Why do banks freeze accounts? 5 Common Reasons for Blocking Accounts and How to Prevent It

What should I do if my bank account is suddenly frozen? Can it be unblocked? What are the preventive measures? As a platform for managing public funds, banks not only have to ensure the safety of customers' assets, but also have the important responsibility of stabilising the financial system and combating money laundering. In this article, we have compiled a list of common reasons for freezing bank accounts, as well as precautionary measures to prevent bank freezing.

Definition of frozen bank account

A bank account freeze is an action taken by a bank to temporarily restrict or completely prohibit a customer from using his/her bank account for specific reasons. This means that the account holder is unable to make deposits, withdrawals, transfers and other financial transactions through the bank.

Freezing an account can cause a lot of inconvenience to both individuals and companies, affecting normal operations and possibly negatively affecting credit history and leading to financial losses.

5 Reasons for Freezing Bank Accounts

For the company.Bank AccountFreezing your bank account is a very serious problem, and the bank will not freeze your account for no reason. The following are the most common reasons for freezing your bank account:

Accounts left unused for a long time

If there is no transaction activity in an account for a long period of time, the bank may consider it suspicious and take temporary suspension measures to prevent fraud and maintain account security.

If this is the reason for the account being frozen, in fact, it only restricts counterless transaction activities, for example, depositing or withdrawing money in person at a bank counter is still not affected.

If you encounter the above situation, you can usually unblock your account if you bring along your identity documents and take the initiative to update your information at the bank. Of course, the best way to avoid this situation is to keep the account frequently used.

Suspected money laundering or criminal activities

If a bank discovers suspicious money movements, money laundering activities, or links to known criminal behaviour, they are obliged to freeze the relevant account.

However, under the procedure of freezing accounts, banks will call their clients to verify the situation. If the client fails to provide reasonable explanations and supporting documents to explain that the funds are not involved in money laundering activities, then the bank will freeze the account.

Unusually Large Transactions or Movement of Funds

Unusually large transactions or movements of funds may also trigger the bank's alert system, particularly in the case ofAnti-Money Laundering (AML)Under Procedure.

Typically this includes sudden large transaction amounts, movement of funds with other suspicious or black money accounts, or inconsistencies with a customer's past transaction patterns that may raise suspicion at the bank.

Account usage does not match with the declared documents

When opening an account, the bank will require the customer to perform a KYC (Know Your Customer)Please fill in the purpose of the account opening, e.g. savings or investment.

If an account declared for personal use suddenly has a large number of business transactions, the bank may consider this a breach of the agreement made at the time of account opening.

Violation of Bank Policies

Each bank has specific policies and regulations. If a customer's account violates these policies, the bank has the right to take appropriate measures, including freezing the bank account.

