Department on its own initiative. If you do not receive it, you can make use of the "BIR56A" function.Request for employer's tax return on salaries and pensions"You can also call the IRD for more information or log on to eTax to view the application directly.

Information required for BIR56A

- Company Address and Contact Information

- Number of staff (total number of staff to be reported for IR56B)

- Name, position and date of signatory

- Attachment List of IR56B Forms

Guide to Filing BIR56A

Confirm that each employee with earnings is listed on the IR56B form and then sign the BIR56A and file it with the IR56B.

The Inland Revenue Department (IRD) has also provided information on how to fill in the form. BIR56A ModelReference.

What should I be aware of when filing tax returns for my employees?

Common Mistakes

Even experienced HR or employers may accidentally step on mines when handling tax returns, such as the following seven situations, which many people mistakenly think that there is no need to file a return:

- The Company has no employees

- No actual operation of the company

- The Company recorded a loss

- Company closure in progress

- Remuneration to persons other than employees

- Remuneration of directors as directors, not as employees

- Employees are part-time in nature

In fact, all of the above situations require tax returns.Error有時Looks like it.Not much.但if年Repeat.Inland Revenue Department會Considerationfirmssystem (e.g. political, adminstrative etc)be out of keeping withRules.likelihoodImpactin the futuretaxationReview.

Points of Attention

- BIR56A form must be completed and returned within one month of issue.

- Must maintain at least 7 years of employee payroll details

- Personal data and total remuneration should be checked with the staff before submission.

- Retain 2 copies of Form IR56B (one copy to be used as a voucher for the company's employee tax return expenses and the other copy to be issued to the employee for work records and personal tax filing purposes).

- Even if the employee has left the company, he is still required to file an employee tax return and send a copy of the IR56B form to his address.

What will happen if the company does not help employees to file tax returns? Both the employer and the employee are in trouble!

employers

When a company fails to file tax returns for its employees, there are two scenarios: if the Inland Revenue Department (IRD) determines that the failure to file is due to negligence, it may be subject to a fixed penalty; but if the IRD determines that the failure is deliberate, it is possible that criminal liability may be involved.

employee

當firms沒幫StaffTax Returns.taxation局likelihoodultimateI don't know.This one.人有Revenue.all rightthe employee himself or herselfNo.ActiveTax Returns.equal toBoth sidesNot even.交Information.in the future一Find out.I will.It's a "yes".evade (paying tax)Tax"Processing!

Employee needsSupplementary report,補Taxes.I'll have to.交Fines.FutureLoan,Migration,creditRecordsmetropolis有Impact.