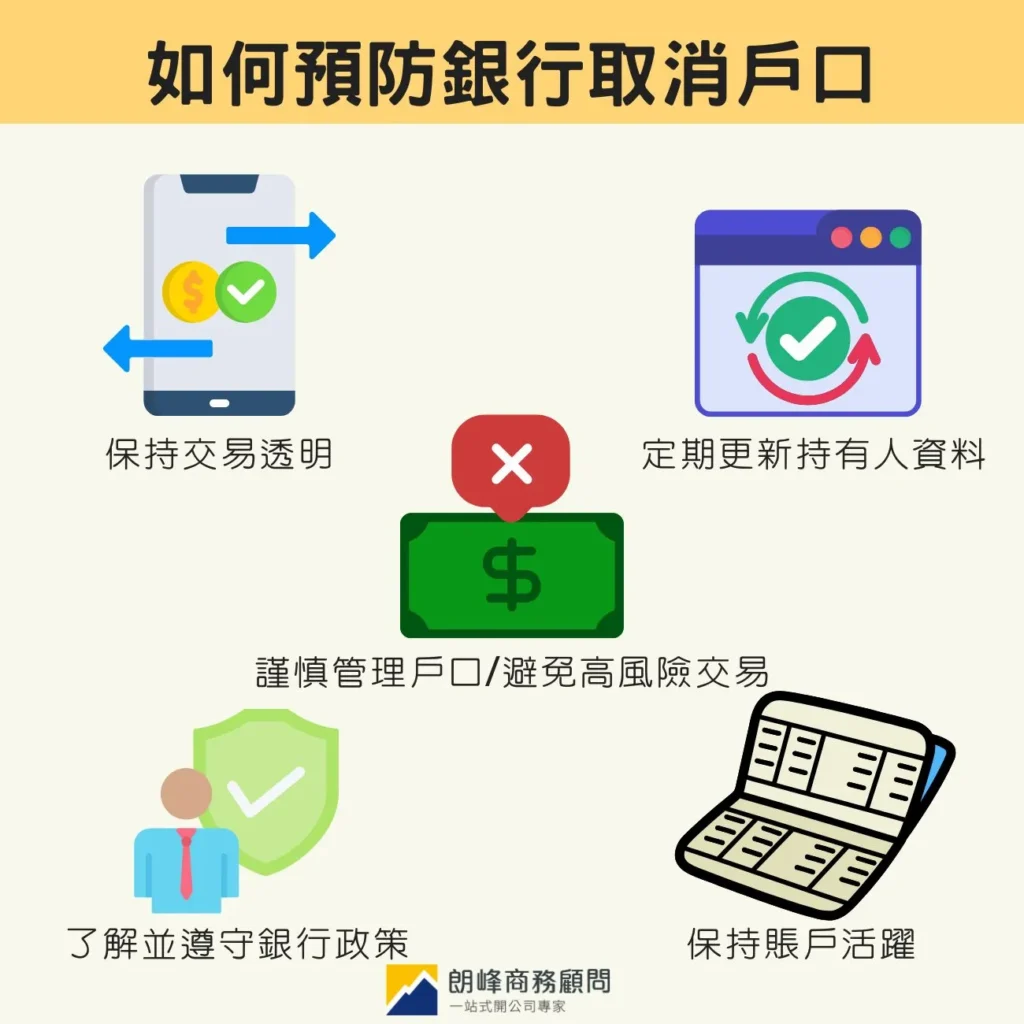

How can I prevent my bank from cancelling my account?

Transparency of transactions

Transparency of transactions is the first and foremost strategy to prevent account cancellation by banks. Especially when making large transactions, make sure you have proof of legitimacy and documentation of the source of funds. These practices will help you to respond to possible enquiries from the bank and will also enhance the bank's trust in you.

If you receive a large remittance, it is advisable to keep the relevant contract, invoice or other supporting documents so that you can explain the source of funds to the bank if necessary. Also avoid any suspicious or unclear transactions.

Regular Updates of Holder Information

Regularly check and update registration information, includingAddress,Phone numbers and emails ensure that the bank can contact you in a timely manner when needed. This not only helps to avoid account freezes due to lack of contact, but also enhances communication with your bank.

Keep your account active

Regular use of an account for reasonable transaction activity can prevent it from being viewed as suspicious by banks for prolonged inactivity, as banks often apply additional scrutiny to accounts that have been inactive for a long period of time.

Understand and comply with bank policies

Fully understand and comply with the policies of the bank you use. Each bank has specific rules and requirements, and familiarising yourself with these policies can help you avoid inadvertent breaches. If your bank raises questions about your account or transactions, respond quickly and honestly.

Good communication can resolve many potential problems and avoid unnecessary freezes caused by misunderstandings. Banks also want to maintain a good relationship with their customers, and positive co-operation is beneficial to maintaining account security.

Prudent Account Management and Avoidance of High-Risk Transactions

Prudence in account management is directly related to account security. Never lend or resell your bank account to others, as this may result in your account being used for illegal activities and eventually closed by the bank.

Banks send out monthly statements to their customers on a regular basis. It is important to review your statement each month and look out for any unusual transactions and avoid engaging in any high-risk or suspicious transactions, including obvious illegal activities and those unusual patterns of transactions that may arouse the bank's suspicion.

Frequently Asked Questions

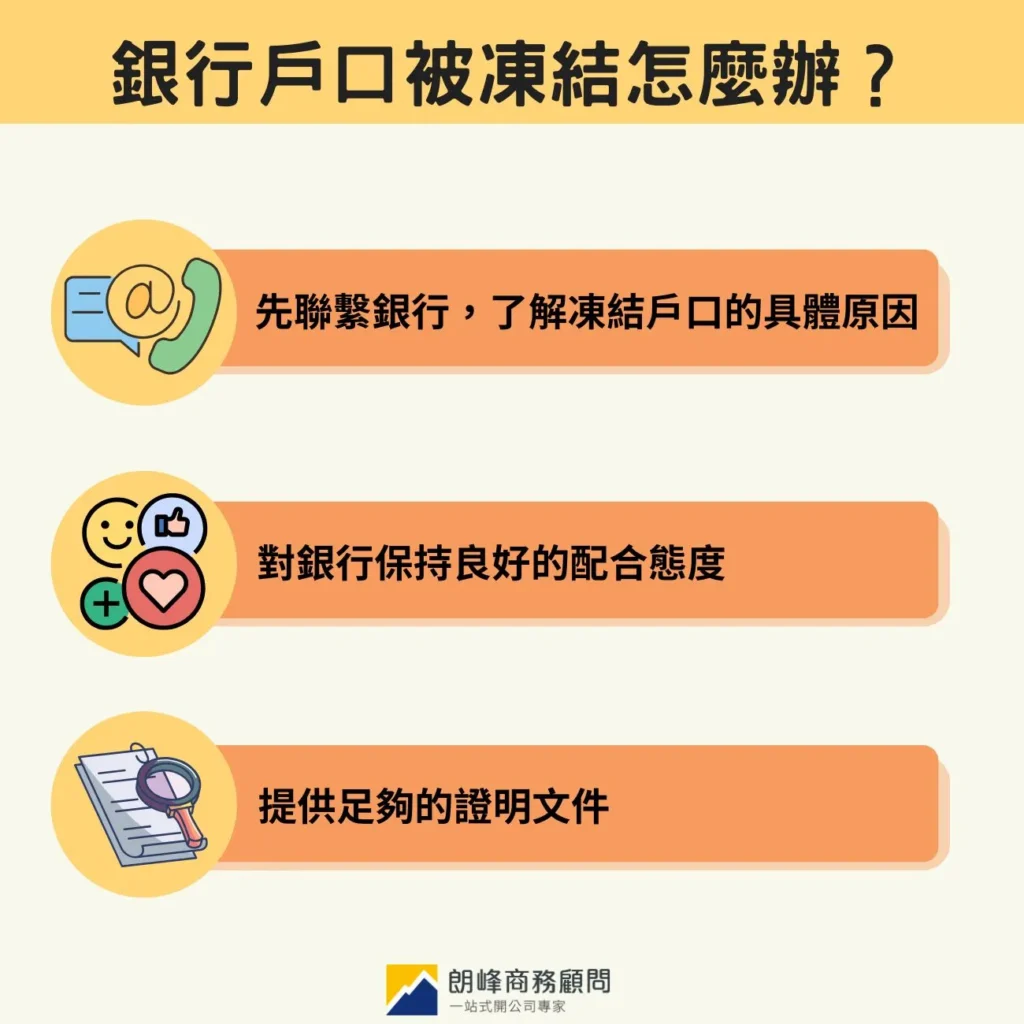

What can I do if my bank account is frozen? Can it be unblocked?

You should first contact your bank to find out the specific reasons for freezing your account.

The bank may ask you to provide some additional documents or explain certain transactions. It is important to be patient and courteous with the bank at this time, and a good co-operative attitude will help you to resolve the issue more quickly. In addition, if anti-money laundering is involved, every bank has its ownbackwashingThe suggestion is to co-operate as much as possible with the banks in their investigations, in terms of money laundering measures and due diligence systems.

The possibility of unblocking exists, but it depends on the cause of the freeze and the proof you can provide. If the freeze is caused by identity verification problems or unusual transactions, as long as you can provide sufficient supporting documents, there is a good chance of unblocking. However, if it involves serious irregularities or suspected offences, it may be more difficult or even require legal assistance.

Can I re-open my account after it has been cancelled by the bank?

The answer to this question is not a simple yes or no. If your account has been cancelled by the bank, reopening it does become difficult, but not completely impossible.

You need to know the reason why your account was cancelled. If the reason is due to prolonged inactivity or failure to update your personal information, you may still have a chance to re-open your account with the same bank, but you may need to provide more supporting documents. However, if the reason is due to serious non-compliance, the chances of reopening the account with the same bank are very low.

You may consider opening an account with another bank, but be aware that in this case, customer information is usually shared between banks, so you may need to explain why the previous account was cancelled. It is always advisable to be honest and transparent. Concealing the issue of cancelled accounts in the past may lead to more serious consequences if other banks find out about it.

Can I get a loan or make a withdrawal if my bank account is frozen?

There is no way to borrow or withdraw money.

This is because the purpose of freezing an account is to temporarily restrict all financial transactions on the account. In this case, you will not be able to receive cash from the frozen account and you will not be able to use the account to apply for a loan. Even if you have been approved for a loan, it may not be disbursed because of the freeze.

If a personal account is cancelled by the bank, will it affect the business account?

The cancellation of your personal account may indeed affect your business account, but the extent of the impact depends on a number of factors.

The impact is more likely if the personal and business accounts are with the same bank. It is possible for the bank to conduct a full review of all your accounts. If the reason for the cancellation of a personal account involves a serious breach of contract or suspicious activity, the bank may take similar action on your business account for risk management reasons.

Even if the personal and business accounts are with different banks, there may be implications as customer information may be shared between banks.

If the cancellation is due to minor reasons such as prolonged inactivity or failure to update personal information in a timely manner, the impact on the business account may be less.

Conclusion

Account freezing is a complex and sensitive topic that involves a number of aspects including personal and business interests, financial security and national security, and may have a significant impact on both individuals and businesses. The best strategy is prevention. Maintain good financial management practices, regularly check and update account information, and comply with banking regulations.

Lonfon Business Consultancy team provides one-stop business consultancy services, from registering Hong Kong company, opening bank account, company secretarial and assisting in filing annual returns, etc., so that you can save your energy and time, and help you start your business blueprint!

Extended reading: "TheWhat is a company secretary? Definition, duties and conditions of appointment in one article》