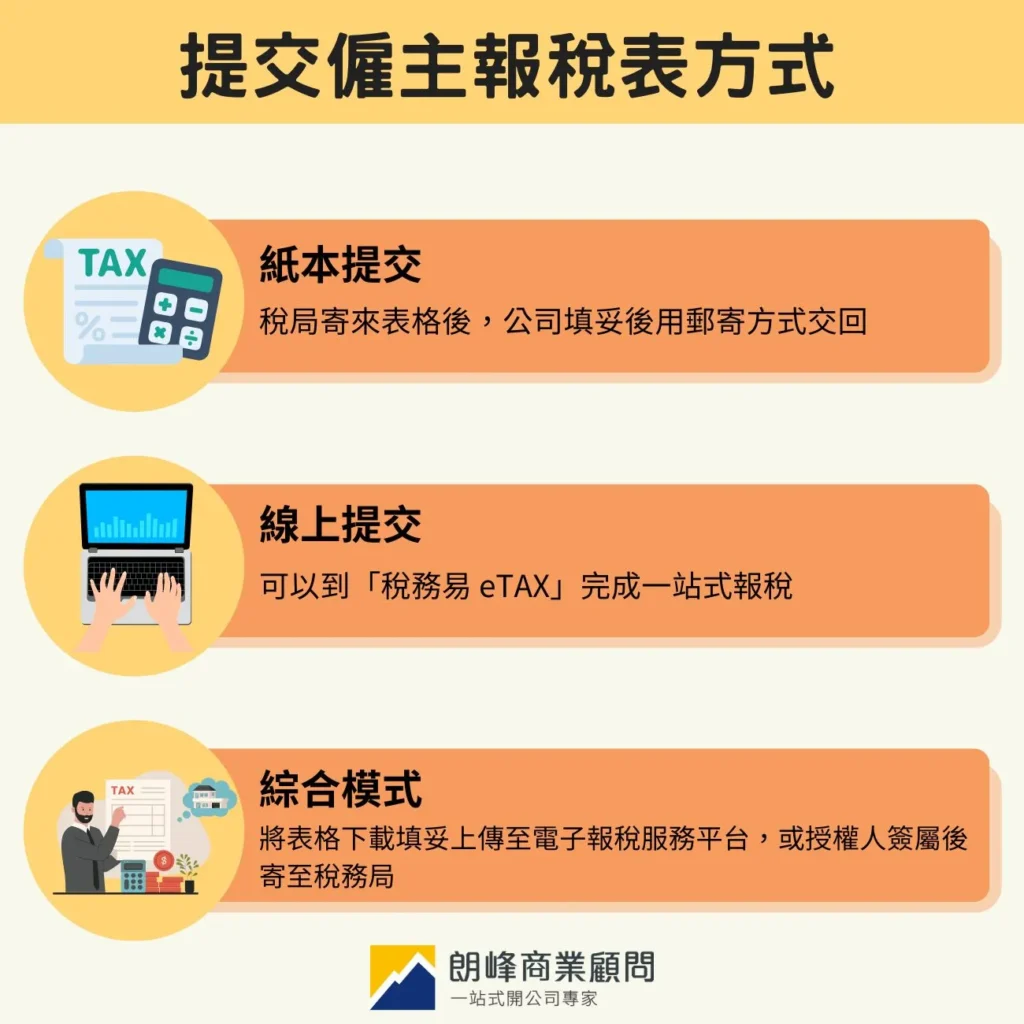

How to file your employer's tax return, 3 ways to find out!

Paper Submission

This is最Traditional的Way.Inland Revenue Departmentsend it to metabularLater.firms填妥後用Mailway (of life)Hand it back.in the event that你firmsScaleNot great,人Not much,No.用electronicSystem.That's it.Paper本交表是最Simpledirect的Way.

butbe carefulMailneedreserveTime.遲交I'll do the same.Penalty.

Submit Online

Available online at eTAXFill in the form,上傳No more printing, signing, mailing, etc. Eliminate the need for printing, signing and mailing, and get instant confirmation of your submission.Suitablemost中minor worksEnterprisesUse.

Integrated Mode

Employers do not need to use an authorised signatory's TaxSmart or SmartEase+ account to assign any employee or agent to generate the data file through the following tools:

- IR56B Form Preparation Tool: Free software provided by the Inland Revenue Department for completing employer tax returns.

- Customised software approved by the Inland Revenue Department (IRD): Programmes designed by the employer and approved by IRD.

After uploading the information file to the employer's electronic tax filing service platform, the system will generate a text checklist (cover page), which can be mailed to the Inland Revenue Department to complete the return after the person in charge or agent has signed the form by hand.

Employer's Tax Return Frequently Asked Questions

How long do I have to keep the data records?

Under the Inland Revenue Ordinance, companies are required to retain information relating to tax returns for at least seven years, including payroll records, copies of tax returns, payroll vouchers, and so on.

Can an employer's tax return be deferred?

Yes! However, you must apply to the Inland Revenue Department (IRD) for an extension of time before the deadline and state the reasons for the extension. If you fail to apply and submit the form late, it will be regarded as an offence and you will be fined.

Can I change the wrong information after submitting?

Yes! If an error is found, you should submit a corrected form (e.g. a revised version of IR56B) to the Inland Revenue Department (IRD) as soon as possible, instead of just making random verbal changes or supplementing the letter with explanatory notes.

Do I need to file an employer's tax return for the expenses of outsourced workers?

Required! When a company has paid remuneration to an informal employee, e.g. freelancer/self-employed person, outsourced contractor, etc., during a tax year, a separate return called IR56M is required to be filed.

This form is used to report to the Inland Revenue Department (IRD) income from commissions, consultancy fees, one-off remuneration, etc. paid by the company to non-employees, and is different from the IR56B used by employees in general.

In principle, any person who does not have a formal employment relationship with the company, but provides services and receives remuneration, is covered by the IR56M.

Can only the person in charge of the company sign the employer's tax return?

Not necessarily, as long as the accountant or executive is authorised to sign the statement, he or she can sign it, but it is necessary to ensure that the signatory has substantive understanding and authorisation of the contents.

Conclusion

Filing tax returns for employees may seem simple, but employers often miss or make mistakes. By submitting the returns on time and ensuring that the information is correct, you can fulfil your responsibility as an employer to file tax returns and avoid penalties and unnecessary tax risks.

Hong Kong Professional Tax Returns Agent Service: Longford Business Consultants

幫StaffTax Returnsseeminglymerely交Table.In practice卻involvedignityClassification,tabularMatching,stopping point日控管等Details.對not fewsmall and medium-sized企In other words.報錯One IR56B.orforget交 IR56M.都suffertaxation局Tracing.so much so thatPenalty!

We are familiar with the corporate tax filing process and can assist with employer tax returns, self-employed tax returns and other tax related matters. Whether you are a new business start-up or an enterprise in need of a systematic tax filing process, you can contact Longfeng to get the support of professional accountants to file tax returns in a secure and time-saving manner.